Submitted by QTR's Fringe Finance

One of my favorite investors that I love reading and following, Harris Kupperman, has offered up his thoughts on the market this week.

Harris is the founder of Praetorian Capital, a hedge fund focused on using macro trends to guide stock selection.

Harris is one of my favorite follows and I find his opinions - especially on macro and commodities - to be extremely resourceful. I’m certain my readers will find the same. I was excited when he offered up his latest thoughts, published below (slightly edited for grammar, bold emphasis is QTR’s).

Please be sure to read both my and Harris’ disclaimers, located at the bottom of this post

The Blowoff

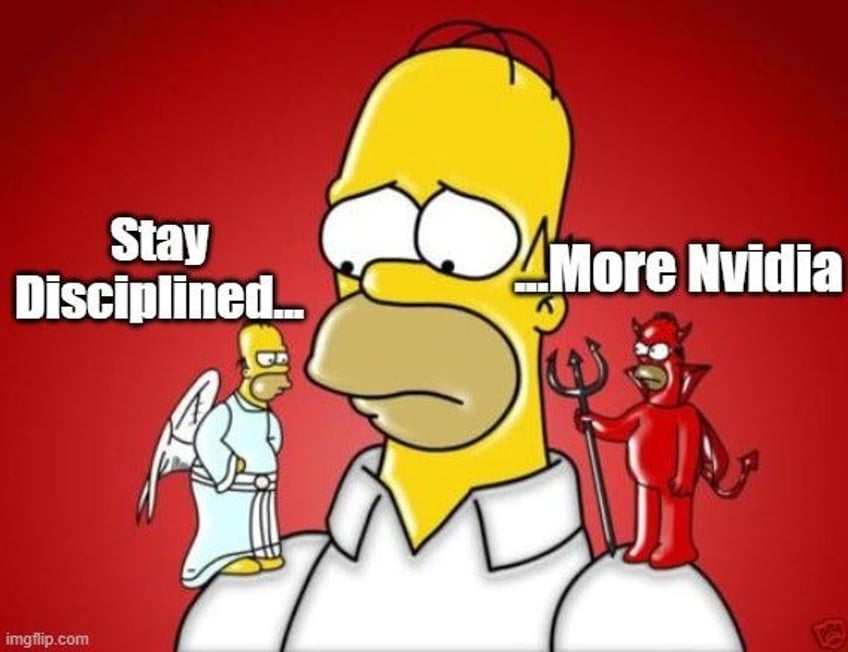

Last summer, I was having lunch with a friend at a plain vanilla shop, who kept checking his phone and muttering, “this NVIDIA is killing me.” After the third time in five minutes, I had to ask:

Me: You run a long-only fund. You don’t short. How is NVIDIA killing you?

Him: Kuppy, you don’t get it. You do your own thing. I’m benchmarked. I’m underweight NVIDIA and trailing massively. There are guys at my firm who are 500bps overweight. One guy is even 700bps overweight. They’re killing it.

Me: Who cares? Just buy something else.

Him: NVIDIA goes up every day. Clients keep asking about it. I feel like an idiot to be underweight.

Me: So, then why don’t you buy some if it’s worrying you so much?

Him: I keep waiting for a pullback. Damn thing is up another 3% today. It never pulls back. I’m getting further and further behind. Not sure what I’m going to do. NVIDIA is killing my year…

The whole experience was surreal. I miss all sorts of trades. I don’t let them bother me. If something is killing me, it’s because I’m losing money. I’ve never worried about making less. It’s just not an emotion that I’ve experienced. Besides, my friend was trailing his benchmark by a few hundred basis points. To me, that’s a bad day, a rounding error—certainly not a crisis. However, I don’t live in the benchmarked world. In that world, trailing your benchmark is existential. Sure, you can do it for a quarter, or maybe even a full year. When that happens, your bonus will suffer, but if you trail for two years in a row, it becomes existential. You’ll get fired. My friend was really sweating it.

His whole way of thinking was so foreign to me. I buy cheap stocks with tailwinds. I don’t know when they’ll work, and I mostly don’t care. If I have a bad quarter or even a bad year, that’s just part of the process. I built my firm specifically to support my investing style. I wanted the flexibility to underperform, to be volatile, to have nasty drawdowns, to be able to avoid owning overpriced garbage if it enters a bubble. My friend didn’t have that luxury and a few hundred basis points of tracking error were killing him. It was impairing his ability to think. He couldn’t even enjoy lunch.

Did my friend ever buy NVIDIA? I assume he did. It was probably the day of a local peak when he couldn’t take the pain any longer, right before a nasty pullback. He likely swept the book and then got drunk. I’m almost sure the pain of missing got the better of him, and he paid up. One can never underestimate the pain of underperformance.

I mention this because I’m reading a lot of year-end fund letters. Everyone is bemoaning...(READ THIS FULL ARTICLE HERE).