What’s behind the numbers?

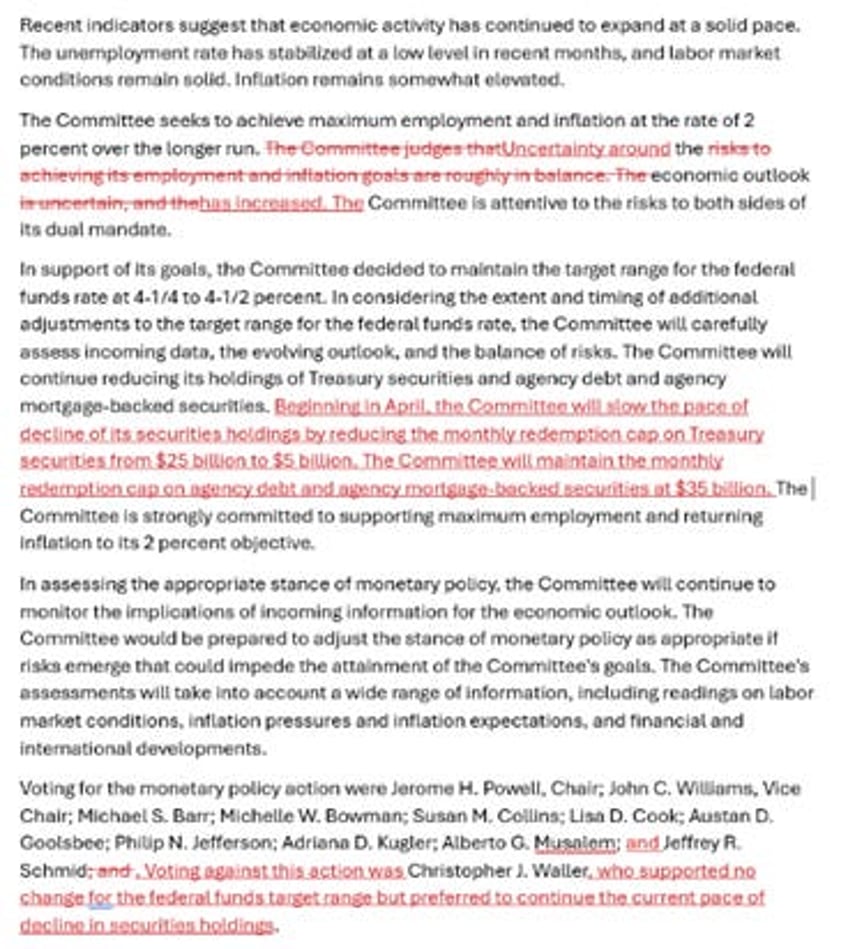

As widely anticipated, the Federal Open Market Committee voted unanimously to keep the federal funds rate within a range of 4.25%–4.5%. In the post-meeting press release, FED officials removed the statement that “risks to inflation and employment are roughly in balance” and instead emphasized that “UNCERTAINTY AROUND THE ECONOMIC OUTLOOK HAS INCREASED.”

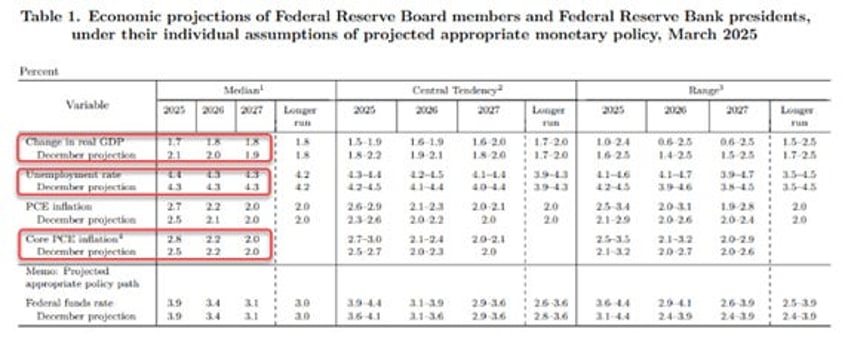

In its updated Summary of Economic Projections, the FED sharply lowered its 2025 growth forecast while raising its inflation outlook. The year-end GDP projection was cut from 2.1% to 1.7%, while the FED increased the year-end core PCE forecast from 2.5% to 2.8% and raised the unemployment rate forecast from 4.3% to 4.4%.

