Published by Theya — Your Keys, Your Bitcoin.

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.

Download Theya on the App Store.

Cliff-Notes:

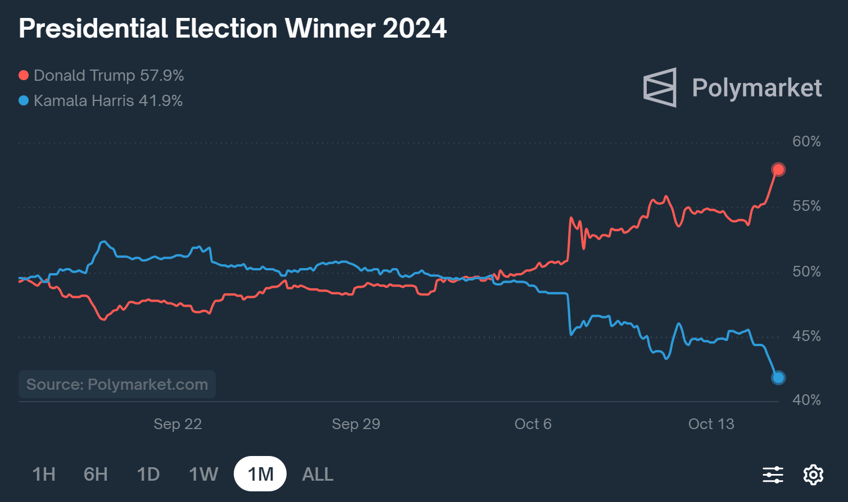

- Former President Trump leads Vice President Harris by 16% on Polymarket; his widest lead since VP Harris joined the race on July 21st.

- Bitcoin is picking up steam, now up 5% in October and 11.6% in the last month. It is challenging its descending wedge, demonstrating strength here just 3 weeks out from the 2024 US election.

The election looms. 21 days from now, the world's superpower will elect a new leader. As a result of such a monumental event, markets price themselves around the probable outcome; currently, markets are coalescing around the increasingly likely outcome of a second Trump term, the 2nd non-consecutive presidential term in history, following Grover Cleveland in 1884 and 1892.

Trump's odds according to Polymarket have risen to 57.9%, his highest odds since Harris entered the race back in late July. His lead against VP Harris is now 16%. Harris' campaign is driven by the media-industrial complex and fleeting enthusiasm of a new, young candidate entering the race in lieu of her aging predecessor. That enthusiasm-driven momentum has faded and is deteriorating by the day as voters come to realize that, similar to her predecessor, she too is inept.

As both Harris and Trump sprint to the finish line in this last 21-day stretch, both will be ramping up their interviews and public appearances, which will make Harris' dependence on a teleprompter to deliver coherent remarks all the more obvious, and thus, voter confidence in her ability to lead as commander in chief will continue to wane. Ceteris paribus, I expect these margins to look largely similar to today's margins once election day rolls around:

Bitcoin has broken out of its ~$16,000 downward consolidation range; marking a bullish reversal from the neutral consolidation the market experienced for 7 months from mid-March to mid-October. Bitcoin is now challenging this yellow wedge constructed using the highest tickmarks on BTCUSD going back to its all-time high, and the local lows set in January and August. This wedge is not set to resolve until March 2025, so the worst-case scenario is 5 more months of chopsolidation until retail is shaken out and bulls are fully in control.

My base case is that the market will be all system's go for BTC following the election in 3 weeks, with a swift and decisive breakout from this wedge, and a move through $80,000 and beyond highly likely before the end of 2024:

