Submitted by QTR's Fringe Finance

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. Larry is one of my favorite market analysts to follow and he gets little coverage in the mainstream financial media, so I’m happy to bring you his thoughts.

Larry was kind enough to allow me to share his thoughts heading into Q1 2025. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 2. Part 1 was published here earlier this week.

MARKETS SMELL FUTURE INFLATION

One of the most interesting market developments during 2024 is that in spite of the stock market doing well, the “sound money” assets (Gold, Silver, Bitcoin) are doing well too. More generally speaking these assets are negatively correlated. In fact, as mentioned earlier it is very unusual for the stock market to be strong and for the prices of gold and silver to outperform it.

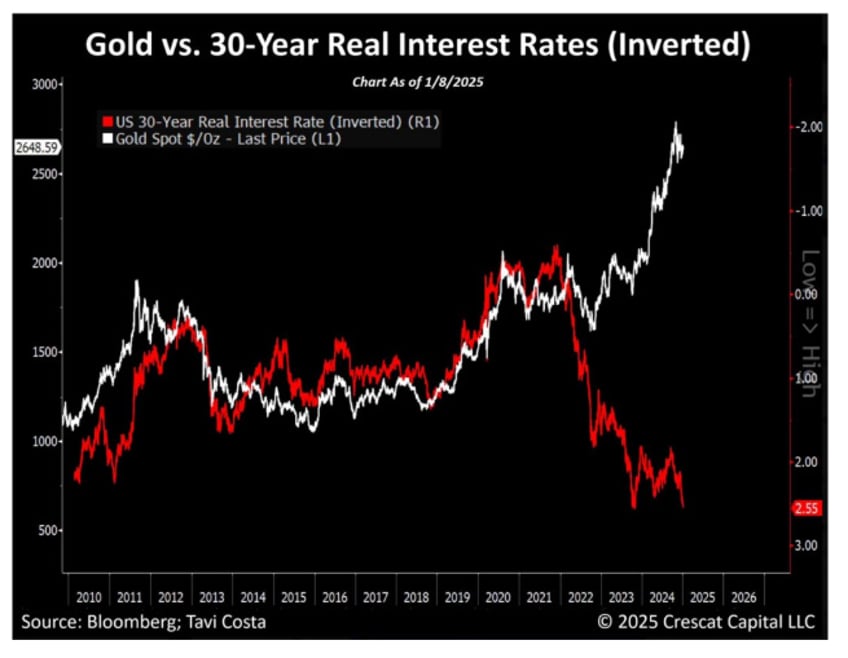

We believe that this is because the markets can see that the Federal Reserve is trapped and they are sniffing out future monetary accommodation. Historically, the price of Gold has correlated with the real interest rates. This makes sense. When bonds offer high real interest rates, or good inflation adjusted returns, then they are more attractive than gold. The opposite is also true.

The next schedule below shows the price of gold versus the real interest rate on bonds (inverted). Note the tight correlation from 2010 to 2022. We have also examined this over much longer historical time frames and the correlation is quite strong. Then note what happened in 2022. When the U.S. seized the $600 billion of Russian foreign exchange reserves the two data series began to diverge. Gold suddenly looked more attractive than Treasury bonds which could be seized. This divergence has persisted because the markets are sniffing out future inflation.

GOLD, SILVER AND BITCOIN SIGNAL INFLATION

We used to live in a world where the U.S. Treasury bond market was the base layer collateral for all financial markets. Due to the U.S. fiscal malfeasance and the inflation that has resulted from these policies, we see sound money alternatives sending an inflation risk signal that is loud and clear.

The two biggest canaries in the coal mine of money printing and monetary debasement are Gold and Bitcoin, and below we see Gold’s outperformance vs. sovereign bonds (Gold up 200% compared to U.S. T-Bonds since 2020)...(READ THIS FULL LETTER HERE).

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Larry’s Disclaimer: These presentation materials shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell, any securities or services. Any such offering may only be made at the time a qualified investor receives from EMA formal materials describing an offering plus related subscription documentation (“offering materials”). In the case of any inconsistency between the information in this presentation and any such offering materials, including an offering memorandum, the offering materials shall control.

Securities shall not be offered or sold in any jurisdiction in which such offer or sale would be unlawful unless the requirements of the applicable laws of such jurisdiction have been satisfied. Any decision to invest in securities must be based solely upon the information set forth in the applicable offering materials, which should be read carefully by prospective investors prior to investing. An investment in EMA not suitable or desirable for all investors; investors may lose all or a portion of the capital invested. Investors may be required to bear the financial risks of an investment for an indefinite period of time. Investors and prospective investors are urged to consult with their own legal, financial and tax advisors before making any investment.

The statements contained in this presentation are made as of the date printed on the cover, and access to this presentation at any given time shall not give rise to any implication that there has been no change in the facts and circumstances set forth in this presentation since that date. These presentation materials may contain forward-looking statements within the meaning of US securities laws. The forward-looking statements are based on EMA’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to it, and can change as a result of known (and unknown) risks, uncertainties and other unpredictable factors. No representations or warranties are made as to the accuracy of such forward-looking statements. EMA does not undertake any obligation to update any forward

looking statements to reflect circumstances or events that occur after the date on which such statements were made. Historical data and other information contained herein, including information obtained from third-party sources, are believed to be reliable but no representation is made to its accuracy, completeness, or suitability for any specific purpose.

No representation is being made that any investment will or is likely to achieve profits or losses similar to those shown. Past performance is not indicative of future results. This report is prepared for the exclusive use of EMA investors and other persons that EMA has determined should receive these presentation materials. This presentation may not be reproduced, distributed or disclosed without the express permission of EMA.