Tokenization: Bain, JP Morgan see $400bn opportunity in alternative funds

Ledger Insights

Submitted by GoldFix ZH Edit; Authored by Ledger Insights

Shortly before Christmas, Bain & Co and Onyx by JP Morgan published a report on the $400 billion revenue potential from alternative fund tokenization. The figure is based on wealthy investors shifting a proportion of their assets into alternatives.

While people tout tokenization as a tool to democratize investment, the reality is that alternative assets are often inappropriate for retail investors. However, wealthy investors are a different story.

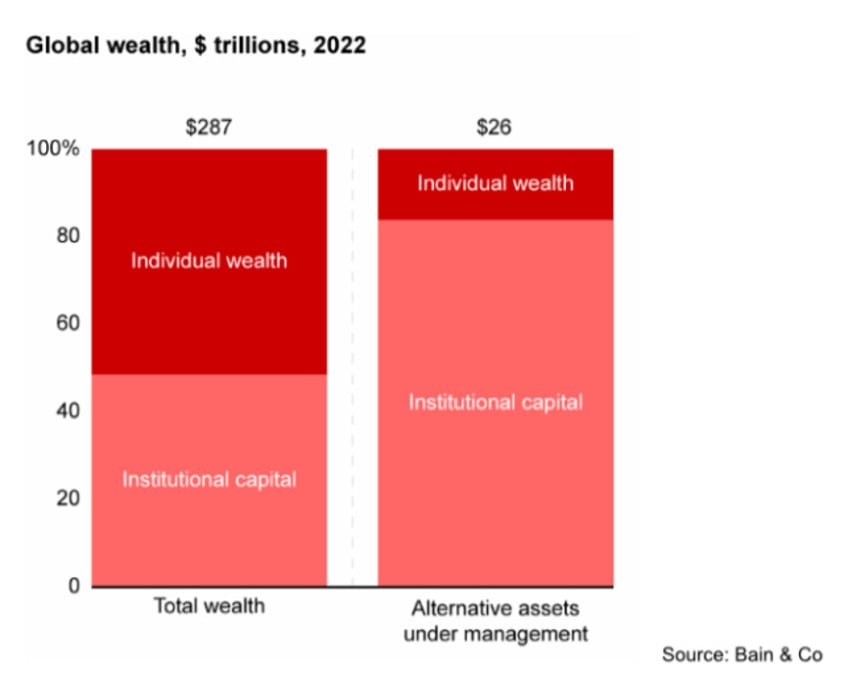

To date alternative asset managers have struggled to expand their reach with high net worth individuals (HNWI), who have just 5% of their wealth in alternatives. That’s despite roughly half of global investable funds sitting in private rather than institutional hands. Currently institutions make up well over 80% of the alternatives investor base.

A key reason is the complexity and frictions involved in the investing process. Tokenization should help with standardization, automation and efficiencies. Rather than individuals needing to commit $5 million for ten years, using tokenization they could invest smaller amounts and have the option to sell tokens if they need to exit earlier. Additionally, there’s the potential to use the tokenized asset as collateral for borrowing.

However, so far efforts to address some of the frictions haven’t produced the desired results. These initiatives include creating feeder funds, funds of funds and registered funds. We’d note that some of the existing tokenization initiatives have adopted the first approach. For example, Securitize set up a feeder fund for a KKR Fund and then tokenized the feeder fund on the Avalanche blockchain.

The $400 billion tokenization revenue opportunity

Currently private individuals have about $150 trillion in wealth of which HNWIs own $80 trillion. HNWIs have 5% invested in alternatives or $4 trillion. The goal is to bring the proportion closer to the institutional figure. So if HNWIs up their exposure to 20%, that would mean an additional $12 trillion in funds flowing into the sector. This is consistent with a Bain report published in mid 2023 on HNWI and alternative investments.

Bain and JP Morgan estimate fund managers could clear $270 billion in additional management fees and carried interest on the $12 trillion. Plus, they might earn a cut from secondary market fees. Think how some NFTs pay a small percentage to the issuer on transfer.

Asset managers aren’t the only ones who might benefit. They estimate it’s a $100 billion opportunity for wealth managers through revenue sharing with fund managers. Plus, there are significant potential savings in asset servicing.

They estimate wholesale (trading) platforms have another $30 billion opportunity from expanded activity. We’d note that one of those platforms, iCapital, announced a DLT consortium in 2022 but has been quiet on the topic since. Finally they predict fund administrators and transfer agents have a $5 billion tokenization upside. Some fund administrators such as APEX are embracing DLT faster than others.

One of the questions is who might lead these initiatives? Bain and Onyx favor wealth managers because they have relationships with both investors and asset managers. The other options are projects initiated by wholesale platforms, fund managers or consortia.

Meanwhile, Onyx by JP Morgan recently shared details about its collaboration with Apollo Global using tokenization to automate and personalize the discretionary portfolios of wealthy clients.

SOURCE: Ledger Insights

Continues here

Free Posts To Your Mailbox