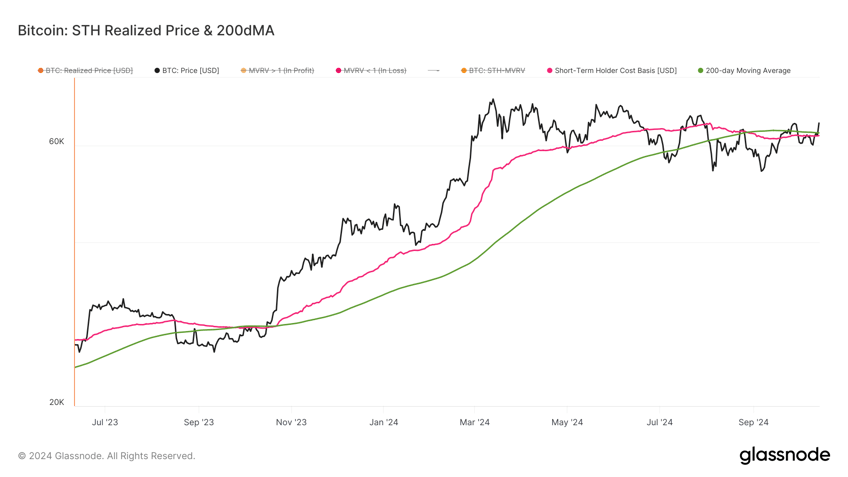

From a technical levels perspective, bitcoin has broken above both its 200-day moving average and the short-term holder cost basis, marking the third attempt at reclaiming these key levels. While broader market dynamics, such as election hedging, may keep volatility subdued in the near term, bitcoin’s ability to hold these key levels in the coming days will be a constructive sign. With higher lows continuing to form, the mid-to-long-term outlook remains decisively bullish, and the potential for stronger upside gains is building:

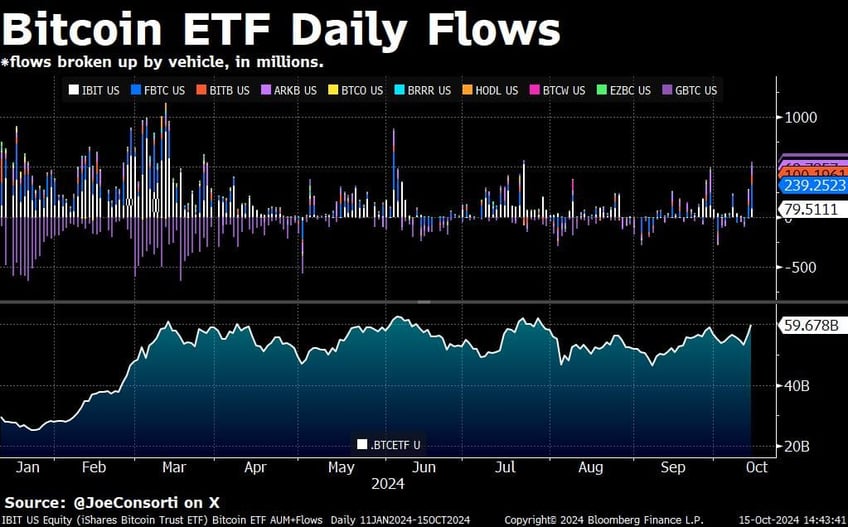

Bitcoin ETF inflows are surging once more, totaling ~$802 million on Friday and Monday. Even as bitcoin's price has chopped lower for 7 months, ETF investors have been continued net buyers, and the total AUM for all 11 spot BTC ETFs is $60 billion, the same as it was when bitcoin hit its all-time high in March.

Despite the drawdown, the total AUM in spot bitcoin ETFs remaining steady demonstrates a heavy bullish bias towards BTC from ETF investors. This is helped in no small part by Larry Fink and other heads of these ETF issuers, who have become the de facto marketing arm for bitcoin, selling people on bitcoin as an asset far and wide for months on end in a concerted effort to drive inflows to their respective vehicles:

