Trump’s Crypto Reserve: A Power Play or a Risk? Why Gold Still Wins

The U.S. may be on the verge of a digital currency revolution. Trump’s proposal to create a Crypto Strategic Reserve—stockpiling Bitcoin, Ethereum, Ripple, Solana, and Cardano—aims to cement America’s dominance in digital assets. But while Washington flirts with a government-backed crypto play, smart investors aren’t forgetting the ultimate reserve asset: gold.

What Is the Crypto Strategic Reserve?

Trump’s plan would mark the first time the U.S. government formally holds cryptocurrency as part of its financial reserves. The move could signal broader acceptance of digital assets and drive institutional adoption, but it also raises serious questions.

Will this make crypto more centralized? Or could it expose the financial system to extreme volatility? And if the U.S. government suddenly becomes a major player in crypto markets, how much control will it have over the price?

While some see this as a game-changer, others recognize that crypto remains speculative, digital, and dependent on government policy. Gold, on the other hand, has outlasted every financial experiment in history.

Why Gold Still Wins

Gold isn’t just another asset—it’s real, tangible wealth that has stood the test of time. While governments manipulate fiat currency and crypto markets swing wildly, gold remains the one constant in an uncertain world.

1. Stability in a Digital Age

Bitcoin is prone to price swings, regulatory crackdowns, and exchange failures. Gold doesn’t disappear in a hack, get frozen in a government wallet, or rely on a blockchain to exist.

2. Hedge Against Inflation and Debt

The U.S. national debt is north of $36 trillion, with over $1 trillion in annual interest payments. Inflation is creeping back, and even with rate cuts on the horizon, the purchasing power of fiat currency is eroding. Gold is the asset investors turn to when they want something that won’t be debased.

3. Central Banks Know the Truth

While the U.S. considers crypto reserves, central banks worldwide are hoarding gold. For the third straight year, over 1,000 metric tons of gold have been added to national stockpiles. China, India, and Poland are leading the charge, ensuring they hold real wealth, not digital speculation.

Gold vs. Crypto: Which One Do You Trust?

A government-backed crypto reserve may be a historic move, but it doesn’t change one fact: gold remains the ultimate store of value. No blockchain, no government, no central bank needed—just a hard asset that has preserved wealth for centuries.

Get Gold in Your Hands Today

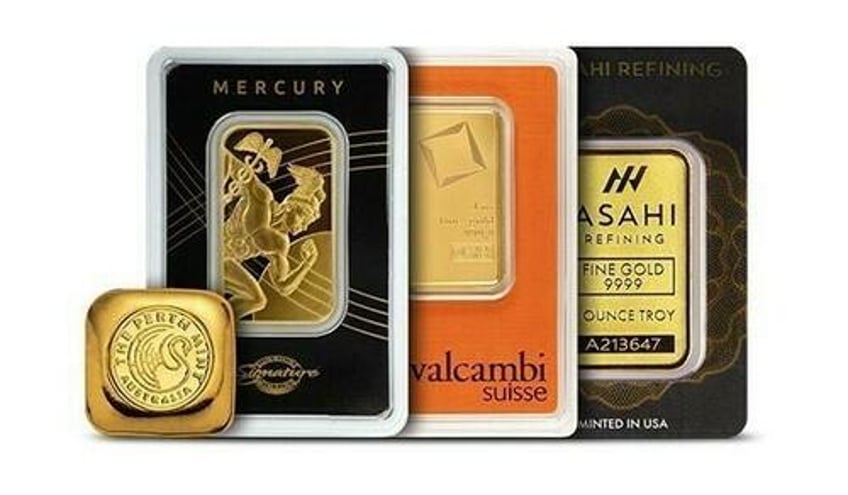

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, offers investors an accessible entry into the gold market.

✔ 1 oz of .9999 pure gold—tangible, secure, and independent of government policies.

✔ No counterparty risk—unlike crypto, gold can’t be frozen, hacked, or erased.

✔ A proven hedge against economic uncertainty—just like central banks, you should be stacking gold while you still can.

Governments are making moves, but you don’t have to wait on them. Take control of your wealth. Secure your Gold Starter Pack today.