By Graham Summers, MBA | Chief Market Strategist

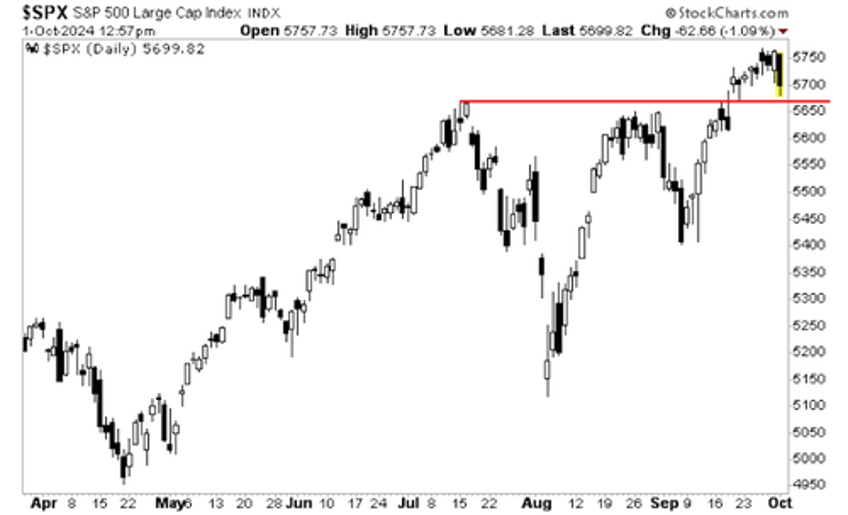

Stocks have broken above critical resistance on a weekly basis. Historically, this has lead to several months’ worth of gains. As I write this, the S&P 500 is backtesting the breakout.

High yield credit, which typically leads stocks is showing no signs of slowing down. It has turned up again and anticipates the S&P 500 breaking above 5,750 in the near future.

Breadth is also strengthening. This bull market rally is getting broader, NOT narrower. And here again, there are no signs of a collapse about to begin. This is a “buy the dip” moment for stocks.

I bring all of this up because a LOT of analysts have gotten bearish. Their clients have MISSED out on these gains! Don’t be one of them!

To avoid making the mistake of panicking during a garden variety pullback, I’d refer you to our special investment report, How to Predict a Crash which details a quantifiable tool that has accurately predicted Black Swan market crashes. It caught the 1987 Crash, the Tech Crash, and the Great Financial Crisis, to name a few.

With just one look at this tool, you can tell whether it’s a good time to buy stocks or not. I detail it, along with what it’s currently saying about the market today in How to Predict a Crash.

Normally, I’d charge $499 for this report as a standalone item. But I’m giving it away FREE to anyone who joins our daily market commentary Gains Pains & Capital.

To pick up your copy now (it doesn’t cost a dime)…

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research