Time To Lock In Some Profits On Gold

Gold has been on a tear this year so far, as you can see by the Sprott Physical Gold Trust (PHYS) chart below.

(The picture is almost exactly the same for the more popular SPDR Gold Trust (GLD), but ZeroHedge readers prefer PHYS).

Trends Toward Peace And Disinflation

Nevertheless, several different trends emerged this week that may be bearish for gold:

- The beginning of the end of The Russia-Ukraine War. War, and geopolitical uncertainty are traditionally bullish for gold. This week, we got intimations of the the opposite. President Trump and President Putin spoke by phone, and Russia and the United States agreed to exchange prisoners and to begin negotiating an end to the war in Europe. The Trump administration already conceded that the Ukraine would not be admitted to NATO, U.S. troops would not serve as peacekeepers there, and any peacekeepers stationed between Russia and the U.S. would not be covered by NATO's Article 5.

- More olive branches from President Trump. President Trump said he'd like to see Russia back in the G-7 (it was called the G-8 at the time), and he planned to propose to both President Putin and President Xi of China that all three countries cut their military spending in half.

- Major steps to cut U.S. federal spending. All else equal, more government spending means more inflation, which can be bullish for gold. This week saw some steps in the opposite direction: Elon Musk's Department of Government Efficiency continued to identify government waste, and the Trump administration began massive layoffs of government employees.

- RFK Jr. confirmed as Secretary of Health and Human Services. A lot of federal spending goes to managing chronic diseases, and Robert Kennedy, Jr. as HHS Secretary intends to take steps to reduce America's chronic disease burden.

How To Lock In Gold Gains

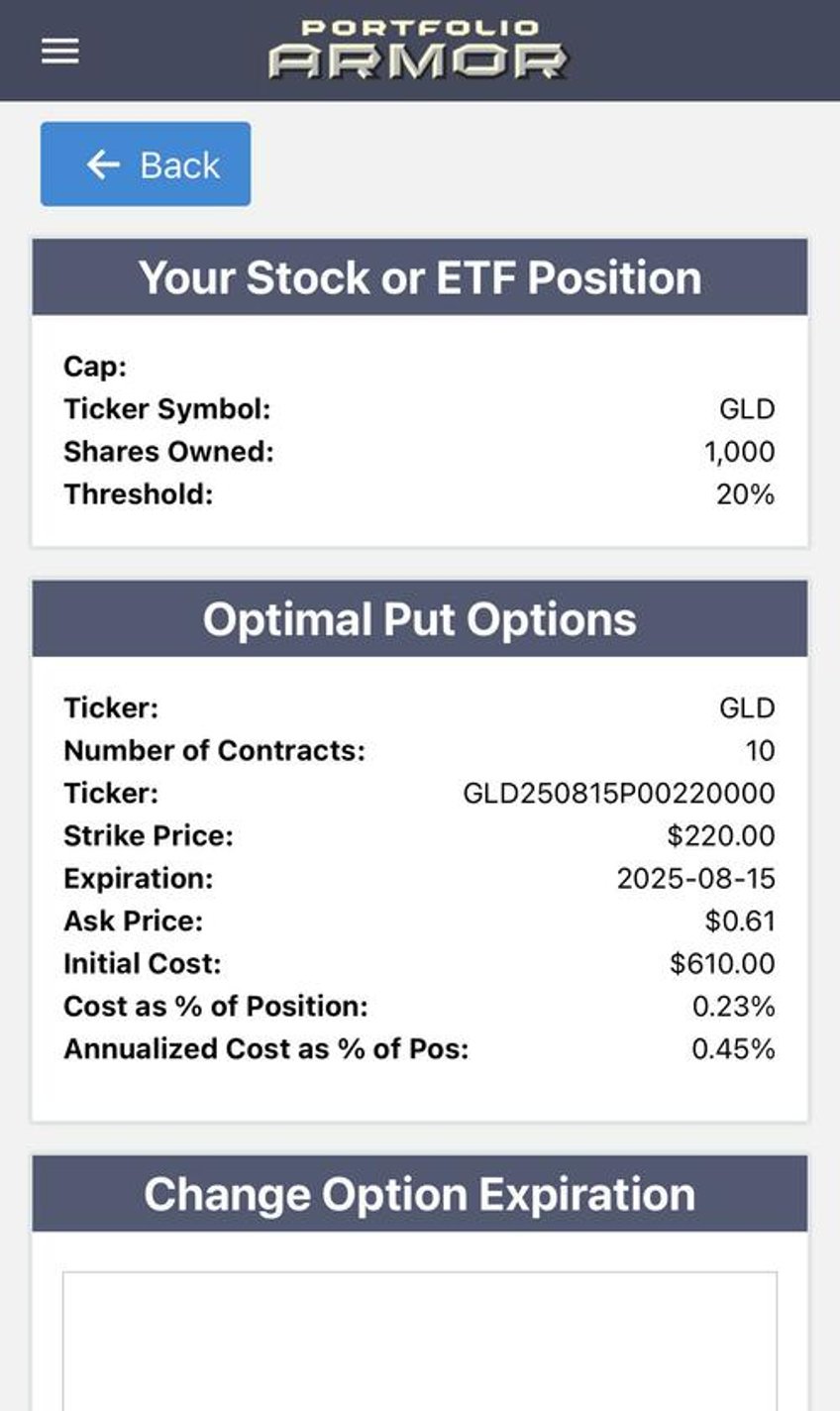

If you are a conservative investor, the simplest way to lock in some of your gold gains would be to sell some gold. If you'd rather not sell, you can also hedge, by using a gold-tracking ETF with options traded on it such as GLD. Currently, the cost of hedging against large declines in gold is extremely cheap.

For More Aggressive Investors

If you're a more aggressive investor, you might consider expanding your horizons beyond precious metals. We've had some success this week with our defined-risk options trades, for example.

Call spread on Astera Labs (ALAB -5.76%↓). Entered at a net debit of $0.50 on 2/3/2025; exited at a net credit of $0.60 on 2/11/2025. Profit: 20%.

Call on Tesla (TSLA 0.00%↑). Bought at $1.91 on 2/11/2025; sold at $4.10 on 2/13/2025. Profit: 115%.

Calls on Opera, Ltd. (OPRA 6.44%↑). Bought for $0.65 on 2/6/2025; sold (half) for $1.85 on 2/13/2025. Profit: 185%.

Calls on Opera, Ltd. (OPRA 6.44%↑). Bought for $0.65 on 2/6/2025; sold (half) for $1.95 on 2/10/2025. Profit: 200%.

Calls on Robinhood Markets (HOOD -1.91%↓). Bought for $2.30 on 10/31/2024; sold (half) for $33.50 on 2/13/2025. Profit: 1,443%.

If you'd like a heads up when we place our next trade, you can subscribe to our trading Substack/occasional email list below.

And if you would like to add some downside protection, while picking your own securities, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).