Individuals and corporations use tax havens to minimize their tax burdens and protect their wealth in low-tax or no-tax jurisdictions.

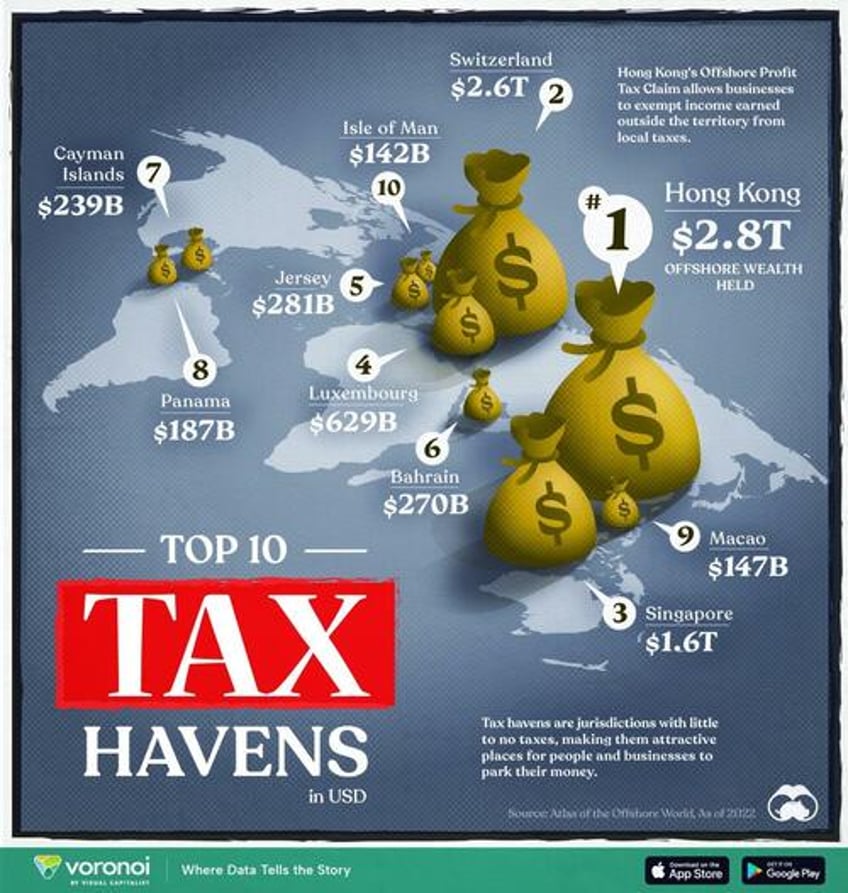

This graphic, via Visual Capitalist's Bruno Venditti, shows the top 10 countries hosting the most offshore financial wealth, according to 2022 data from the Atlas of the Offshore World.

What Is a Tax Haven?

A tax haven offers foreign businesses and individuals minimal or no tax liability, along with a politically and economically stable environment.

Entities may legally use tax havens to store money earned abroad while avoiding higher taxes in the U.S. and other countries.

For this purpose, companies often establish a shell corporation - a corporation without active business operations or significant assets in the country where it is located.

Hong Kong tops the list with over $2.8 trillion in offshore wealth. The territory boasts a robust banking infrastructure and a business-friendly environment. Additionally, its Offshore Profit Tax Claim allows offshore owners to pay 0% tax on offshore income.

That said, it remains to be seen how China’s more tight-knit control of the special administration region will affect offshore tax treatment in the long term.

After Hong Kong, Switzerland hosts the most offshore financial wealth. The country has long served as a safe haven for wealth, particularly from Western European countries.

To learn more about this topic, check out this graphic that shows where corporate taxation rates are the lowest in the world as of 2023.