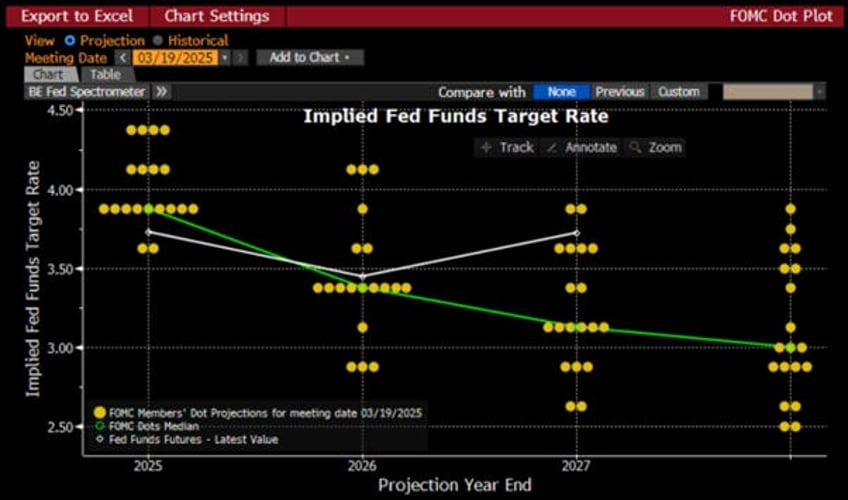

The "dot plot" of rate projections, which the central bank uses to signal its outlook for the path of interest rates, shows the year-end 2025 median projection for the FED Funds rate at 3.88%, still pricing in two FED rate cuts for the remainder of the year and remaining mostly unchanged from 3.73% in December.

Adding to the uncertainty surrounding the path forward for the U.S. economy, the FED announced that it will slow the balance sheet runoff from $25 billion to $5 billion per month. This decision reflects the FED’s lack of a clear outlook on underlying liquidity, as the U.S. Treasury is not mopping up as much cash as usual. The Treasury has had to scale back bill issuance due to operating under the debt limit.

FED Balance Sheet (blue line); US Unemployment Rate (red line).

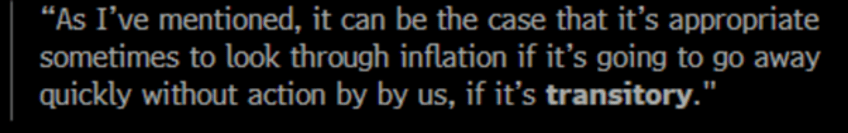

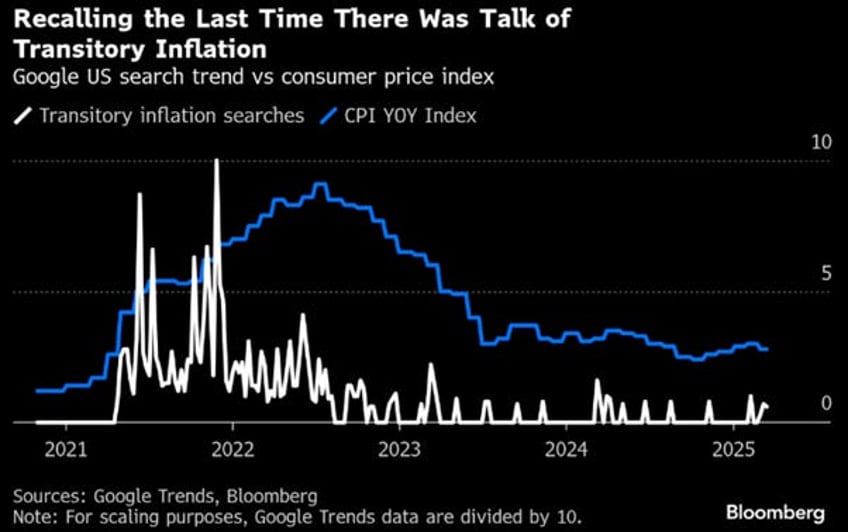

In his press conference, Powell began by stating that he, along with the FOMC committee, acknowledges that future policies will be shaped by measures taken and to be taken by the new administration. When asked about the revision to inflation and how much of it is due to tariffs, he bluntly replied, "Clearly, some of it," but added that the FED’s PhDs are still trying to assess the full impact. He noted that the effects of tariffs and other fiscal policies could be ‘transitory’ or not.

Looking back at the at last time the infamous T word was mentioned it presaged a sustained period or rising prices that was anything but.

