In 1953, the Kuwait Investment Authority became the world’s first sovereign wealth fund, designed to manage the country’s excess oil wealth.

Since then, numerous funds have launched, with the 100 largest globally holding $13.7 trillion in assets. Sovereign wealth funds are large pools of money run by governments that are typically resource-rich, such as Saudi Arabia and Kuwait. They may also have large foreign-exchange reserves, such as China and Singapore.

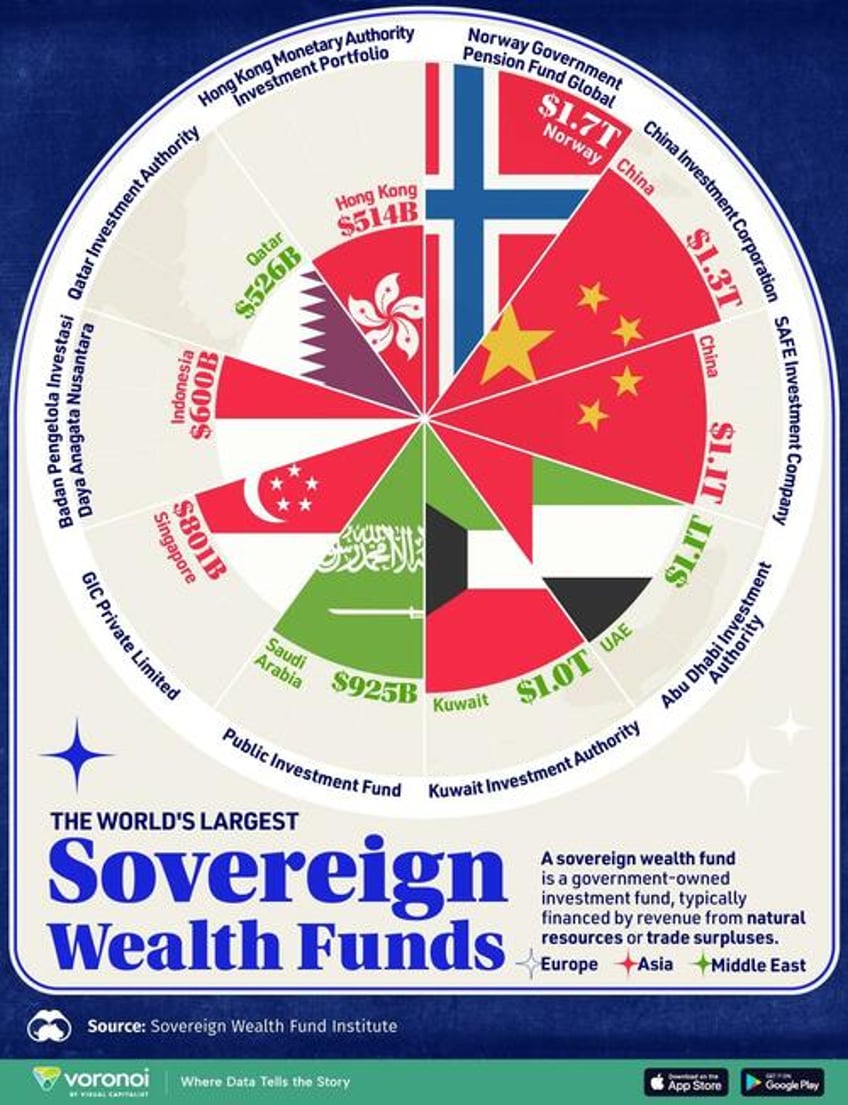

This graphic, via Visual Capitalist's Dorothy Neufeld, shows the world’s largest sovereign wealth funds, based on data from the Sovereign Wealth Fund Institute.

The Top 10 Sovereign Wealth Funds, by Assets

Here are the biggest sovereign wealth funds, managing over $9.6 trillion in combined assets:

Norway runs the largest globally, thanks to its vast oil and gas production in the North Sea, which generates 10% of the country’s GDP.

In 2024, the fund earned a record $222 billion in profit fueled by strong gains across the tech sector. Last year, Apple, Microsoft, and Nvidia stood as the fund’s top holdings.

Following next in line are China’s two biggest funds, holding $2.4 trillion in assets. In particular, these funds play a key role in financing the Belt and Road Initiative and other strategic industries. Through these funds, billions have been invested in railroads, green energy, and mining projects across Africa. Notably, Chinese investment across the region is 2.5 times greater than Western nations put together.

Ranking in fifth is Saudi Arabia’s Public Investment Fund, with $925 billion in assets. Over the past decade, it has made a $3.5 billion stake in Uber, along with investments in Nintendo and Heathrow Airport. In 2025, the fund plans to invest $1 billion in sports streaming service DAZN.

America’s First Sovereign Wealth Fund

In early February, President Trump signed an executive order to establish an American sovereign wealth fund, although the source of these funds remains unclear.

Typically, these funds are financed by budget surpluses, yet the U.S. faces a $1.8 trillion deficit. Not only that, it is the fifth consecutive year the deficit has run over $1 trillion. While Trump suggested the fund can be used to buy TikTok to allow it to continue operating in the U.S., the fund will not be fully launched for another year.

To learn more about this topic from an investment holdings perspective, check out this graphic on the green investments of sovereign wealth funds.