By Graham Summers, MBA | Chief Market Strategist

Stocks have experienced a great deal of volatility in the last week.

However, when you take a step back and look at the big picture for the equity markets, it’s clear that stocks have been in a consolidation phase since mid-May. That consolidation has been between 5,200 and 5,600 on the S&P 500.

Why is this happening?

There are two critical issues the market is trying to determine:

- When and how aggressively the Fed will start cutting rates.

- Who will win the Presidential election in November.

Regarding #1, three factors have “muddied the waters” in terms of figuring out when and how aggressively the Fed will cut rates this year.

Those three factors are the inflation data, unemployment data, and GDP data.

With the economy not yet contracting, unemployment spiking due to immigration NOT job losses, and inflation trending down, albeit in a noisy fashion, the Fed has suffered from institutional inertia as it opts to focus on the data as opposed to cutting rates.

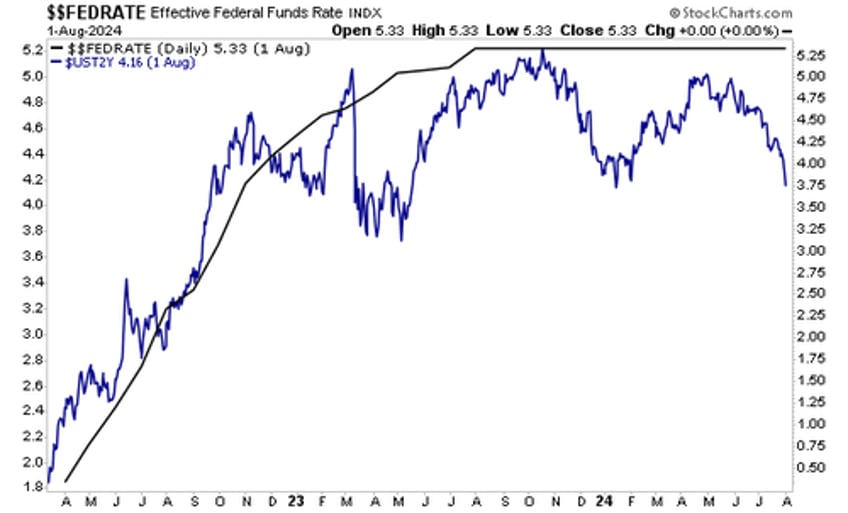

However, at the end of the day, the Fed tends to take its cues from the yield on the 2-Year U.S. Treasury. And the yield on the 2-Year U.S. Treasury is telling us the Fed is WAAAAAY behind the curve. The Fed needs to take action and soon or it risks a recession.

Regarding #2, the Presidential election has also provided a great deal of confusion for stocks. Some of the more critical items of note include A) the Democrat candidate was replaced in July when President Biden opted to not continue with his campaign, B) Kamala Harris has yet to debate Donald Trump, and C) the economic agenda of the two current candidates couldn’t be more different when it comes to specific policies.

However, at the end of the day, both candidates have proven to be big on social spending. In this sense, whoever wins the election, we can assume the government will continue to run significant deficits. And this will provide stimulus to the economy, which will benefit stocks.

You can see this in the monthly chart of the S&P 500. Sure, it’s experiencing a down month thus far in September, but the uptrend is clearly intact. For this reason, we view the current pullback as an opportunity to “buy the dip” not “sell the farm.”

As investors, our job is to make money, not look for any excuse to dump stocks and panic about something bad happening. And as I’ve outlined in recent articles, this means riding bull markets for as long as possible, and then side-stepping bear markets when they eventually hit.

In the very simplest of terms, you need to be invested in stocks, until an objective, verifiable tool (not your feelings or limiting beliefs) tells you it’s time to “get out.”

I’ve developed a tool that takes ALL of the guessing work out of this problem. With just one look at this tool, you can tell whether it’s a good time to buy stocks or not. I detail it, along with what it’s currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research