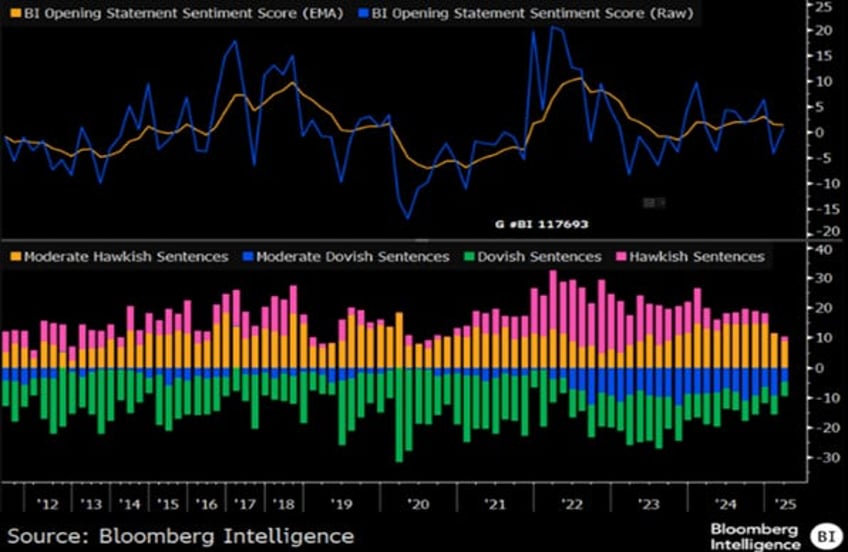

In a nutshell, the analysis of the Chair's opening remarks shows that this statement was effectively neutral: it is less dovish than the January reading, which had leaned modestly dovish when 'hawkish' statements softened that month.

Thoughts.

While the FED has been attempting to influence business cycles for the past 60 years, examining the FED Funds rate changes alongside the business cycle, illustrated by the relative position of the S&P 500 to oil and its 7-year moving average, reveals a consistent pattern. A decline in the FED Funds rate has almost always coincided with the peak of the S&P 500 to oil ratio. Furthermore, no FED Funds rate cycle has ever prevented the ratio from falling below its 7-month moving average, signalling a shift from economic boom to bust in the US economy.

Upper Panel: FED Fund Rate (purple line); Lower Panel: S&P 500 to WTI ratio (green line); 84-Month moving average of the S&P 500 to Oil ratio (red line).

The common belief among Wall Street and its pundits is that rising inflation is bad for equity markets, but the reality shows that the 12-month return for the S&P 500 has been strongest when the Gold to Bond ratio, an unbiased indicator of the US economy's inflationary environment, has been above its 7-year moving average and rising, as it has since the start of this decade, except for the brief inflationary bust in 2022.

Upper Panel: Gold to Bond ratio (blue line); 84-Month Moving Average of the Gold to Bond ratio (red line); S&P 500 Index (green line); Lower Panel: S&P 500 Index 12-Month Rate of Return (Yellow Histogram).

