Trump Victory Likely Stronger for the USD

TL;DR

- If Trump Wins, the Dollar should be stronger

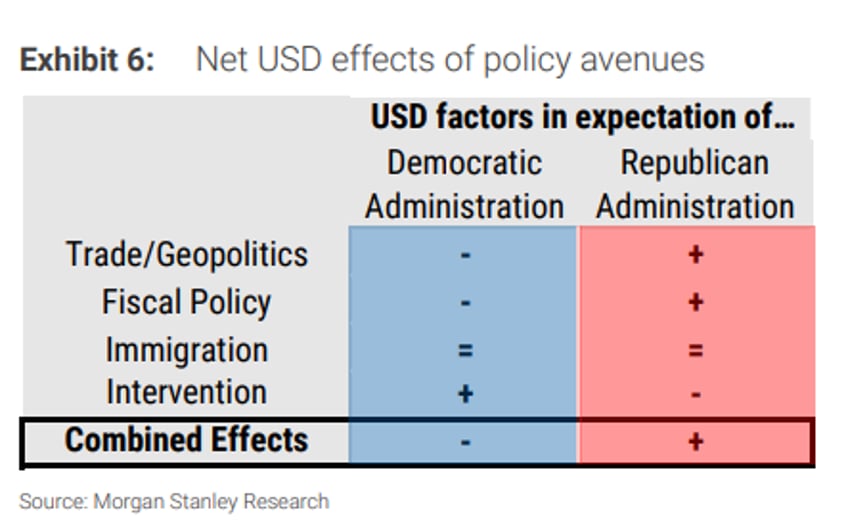

- The most important driver of dollar strength under either candidate will be Trade and Geopolitics; Monetary policy does not matter as much

- Interestingly: If Trump wins the Fiscal expansion will be bigger than if Harris wins. But that will be positive for the dollar based on how the money will be spent under a Republican administration.

Contents:

- Overview

- Election Impact on USD

- Fiscal Policy Considerations Are Very ironic

- Monetary Policy and the Fed Don’t Matter Much

- Immigration Policy Changes Matter Little

- Trade and Geopolitical Risks Matter Most

- Slides

- More…

The Bank's Bottom Line

Morgan Stanley's recent report, The White House and the Dollar, examines in extensive detail how the upcoming U.S. presidential election might affect the U.S. dollar (USD). The report focuses on the potential impacts of different fiscal, trade, and monetary policies that could emerge under various administrations, shaping the future performance of the currency.

Their bottom line is:

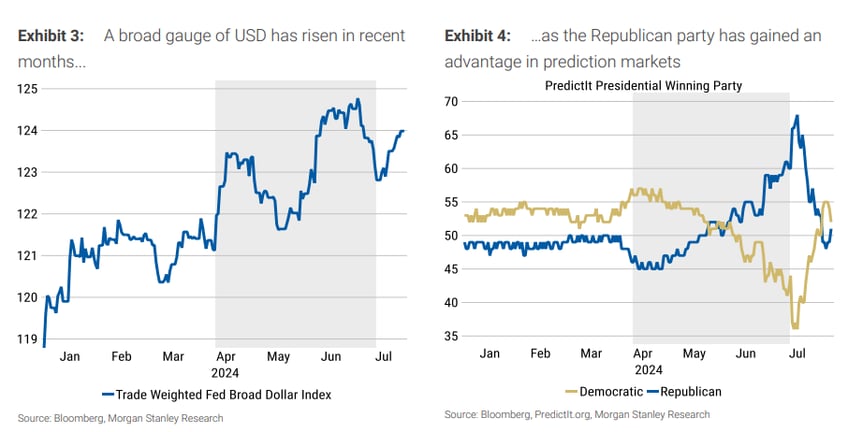

Broadly, we expect trade and geopolitical considerations to be a tailwind to USD if a Republican White House looks increasingly likely and inclined to pursue trade confrontation. Conversely, we expect trade and geopolitical considerations to be a headwind to USD if the Democratic Party looks increasingly likely to retain control of the White House

Monetary policy matters little by comparison it would seem as the changing world and how we react to it weighs more on national policy

Election Impact on USD

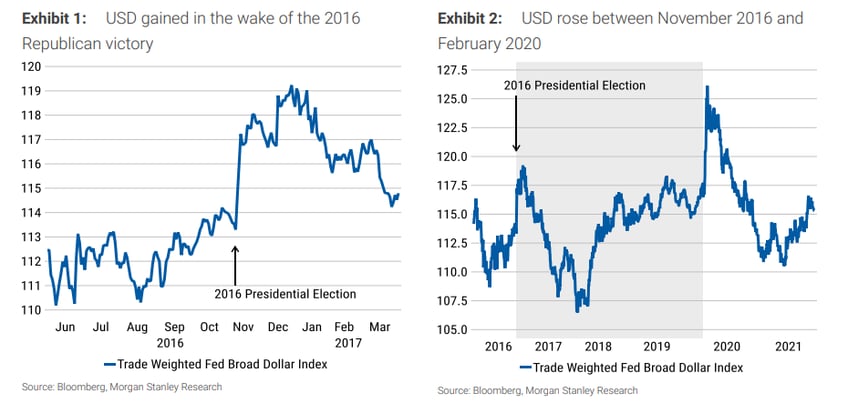

The election's outcome could significantly sway the USD. If Republicans win, policies could favor a stronger dollar. In contrast, a Democratic victory might bring less aggressive fiscal policies, potentially leading to a weaker USD.

Fiscal Policy Considerations Are Very Ironic

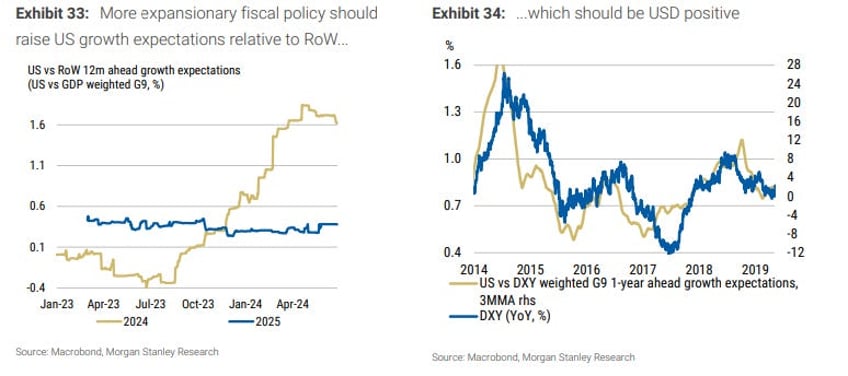

A Republican sweep, (interestingly) is seen as the most fiscally expansionary scenario, with an expected increase in the U.S. deficit by around $1.6 trillion. On the other hand, a Democratic administration is likely to pursue a more restrained fiscal approach, resulting in a smaller deficit impact. The GOP will perhaps spend more. However, the spending will be perceived as good for business and thus economically productive as exhibits 33 and 34 show.

Monetary Policy and the Fed Don’t Matter Much

The possibility of a Republican administration appointing a Fed Chair who favors lower interest rates is mentioned, which could reduce the appeal of USD-denominated investments and potentially weaken the dollar.

We conclude that there are not significant differences in Fed policy in any of the 2024 election outcomes – monetary policy is likely to be easier in all four scenarios listed here

Despite potential political pressures, the report expects the Fed's independence to remain intact, regardless of which party is in power

Continues here

Free Posts To Your Mailbox

.