For much of the past year, oil traders were desperate to find a bullish thesis. Now, in the span of just a few weeks, they have two.

On one hand, amid mounting fears of a supply and inventory glut, Biden's parting gift of accelerated sanctions against Russian oil exporters and tankers appears to have promptly removed as much as 1.5 million barrels in daily supply, and pushed oil prices to a 5 month high.

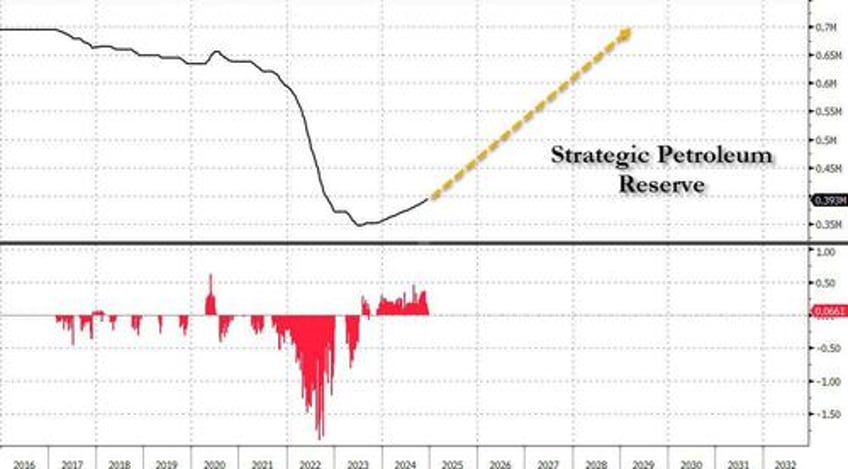

But while Russian supply is set to shrink materially for the next few months, US demand is about to surge. That's because President Donald Trump said during his inaugural address that he plans to refill the US’s strategic oil reserve “right to the top” after it reached lows not seen since the 1980s under Joe Biden's handlers, who drained about half of the SPR after the Ukraine war to prevent a surge in oil prices.

Trump vowed to “bring prices down, fill our strategic reserves up again right to the top and export American energy all over the world” during his inaugural address at the Capitol Monday.

The Strategic Petroleum Reserve, which has a maximum capacity of about 700 million barrels, currently stands at at 394.4 million barrels following a record selloff during Biden’s administration, which drained about half by late 2023. The drawdowns under Biden included selling 180 million barrels into the global market in an attempt to bring down gasoline prices following Russia’s 2022 invasion of Ukraine.

Biden had begun slowly refilling the emergency cache, which was created in the aftermath of Arab oil embargo in the 1970s, but ran out of funding to buy more crude after purchasing about 60 million barrels. It would take an act of Congress to appropriate more money for the Energy Department’s petroleum account.

Of course, the moment such act is passed, oil traders will start frontrunning the US government and push crude prices sharply higher, especially if and when China finally capitulates and unleashes the massive stimulus its economy so badly needs.

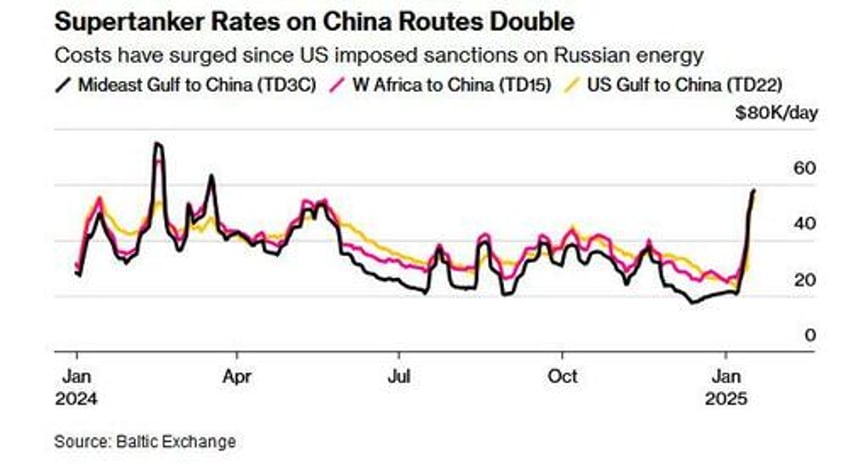

But while it will take some time before Trump's plan to refill the SPR is implemented, the Russian export squeeze is already hitting the global commodity market hard, with costs to hire an oil supertanker on key routes to China more than doubling since the US imposed sanctions on Russia two weeks ago, showing the extent to which the move has upended the global shipping market.

The sanctions have jolted a freight market that was, until recently, dealing with softer demand due to supply curbs, a tepid Chinese economy, and an easing of Middle East tensions. The number of confirmed journeys hasn’t changed much, but the pool of available ships has shrunken rapidly, and there’s intense competition on certain routes.

As shown below, daily rates for very-large crude carriers on the Middle East-to-China route surged 112% to $57,589 in the week through Friday, according to Baltic Exchange data, after Washington sanctioned nearly 160 tankers hauling Russian crude on Jan. 10. Those on the US Gulf-to-China journey jumped 102%, while West Africa-to-China saw an increase of 90%.

The reason for the surge in tanker rates is that in recent days, major Chinese refiners have been been rushing to buy crude from the Middle East, Africa and the Americas to make up for the loss of Russian oil. A VLCC from the US Gulf to China was hired for $9.5 million last week, compared to a low-$7 million range over the last couple of months, shipping fixtures show. Indian Oil Corp. is also snapping upup Middle Eastern barrels, adding to the pressure.

Separately, there’s concern that tanker rates could remain elevated if Trump takes a tougher line against Tehran, which he has also promised to do.

“Rates could hold at these levels if Trump dials up the pressure on Iranian oil shipments, which is more likely than not,” said Junjie Ting, a Singapore-based shipping analyst at Oil Brokerage.

The rising demand for VLCCs, which can carry around 2 million barrels of oil, is also feeding through to costs for smaller vessels, which tend to be viewed as less cost-efficient on longer routes. Rates for Suezmaxes, that hold about 1 million barrels, have climbed on increased demand and tight supply, shipbroker SSY said in a report.