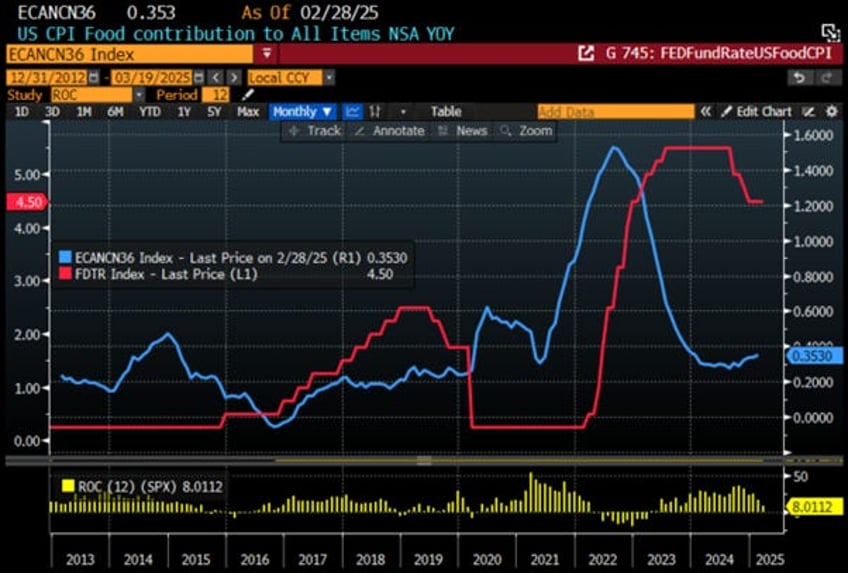

In an environment where inflation is driven by shortages, trade wars, geopolitical conflicts and lower confidence in public institutions, the FED, along with other central banks clinging to outdated Keynesian economics, is increasingly irrelevant in combating inflation. For instance, the FED can't control rising food prices, like those of eggs, which are driven by shortages and government regulations, such as tariffs, affecting the supply of essential goods. Adjusting rates won’t make a difference, as the belief that the FED can control the business cycle ignores basic common sense. Ultimately, inflation equals economic growth, a natural feature of any system, while deflation signals economic contraction. So, should we really fear inflation and celebrate asset depreciation?

Upper Panel: US Food CPI YoY Change (blue line); FED Fund Rate (red line); Lower Panel: S&P 500 Index 12-Month Rate of Return (Yellow Histogram).

Those who truly understand the business cycle and how to adapt their portfolios know that interest rates fall during recessions or depressions and rise during economic booms. Equity investors don't need a PhD in finance to recognize the strong correlation between the FED Funds rate and the S&P 500's 12-month return. Yet, analysts spout generic jargon without questioning its accuracy. The myths they promote are just nonsensical, and mainstream media, failing to analyse the data, continues to spread confusion, ultimately benefiting Wall Street elites and their pundits.

S&P 500 Index (blue line); FED Fund Rate (red line); 12-Months Rate of Return of S&P 500 Index (Yellow Histogram).

This should come as no surprise to those who understand that equity market performance is driven by the business cycle, which affects corporate America's profitability. Over time, when the S&P 500 to Oil ratio trends downward and breaks below its 7-year moving average, corporate earnings typically decline, aligning with the FED's decision to cut rates.

Upper Panel: S&P 500 to Oil Ratio (green line); 84-Month Moving Average of S&P 500 to Oil Ratio (red line); Lower Panel: FED Fund Rate (blue line); S&P 500 Index 12-Month Forward EPS (red histogram).

What is bad for both the equity and bond markets is stagflation, as the real challenges for investors, tariffs, war, taxation, and government spending, are beyond the FED's control. As the US economy heads into an inflationary bust, neither stocks nor bonds will offer positive inflation-adjusted returns as it was the case more recently in 2022.

Upper Panel: S&P 500 to WTI ratio (blue line); S&P 500 to WTI ratio 84-Month moving average (red line); Middle Panel: S&P 500 adjusted to inflation 12-Month Rate of Change (Yellow histogram); Lower Panel: Bloomberg US Treasury Total Return Index 12-Month adjusted to inflation Rate of Change (Purple histogram).

Those who understand that the US economy is gradually shifting from an inflationary boom to an inflationary bust should not be surprised of the impotence of the FED. As the S&P/Gold ratio is hanging just above its 7-year moving average, a leading indicator, typically by 3 to 6 months, for a similar trend in the S&P/WTI ratio, which reliably signals a shift from economic boom to bust will understand that the action taken by the FED will not impact the trend in long dated yield as the USD (i.e., US Treasuries) remains a poor store of value compared to gold, the timeless and resilient store of value.

Looking at what the FED was forced to do historically when the S&P 500 to gold ratio broke below its 7-year moving average, such as between June 1971 and July 1983 or February 2002 and May 2013, pushing the S&P 500 to WTI ratio below its 7-year average a few months later, the FED has consistently been compelled to raise rates sooner rather than later to combat monetary illusion, ultimately leading to an economic bust. This suggests that if Powell and his PhD colleagues are genuinely committed to keep the USD, the world reserve currency, as a reliable store of value and therefore fighting inflation for the benefit of the American people, as proclaimed at every press conference, it seems inevitable that the FED will have to reverse course in 2025 and raise rates again, if only to maintain the appearance of not fully colluding with the Treasury to finance additional reckless government spending at the cost of increasingly entrenched inflation in the US economy.

Upper Panel: S&P 500 to Gold ratio (yellow line); 84-months Moving average of S&P 500 to Gold ratio (red line); FED Fund Rate (axis inverted; green line); Lower Panel: S&P 500 to WTI ratio (blue line); 84-months moving average of S&P 500 to WTI ratio (orange line); FED Fund Rate (axis inverted; green line).

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/lost-in-the-transitory-tariff-sto…

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.