Submitted by QTR's Fringe Finance

The phrase “Gentlemen, this is what we planned for” was echoing through my head today. I think it’s from a movie or something—maybe one of you can tell me.

Or, like I do now sometimes at 42 years old, maybe I’m just imagining things.

Regardless, this characterizes my sentiment on markets as we get started with the first week of March. Let’s take a look at how my 25 Stocks I’m Watching for 2025 list (part 1 here and part 2 here) are holding up against the S&P average, and then I will offer up my take on where the market stands today and what could be next.

As always read my disclaimer at the bottom of this post, and also on my “About” page.

As you can see from this chart originally published on March 3, 2025, those 25 stocks are up about 3% YTD and outperforming the S&P - which is now down about 1% YTD - by about 4%.

I sure would like to have some brilliant brand-new wisdom for you, but the fact of the matter is that the last two weeks of the market selling off are pretty unsurprising.

As you guys likely know already, I have believed that we are long overdue for a major pullback in equity markets, which now seems to be happening enough so that the beginning stages of questioning bullish sentiment across the street is taking slight hold.

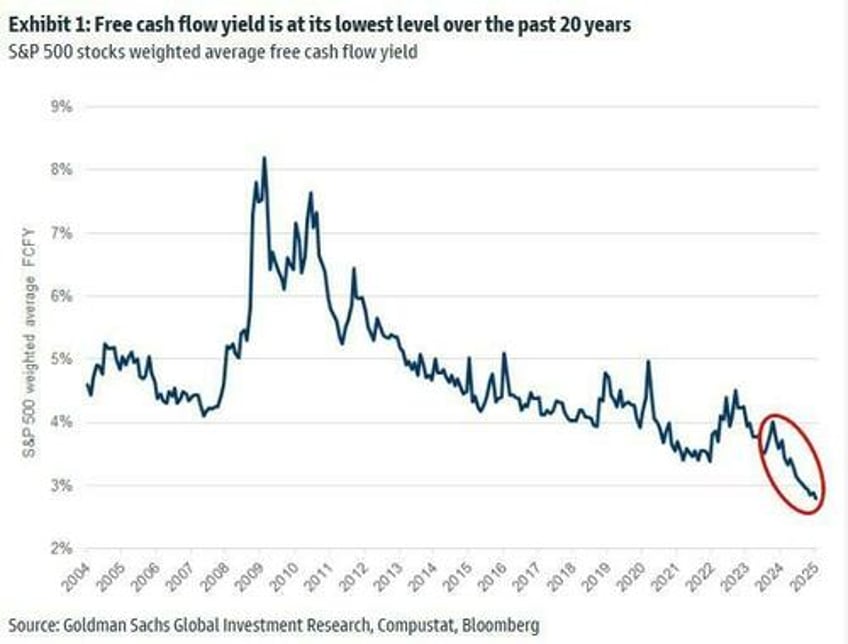

As I pointed out (read: screamed) on this George Gammon podcast last week (~34:00 min), no matter how you slice and dice the valuation of the market, it would be pretty easy to make the case for a drawdown of as much as 40% without trying too hard or being too sensationalist. Of course, in a world where even 2% drawdowns cause most market participants to make faces as though they are passing tennis balls through their urinary tracts, I don’t really expect the market to stay at a 40% drawdown level for any prolonged period of time before the Fed jumps in and tries to save the day—sending sound money and any asset without a fixed supply through the roof.

A couple of times over the last two weeks, the market has tried to rally. Even Monday morning, the sentiment coming into the week from Goldman Sachs, via a note I read on Zero Hedge, was that there was going to be some sort of fantastic short squeeze thanks to the bullish move in crypto over the weekend that occurred as a result of President Trump announcing his plan for the strategic crypto reserve.

But like all of the rally points over the last two weeks, this one failed to hold, and it is starting to feel as though being bearish—which usually equates to swimming upstream—is now starting to turn slightly more towards swimming downstream as it relates to overall sentiment in markets.

Needless to say, I wasn’t surprised that the market was red again this past week. Here's my take on stocks I'm watching and how I think the overall market is going to do heading into the middle of the year..(READ MY FULL ANALYSIS HERE).

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. Assume any and all numbers in this piece are wrong and make sure you check them yourself. Also, I am an investor in Mark’s fund, mentioned above. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.