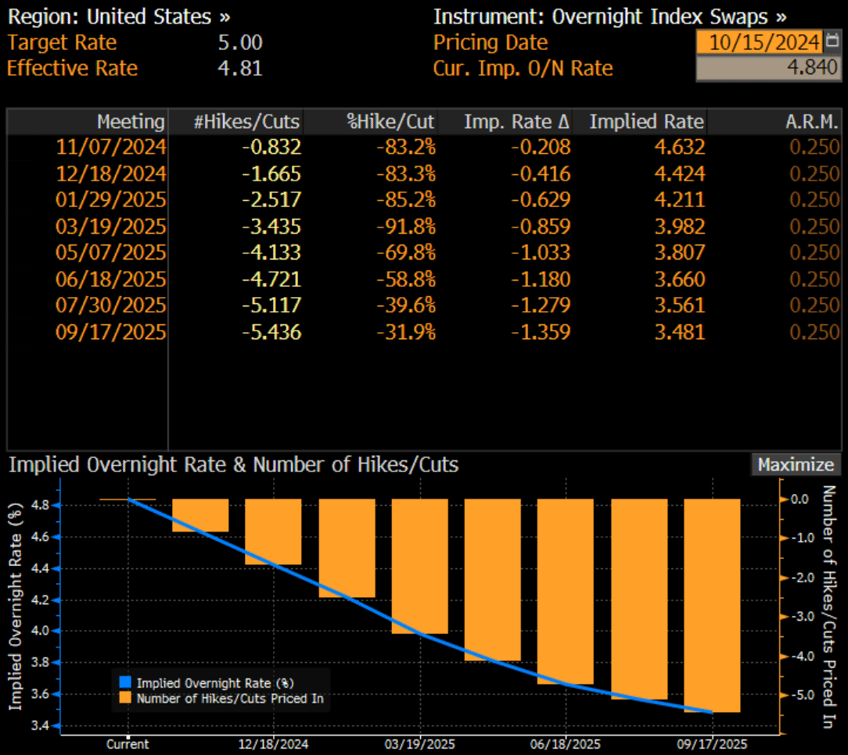

While bitcoin is marginally influenced by election odds, it is first and foremost a macro asset that is influenced by the direction of global liquidity. As the Fed cuts rates into a resilient domestic economy, and the world's central banks cut rates in unison at their most aggressive pace since 2007, bitcoin stands to capture that easing with outsized upside potential compared to all other macro asset classes.

The S&P 500 is still setting new all-time highs on a near-daily basis, while higher beta assets such as the Nasdaq 100, Russell 2000, and bitcoin are still trading anywhere from 1% to 11% below their all-time highs set in Q1 and Q2 of this year. Once the election is in the rearview, these high beta assets will have their day in the sun once more, and be the outperformers as people move out on the risk curve and into assets with a higher return profile.

There is currently $6.5 trillion locked up in retail and institutional money market funds yielding anywhere from 3% to 5%. With the Fed projected to cut rates by an additional 150 basis points over the next year, much of that capital will move out of MMFs and into vehicles where it can capture greater return:

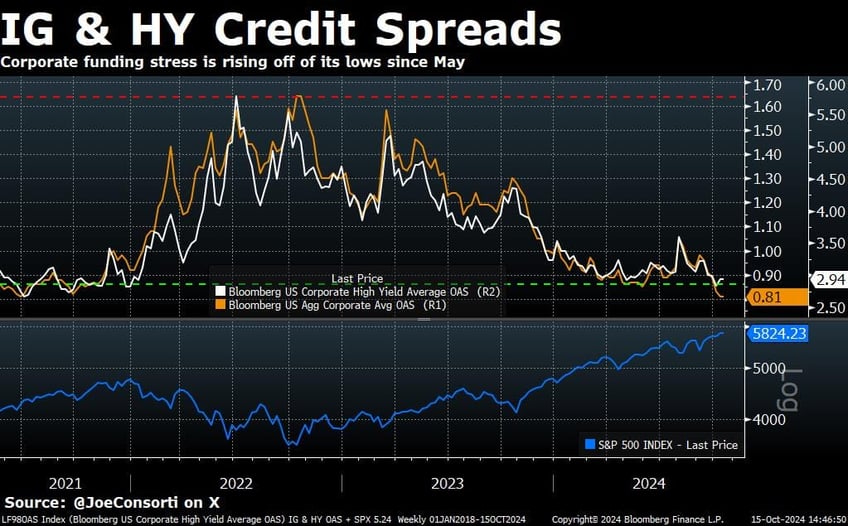

Investment-grade (IG) credit spreads have dropped to 0.81, and high-yield (HY) spreads have fallen to 2.94, both resting at cyclical lows. This narrowing in spreads reflects a robust business outlook, as investors demand less compensation for corporate credit risk. With borrowing costs remaining low and credit markets showing strength, equities continue to look like an attractive trade over the next few quarters. Tight credit spreads suggest corporate fundamentals are solid, supporting risk-on sentiment as the environment remains favorable for business growth and profitability:

Before we go: make sure you check out Theya's brand-new web app.

Now, non-iOS and Android users can set up secure and robust bitcoin multisig vaults in 15 minutes or less, all from the comfort of your computer.

Check it out at app.theya.us

Take it easy,

Joe Consorti

Theya is the world's simplest Bitcoin self-custody solution. With our modular multi-sig vaults, you decide how to hold your keys.

Whether you want all your keys offline, shared custody with trusted contacts, or robust mobile vaults across multiple iPhones, it's Your Keys, Your Bitcoin.