Submitted by QTR's Fringe Finance

If 5% rates on the largest debt bubble in the history of mankind—ensuring eventual stock market implosion—isn’t enough to convey to the populace that we are entering "risk-off" territory, perhaps a massive series of global wars will do it. First Russia in Ukraine. Now, Israel and Hamas. And in the words of my good friend Kenny Polcari this Sunday:

“And what happens when China takes Taiwan? Which should happen anytime now. Complete global geopolitical unrest. Whats Jo Jo's plan now?”

Even though Tom Lee will find some way to go on CNBC and try to convince the world that everything happening with Israel and Hamas is bullish for markets, I definitely don't subscribe to that notion.

That said, the situation we are in now sadly aligns almost precisely with the outlook I had for geopolitics and the market heading into the beginning of 2023, it just hasn’t played out as quickly as I thought it would. As a reminder, coming into this year, I expected interest rates to maim the market and geopolitical tensions to continue to rise.

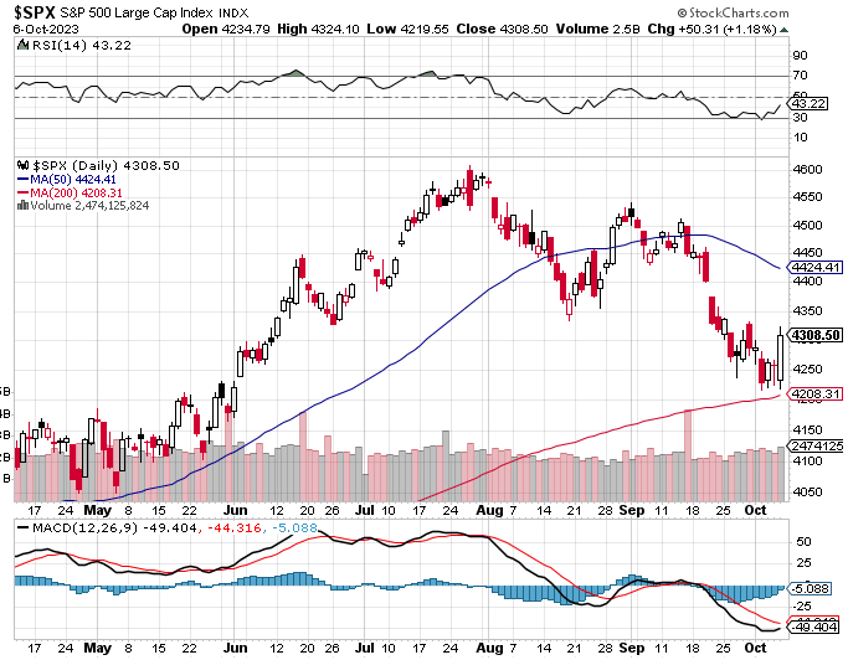

From a 30,000 foot view, most of the year I have been expecting volatility and have been wrong. But in the days that followed writing this piece, the market has shown some signs of shakiness and was down for most of September after defying odds, rising higher and crushing the VIX during the year.

This morning, Dow futures are down 200 points, oil is up about 5% and gold is up about $20. Ho hum.

As I said over the summer, if all of my bullshit about the economy, interest rates and lagging indicators was just an excuse to justify getting things wrong, I’d buck up and just admit it. But I still believe that the market is going to eventually have to pay for the monetary policy decisions of the last 10-15 years and the sharp rate hikes of 2022 and 2023.

Shakiness in markets actually just started just days after Paul Krugman took to CNN to proclaim: “The economic data have been just surreally good. Even optimists are just stunned…This is a goldilocks economy.”

But now, with the new tension in the Middle East, I believe volatility is going to escalate very quickly in markets at a time when the mathematical certainty of high interest rates was already poised offer a violent reality check. I'm not going to spend a lot of time harping on what other potential risk factors could introduce volatility to the market (an unprecedented presidential race, major rating agencies downgrading U.S. debt), because I think high rates and geopolitical unrest on their own are likely going to be enough to throw things off the rails as it stands.

Names And Sectors I’m Watching

Please be sure to read my full disclaimer at the bottom of this post and note that all figures I used are only estimates calculated quickly and off the cuff and may not be accurate. Please do, and check, your own work! I am an idiot and get shit wrong all the time!

As far as the specific stocks and industries I’ve been following and writing about, lets take a look. I’ve also written about three new retail stocks I’m buying and why.

I feel like the themes that I have been writing about on this blog for the last year — namely...(READ THIS FULL ARTICLE HERE).