An Icarus Stock

After hitting a split-adjusted high price this year of $122.90, Super Micro Computer (SMCI -0.17%↓) made a new 52-week low on Friday, in the aftermath of its auditor, Ernst & Young, resigning. Nevertheless, there are at least two major catalysts pending for the company:

Whether it will get delisted by Nasdaq or not. Super Micro Computer could be delisted as soon as Monday if it doesn’t file a plan to get back in compliance with Nasdaq regulations (which, presumably, includes a timeline for hiring a new auditor). Update: looks like this catalyst kicked in after hours on Friday.

JUST IN:

— TrendSpider (@TrendSpider) November 15, 2024

Super Micro Computer plans to submit a resolution plan by Monday to avoid Nasdaq delisting.$SMCI 📈 +19% in after hours pic.twitter.com/y7M2pPQvm5Nvidia’s (NVDA -3.63%↓) conference call next Wednesday. On November 4th, Taiwan-based industry paper DigiTimes Asia reported that Nvidia was routing some of its chip orders away from Super Micro Computer. Analysts are likely to ask Nvidia to quantify this on Wednesday.

Given those catalysts, SMCI is likely to move strongly in either direction by the end of next week. I asked my friend David Janello, PhD, CFA to structure a couple of trades for us that can enable us to profit whether SMCI spikes or tanks next week.

Dr. Janello is the founder of SpreadHunter, and the author of The Nuclear Option: Trading To Win With Options Momentum Strategies.

Below is his guest post with the trade, and an elaboration of how you can structure similar trades yourself.

Managing Explosive Situations

A Step By Step Guide

Let's break things down into steps to illustrate how to manage an explosive trade.

Step One : Look at the Straddle Price

The At-The-Money Straddle Price provides a lot of information to traders before a big event. Although it does not indicate at all which direction the stock will move after the special event (earnings, biotech approvals/disapprovals etc.) over time the Straddle Price is downright clairvoyant at predicting the magnitude of the stock move post-event. This is because the really smart money — like corporate insiders — usually have better forecasting powers than everyone else, even if they don't have access to insider information. A good example from the recent past is the behavior of Trump Media & Technology Group (DJT 4.89%↑) stock before the 2024 election. Two weeks before the 2024 election DJT was trading for 34.50 and the ATM Straddle Price was 18.00 (9.00 put / 9.00 call). This implies a max price of 34.50 + 18.00 or 52.50. As Trump's election chances shifted DJT hit a max price of 51.51 on October 29 which is within 1.00 of the price predicted by the Straddle.

