NATO MEMBER

Before we get into this, please remember that Turkiye is part of the North Atlantic Terrorist Treaty Organisation (NATO).

Turkiye detains dozens of suspected Mossad agents

Turkish authorities have arrested over 30 people with suspected ties to Israel’s Mossad intelligence service, Interior Minister Ali Yerlikaya said on 2 January.

But wait, it gets better.

Our fight against organized crime organizations and spies that disturb the peace of our families will continue with determination and determination,” the interior minister said.

Hahaha, the Turks are calling Israeli intelligence “organised crime.” I’ll bet there are heads exploding in DC, Brussels, and, of course, Tel Aviv.

Be sure, we’ll shortly be seeing any or all of the following:

- An attempted “colour revolution” in Turkiye. The last one orchestrated by the CIA in 2016 failed, but hey…

- Sanctions, because they worked so well against the Russkies. When you’re a hammer, then everything looks like a nail.

- CNN running stories about Erdy killing babies or even worse… misgendering alphabet people.

What surely must be clear to all but a complete moron at this point is that Turkiye has already decisively moved towards the East, and the only reason they’re still in NATO is to collect the few billion a year in military spending they get from the US. This can’t and won’t last.

Why this matters is multifaceted but certainly it is worth noting that control of the Bosphorus is crucial.

In fact, while the Suez is currently becoming a hotbed of activity (as it always is in global conflicts), so too is the Bosphorus.

I point all this out because it’s simply fascinating to me, but also because it’s important to understand how assets are likely to be priced. Which brings me to oil…

You’d think that in the midst of the above oil would be trading higher, but no.

Energy stocks are out of favor. Fund managers had less exposure to energy stocks heading into 2024 than at any time since December 2020, according to the latest Bank of America Global Fund Managers Survey. With energy prices slipping, investors went from 4% more exposure to energy stocks than their benchmarks in November to 11% less exposure in December—the largest month-to-month decline since January 2016. They had 23% more exposure to tech than their benchmarks.

So where are all the pointy shoes placing their bets?

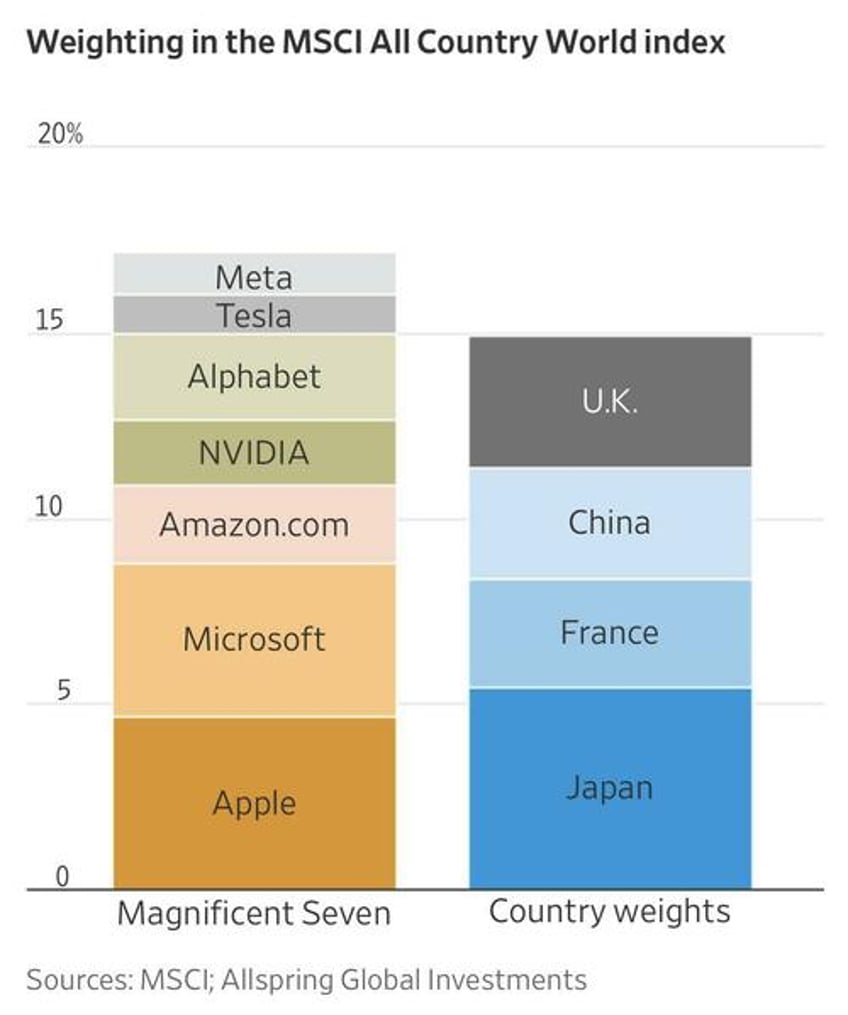

Into the Magnificent 7, of course.

You know what they’re all betting on? The Fed slashing interest rates and juicing the market.

These particular equities are priced for perfection as we head into 2024. I certainly wouldn’t want to be long them.

Source: Insider 288 | Follow Capitalist Exploits on Twitter | Subscribe To Insider