TSL's Steven Blitz Thinks Fed "Inching Towards a July Cut"

TL;DR

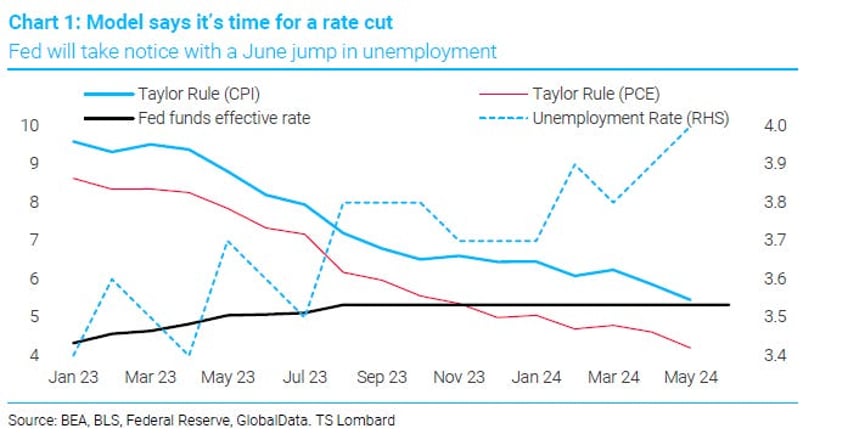

- Using a modified Taylor Rule, Fed Funds "should" be 4.2% given current PCE of 2.6%

- If June unemployment ramps, then a July Rate Cut may finally be triggered according to TSL models

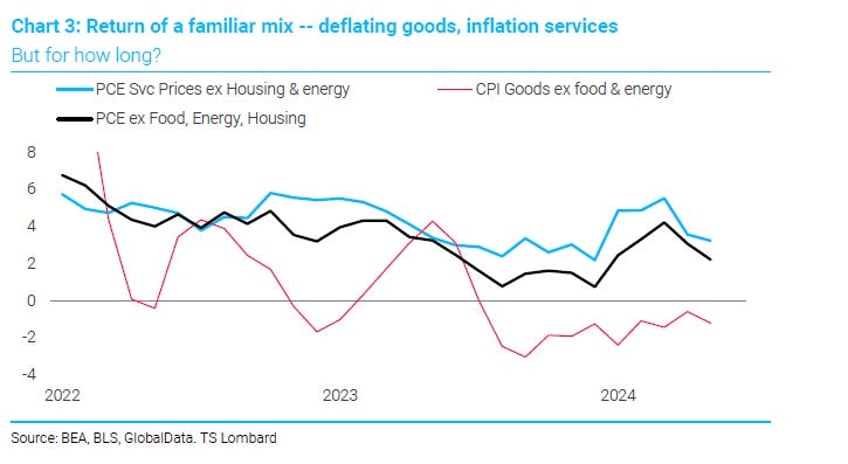

- Goods disinflation is back,albeit for a different reason this time, Services disinflation, not so much yet

- Housing is cracking, implying Services inflation is next

Contents: (450 words, 5 graphics)

- Fed Strategy

- Economic Dynamics

- Inflation Analysis

- Real Economy Insights

- Fed's Potential Actions

- Bottom Line

Fed Strategy

Steven Blitz's report highlights the Federal Reserve's potential policy actions, driven by lower PCE inflation figures influencing the Taylor Rule towards a rate cut. The Fed is shifting its focus from inflation control to managing growth signals, with this week’s June employment data playing a crucial role in their decision-making.

Economic Dynamics

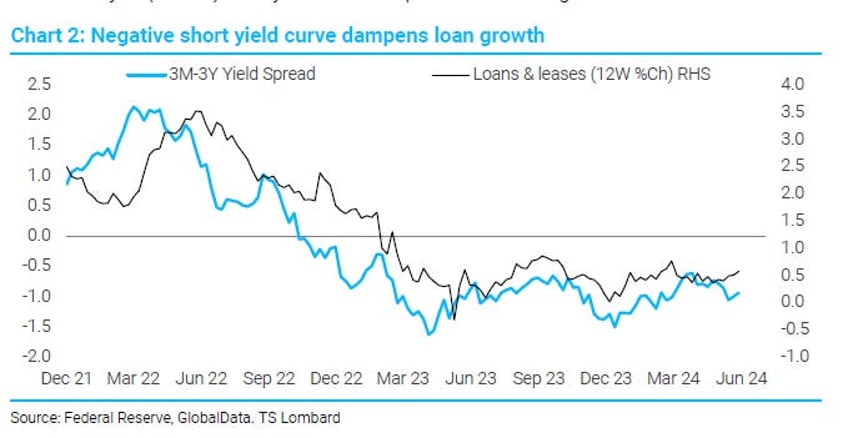

The current economic scenario is multifaceted, as always. While the public is preoccupied with immediate concerns, the Fed aims to maintain stability1. Real growth has shown resilience despite challenging conditions, thanks to a significant liquidity overhang that could be accelerated by a drop in short-term interest rates. However, the threat of recession remains due to the inverted real yield curve and negative real growth in bank lending, indicating slower growth ahead.

Blitz’s adjusted Taylor Rule model, which considers the current 2.6% Core PCE inflation rate, suggests a funds rate of 4.2%, pointing to a potential 25bp cut in September, likely to be announced in July if supported by June employment data.

Inflation Analysis

The report provides a detailed view of the inflation landscape. While headline PCE prices, excluding food, energy, and housing, show a modest 2.2% Y/Y increase, this is mainly driven by deflation in goods rather than a broad reduction in service inflation. Service inflation, excluding housing and energy, remains above 3% but has slowed in recent months, indicating a decelerating economy, though not quickly enough to raise immediate recession concerns.

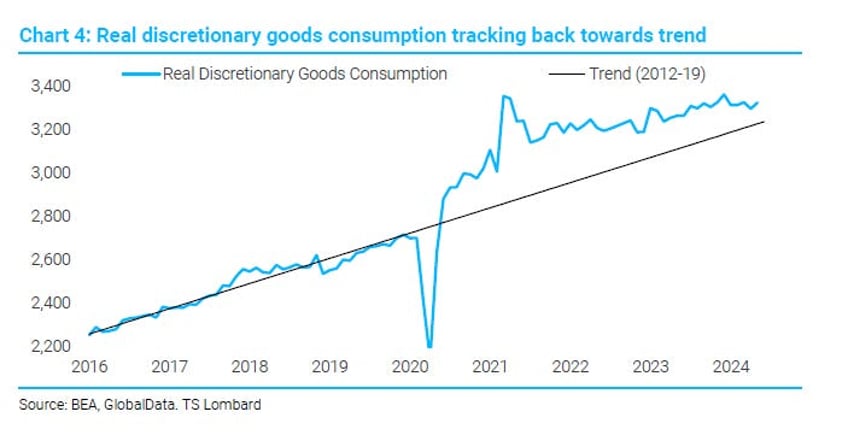

Real Economy Insights

Hiring and real discretionary spending are both decelerating but remain positive. Real discretionary goods consumption is gradually returning to its 2012-2019 trendline, indicating post-pandemic normalization. Similarly, spending on real discretionary services is aligning with pre-Covid levels but hasn't fully recovered. The overall economic outlook shows no immediate recession, but vulnerabilities, especially in housing, are evident.

Continues Unlockedhere

Free Posts To Your Mailbox