The Wave Of Retail Silver Selling, & What It Means For The Market

[Retail Pukes right into the hands of Bullion Banks]

Submitted by GoldFix

Throughout the past year and a half, one of the primary themes in the precious metals industry has been the large wave of retail selling, particularly on the silver side.

Which makes you wonder what might have happened to the silver price (or the industrial silver supply) if that selling had not been taking place. Because we have heard multiple reports from bullion wholesalers who have talked about how some of that retail silver is getting melted down into 1,000 ounce bars for industry.

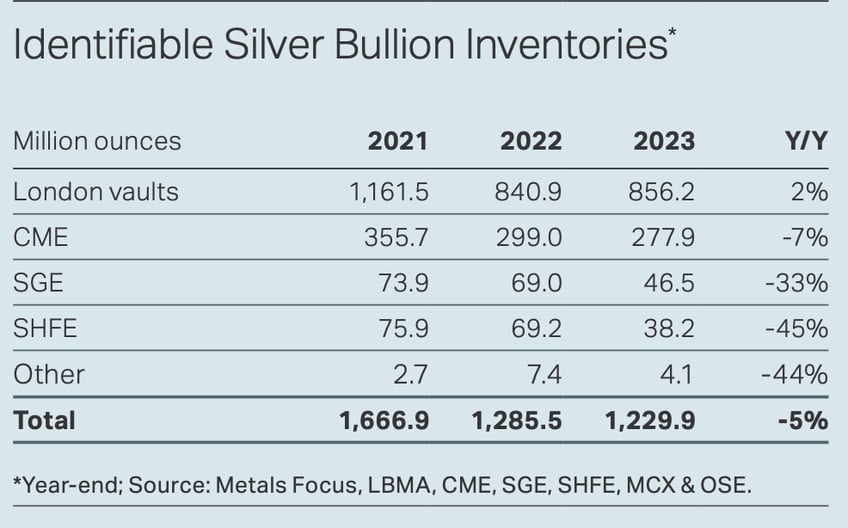

On one hand, this phenomenon speaks as a verification of a market deficit. And also follows how in 2022 we saw the COMEX and LBMA inventories decline, then in 2023 we saw the ETF inventories dwindle, and since then we've seen a big dent in the retail supply held by investors.

The estimates I've seen, along with my own research, come back to there being about 4 to 6 billion ounces of above-ground silver in investment grade bars or coins (including industrial 1,000 ounce bars).

The known stockpiles have hovered between 1 and 2 billion ounces in recent years, and the estimates I've seen of the amount held by the retail public are usually around 3 billion ounces.

Unfortunately, I have not had much luck yet in my efforts to even begin to gauge how much silver has actually been sold back in the past year and a half. But the various dealer reports I have heard over that time would suggest it's a lot.

Although whatever amount it is, that still means that the net overall available supply is coming down.

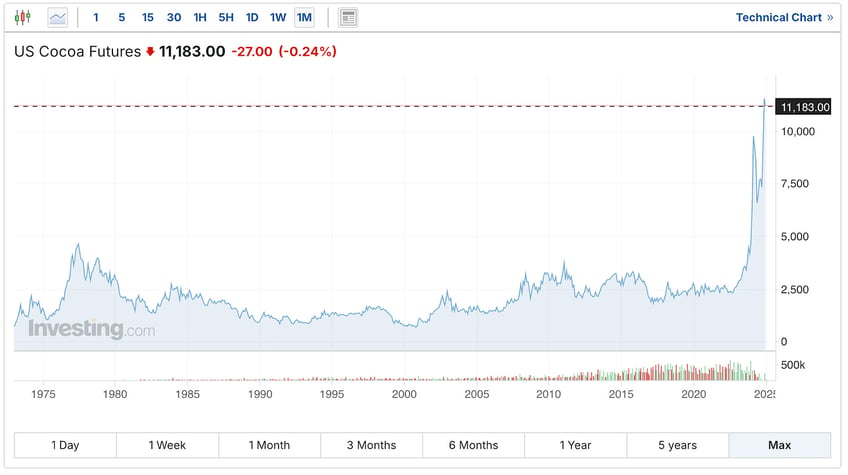

Which might not matter today or tomorrow. But with no end to the deficit in sight, these are the kind of other factors that add up, and have the potential to eventually matter. And when they do finally matter, it can be in a substantial way (take a look at the cocoa chart over the past few years).

It's also interesting to wonder what might have happened to the silver price in 2024 had these conditions not been in place. Because if silver rallied as much as it did with retail investors selling, what would have happened to the price if retail was neutral, or even buying?

For all of the frustration silver investors have had during times when investors are buying but the price doesn't move higher, hopefully 2024 came as a welcome reprieve. As the price rose substantially, even in the face of large-scale retail selling.

I continue to see this selling as a net long-term positive for the silver price. Because regardless of whether you or I think anybody else should or shouldn't be buying silver, there's still less silver out there, which ultimately adds to the pressure on the market.

[ Bonus: Rick Rule discusses How Close The Silver Market Came to Breaking ]

I have not yet seen any substantial indication that the selling has subsided. But of course we'll keep an eye on that this year.

As especially with everything that the Trump Administration continues to suggest it has planned, it's very possible that especially in the second half of 2025, what's happening on the retail level could well be very different.

Related:

ICYMI - Rick Rule warns ‘the REAL silver squeeze’ is yet to come https://t.co/wbDb4GxXdp via @RealRickRule pic.twitter.com/rAvC6qKpUK

— Chris Marcus (@ArcadiaEconomic) January 6, 2022

Sincerely,

Chris Marcus for Arcadia Economics' Gold & Silver Daily