Governments around the world are issuing staggering amounts of debt to “paper over” any weakness in the private sector with public spending. As Bloomberg notes, collectively, the U.S., U.K., E.U., and Japan will issue $2 trillion in new debt this year.

This is keeping the world from entering a recession, while simultaneously setting the stage for the next round of inflation. Remember that the first wave of inflation (2021-2023) was triggering by egregious levels of public spending/ stimulus during a time of private sector weakness.

In the U.S., it is clear the Biden administration is implementing policies to prop up the economy and financial markets for the 2024 election regardless of the consequences the policies will bring down the road.

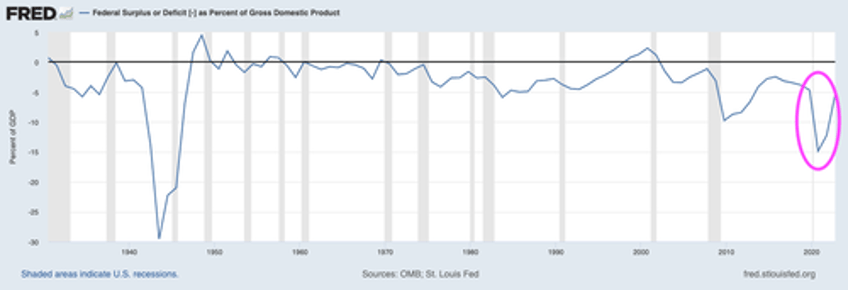

Case in point, the U.S. is running the levels of deficit you usually see during a recession, at a time when the economy is technically still growing. Indeed, the only periods in which the U.S. was running a larger deficit as a percentage of GDP in the last 100 years during World War II, and the Great Financial Crisis.

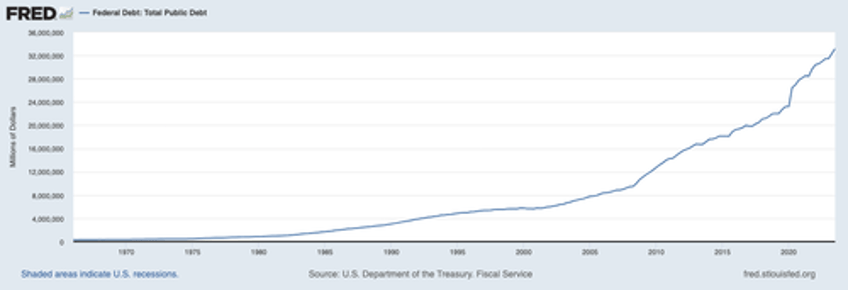

As you likely know, deficits are financed via the issuance of debt. And because the U.S. is constantly having to roll over old debt into new debt while also issuing new debt to finance its deficit, the country has added some $2 TRILLION in debt in the last seven months alone!

My question to policymakers: what if all this spending brings back higher inflation when the U.S. finally rolls over into recession? What’s the plan, then?

Gold has figured it out already. Other asset classes will soon, too.

If you’re looking for someone to guide your investing to insure you crush the market, you can sign up for our FREE daily market commentary, GAINS PAINS & CAPITAL.

As an added bonus, I’ll throw in a special report Billionaire’s “Green Gold” concerning a unique “off the radar” investment that could EXPLODE higher in the coming months. It details the actions of a family of billionaires who literally made their fortunes investing in inflationary assets. And they just became involved in a mid-cap company that has the potential to TRIPLE in value in the coming months.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html