Intro:

Submitted by GoldFix ZH Edit

TS Lombard takes a look back at what happened in 2023 or, to be more precise, what didn’t happen. This is risky stuff, considering it usually shows how fallible economists can be. Nevertheless, they bravely do so.

Contents:

- There was no US recession.

- Unemployment didn’t need to rise for inflation to come down.

- Central banks didn’t cut.

- We didn’t get a 6.5% BoE terminal rate.

- The BoJ didn’t raise interest rates.

- There was no banking crisis

- There was no US government default.

- China didn’t have a reopening boom.

- The global property market didn’t collapse.

- Geopolitical shocks didn’t shock.

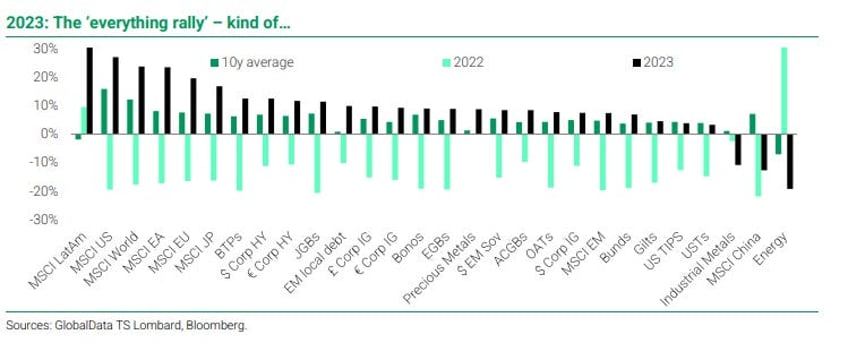

- 2023 market performance.

2023 REVIEW: THE YEAR THAT WASN’T – 10 THINGS THAT DIDN’T HAPPEN

Authored by Skylar Montgomery Koning,and Andrea Cicione Head of Research for TS Lombard

[Excerpted]

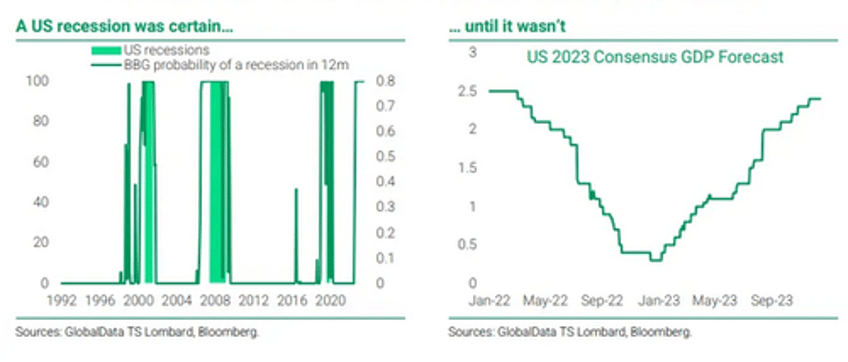

1. There was no US recession.

Heading into 2023 with an inverted yield curve, 425bp of Fed tightening behind us and real rates in restrictive territory, consensus shifted to a ~70% chance of recession (albeit a mild one). The Bloomberg US recession probability had jumped to 100% in August 2022 and remained there until the data stopped being published in June 2023.

Global Macro MD Dario Perkins reminds us all humorously in a separate report to get ready to say 'you are sorry' to Bloomberg this year.

"If you poked fun at the Bloomberg economics team for saying there was a “100% chance of recession” in November 2022, you better have your apology ready in 2024."

However, the economy was more resilient to interest rate hikes than both we and consensus had expected. This was due to the long duration of US debt as well as to a large positive fiscal impulse and the associated high levels of net wealth. Not only did we not get a recession, but 3Q23 QoQ growth came in at 5.2%. Going into 2024, growth is expected to slow but a US soft landing is now the base case.

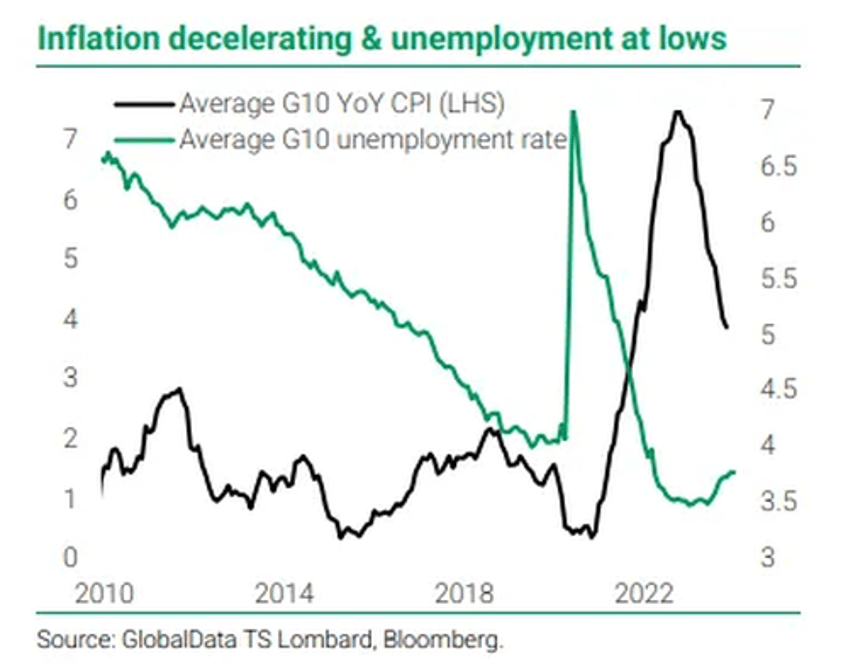

2. Unemployment didn’t need to rise for inflation to come down.

The majority view was that in order to get inflation down amid demand pressures, there would need to be a sharp economic slowdown and a corresponding rise in unemployment. Amid the fake cycle, what we have had instead is supposedly immaculate disinflation; MoPo tightening has reduced the number of job vacancies without putting people out of work, with demand destruction hitting the sectors where shortages were most pronounced. At the same time, the labour participation rate has risen.

7. There was no US government default. [Yet]

Amid increasingly polarized politics in the United States, markets got jittery in the second quarter, with US CDS spreads rising as the debt ceiling loomed once again. In June, we got the expected resolution but it was a reminder to investors of the structural issues with US govvies – something that markets were reminded of a couple months later when Fitch downgraded US debt to AA+ from AAA citing a growing debt burden and repeated debt-limit standoffs.

HAPPY NEW YEAR TO THE ZEROHEDGE COMMUNITY

30% off GoldFix Annual Premium membership for life

- 1 Free Month added on top (effectively $6.73 a month. We add the month manually in a day or 2)

- No Founders Discounting

- Get 30% off forever

- Offer expires January 3rd

10. Geopolitical shocks didn’t shock.

Russia’s invasion of Ukraine in 2022 had a large impact on asset markets and economies but the adjustment was made in that same year. Supply chains were modified, infrastructure built and energy prices came down; markets moved on amid inherently un-discountable tail risks.

In October, a conflict began between Israel-Hamas and the associated threat to oil supply saw energy prices spike. But once again, amid hard-to-price extreme geopolitical risk, markets simply moved on.