Submitted by QTR's Fringe Finance

There has never been a point in history like the one we stand on the edge of today.

It's a simple concept: the unprecedented combination of geopolitical volatility and flawed monetary policy, combined with domestic division, has never happened in the past the way that it is happening now.

Ergo, while it may sound sensational, it's actually a relatively common sense point: People should expect the world—and with it, financial markets—to be on the edge of volatility like never before.

"Really, Chris. More fear-mongering?" you'll say. "Isn't this just another sensational blog post to try to justify your bullishness on gold and bearishness on risk assets?"

You're welcome to think that way if you'd like, but I believe you'll be doing yourself a big disservice.

Right off the bat, let's examine monetary policy. Sure, rates have been at 5% before, but they haven't been there with $33 trillion in debt outstanding.

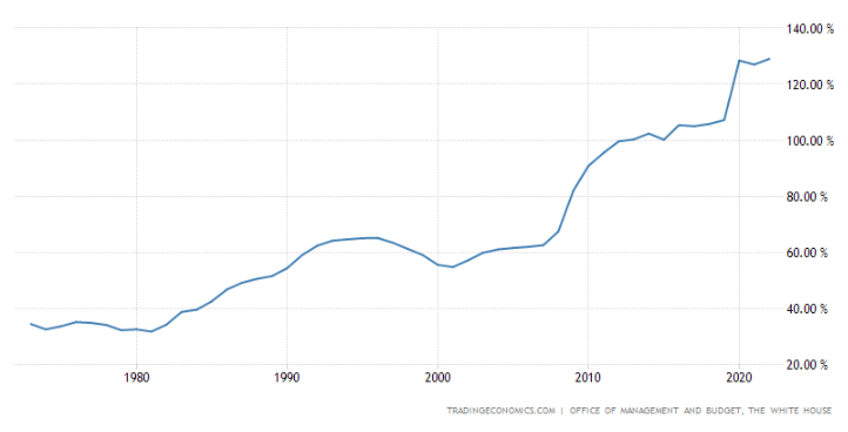

In other words, while interest rates aren't at historical highs, as many of my readers pointed out in the comments of my last article, they are the highest they've been with the largest amount of debt outstanding we've ever had. This chart of U.S. debt-to-GDP helps make the point of where we stand:

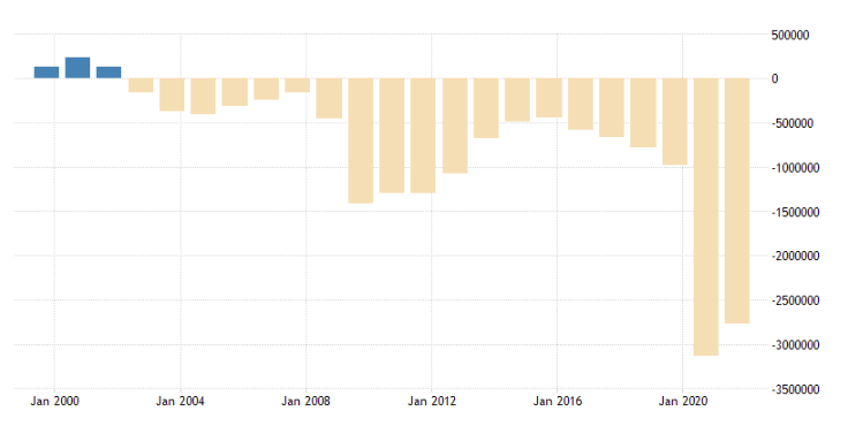

And it isn't enough that we face an unprecedented amount of debt-service obligations; both our monetary and fiscal policies continue to exacerbate the problem. Our government has proven it absolutely cannot cut spending and has no regard for what can only be described as its toxic and debilitating deficit, even when the nation's finances are at their most precarious.

This shot of our surplus/deficit is, to use financial jargon, f*cking insane.

On top of that, we have a market that has been artificially and exponentially pumped higher through passive ETF investments, trillions of dollars of COVID liquidity, and the weaponization of the options market (Tesla, in my opinion, will be the poster boy for this assertion, if I’m correct, when the company first encounters an unavoidable piece of negative fundamental news that outruns mysterious options players constantly buying calls in the name.)

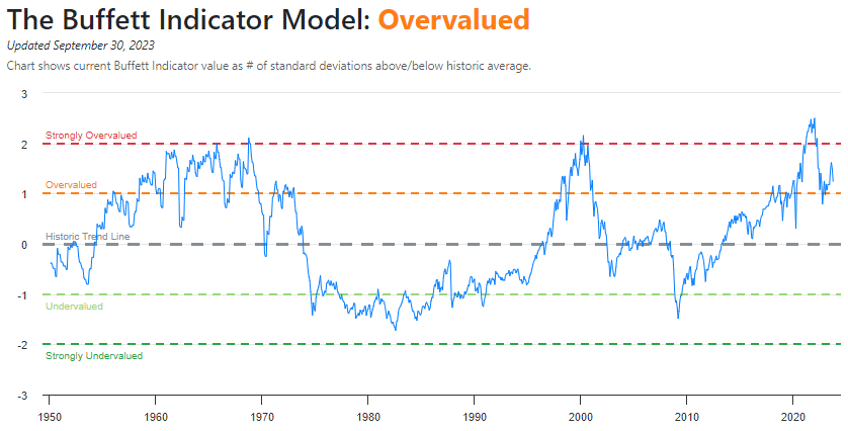

I mean, the market closed up for the 4th straight day on Wednesday, after inflation data came in above estimates (which should signal the Fed isn’t doing enough to beat inflation), after a war in the Middle East broke out (essentially doubling the potential geopolitical volatility on the horizon for the time being) and while valuations (market cap/GDP, P/E, throw a dart and pick one) remain near historic highs.

You don’t think that’s the normal “market stairs up” led by legitimate bids for stocks, do you? Doesn’t something feel…off…about that?

The old adage used to be that the stock market takes the stairs up and the elevator down. Now, with the increased liquidity, the market has taken a rocket ship up—meaning that when the elevator comes down, it won't be an orderly ride down 5 floors on Central Park West. It'll be like when that Red Bull guy did the 71,500 foot jump from the stratosphere.

We've overclocked the market, monetary policy, and investor psychology in a way that we never have before. It's not just the stock market that's going parabolic; investor sentiment and the mechanics of the market that drive prices higher are, too. Both the stock market and our national debt are on the last legs of a 4 a.m. Las Vegas bender. And for those who have...(READ THIS FULL ARTICLE, FREE, HERE).