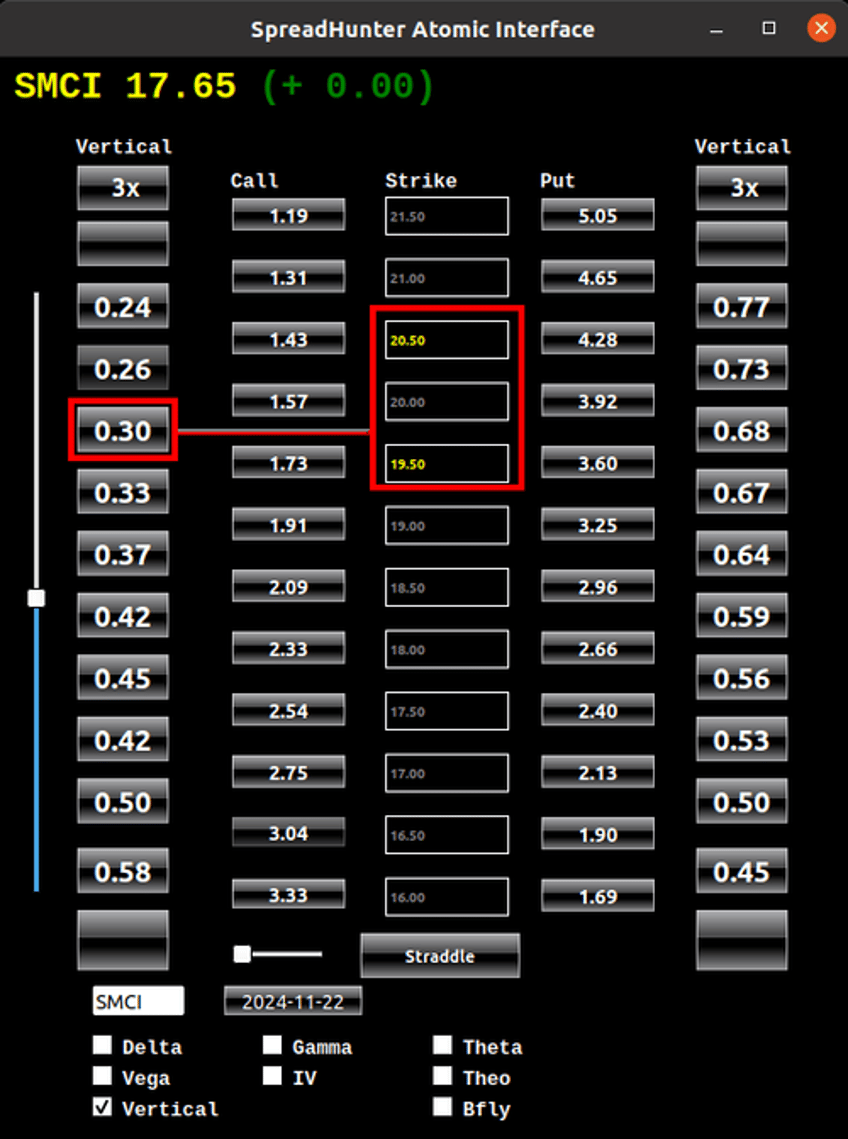

What does the Straddle Price suggest for SMCI? When I put the trade on this morning, SMCI stock was trading for 17.50 and the SMCI Nov 22 Straddle was trading for about 5.00. This suggests a move of +/-5.00 in either direction.

Step #2 : Evaluate the Alternatives

The most direct bullish options trade is to buy the 17.50 strike call for 2.50. If the stock rallies +5.00, the 17.50 call will be worth 5.00- at expiration, for a 100% gain. However, if the stock collapses, the call loses 100% of its value.

Can we do better with Call Vertical Spreads?

At the same time the Call Option was trading at 2.50, the 19.50-20.50 Call Vertical was trading for 0.31 with a max payout of 1.00 at expiration. With SMCI at 22.50, the vertical offers a much bigger payout on a percentage basis than the straight call. Unfortunately, the Call Vertical loses 100% of its value if the stock collapses, just like the Call Option.

We can hedge the downside risk by purchasing a Put Vertical along with the Call Vertical. In this case, the 14-15 Strike Put Vertical was trading for 0.33. The total debit for both spreads is 0.64, with a max payout of 1.00 if the stock moves below 14 or above 20.50 at expiration. This combination of Long Call Vertical + Long Put Vertical offers max profit of 56% and only loses 100% if the stock remains unchanged, which in this case appears to be unlikely.

The combination of two long verticals creates a spread also known as an Iron Condor or Iron Butterfly. At SpreadHunter we prefer to view this spread as two separate verticals, which simplifies things and offers more flexibility entering and exiting the position.

Step #3: Execute The Trade

The stock is Super Micro Computer (SMCI -0.17%↓), and there are two parts to this trade:

Open a put spread expiring on November 22nd, buying the $15 strike puts and selling the $14 strike puts for a net debit of $0.33.

Open a call spread expiring on November 22nd, buying the $19.50 strike calls and selling the $20.50 strike calls for a net debit of $0.31.

The max profit is 56%, and that occurs with the stock above $20.50 or below $14 next Friday. The max loss is $100%, and that would occur if the stock doesn’t move at all between now and next Friday.

Step #4: Manage the Position

Step #4: Manage the Position

We’ll be illustrating this in a follow up post!

Maybe This Isn’t For You

Maybe you would rather stay safe. That’s fine; you can download the Portfolio Armor iPhone hedging app by clicking on the QR code below or aiming your iPhone camera at it.

If you'd like to stay in touch

You can subscribe to Dr. Janello's Substack here.

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).