Why Be Bullish On China

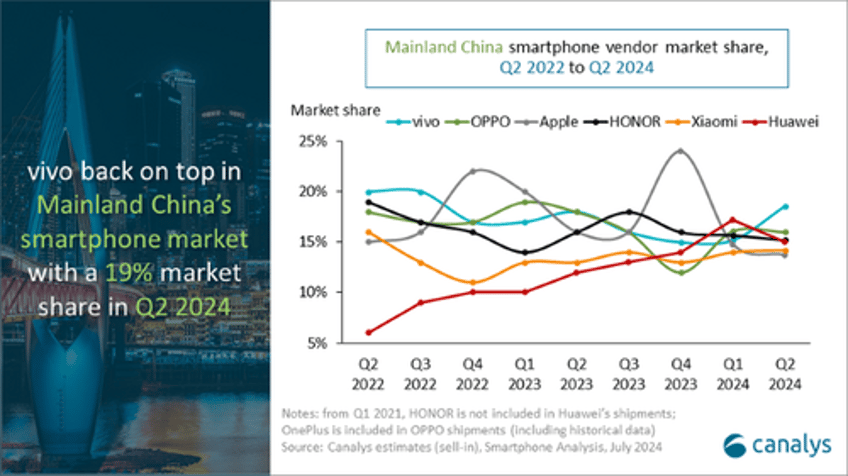

Consider two companies, one Chinese, Xiaomi (XIACY) and one American, Apple (AAPL). Earlier this year, after a decade of experiments that went nowhere, Apple abandoned its foray into electric cars without even bringing one to market. Xiaomi is sort of the Apple of China, except perhaps not quite as upscale. It had a slightly higher share of the domestic smartphone market than Apple in the 2nd quarter.

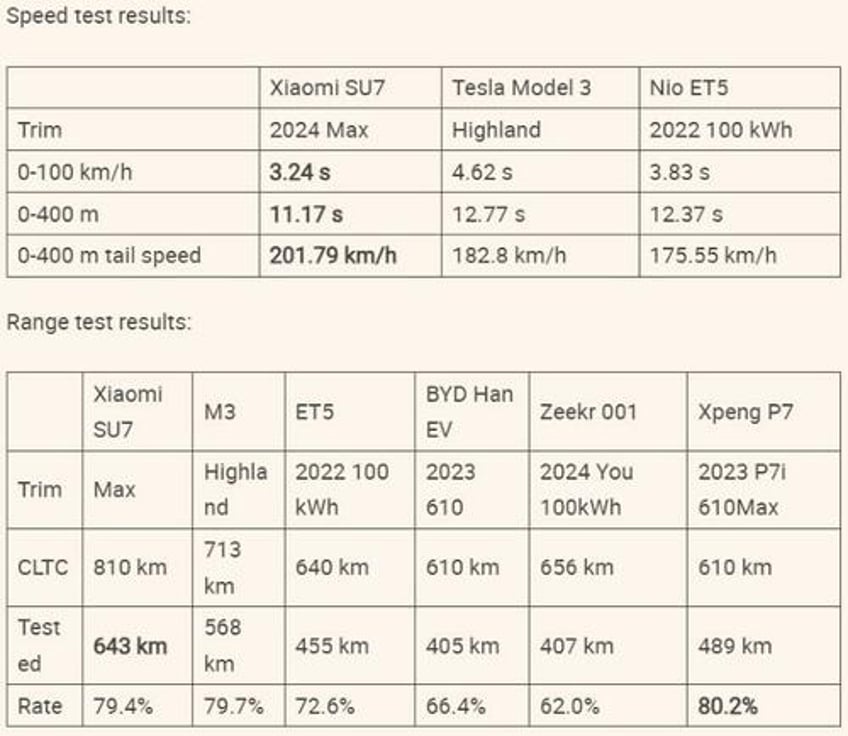

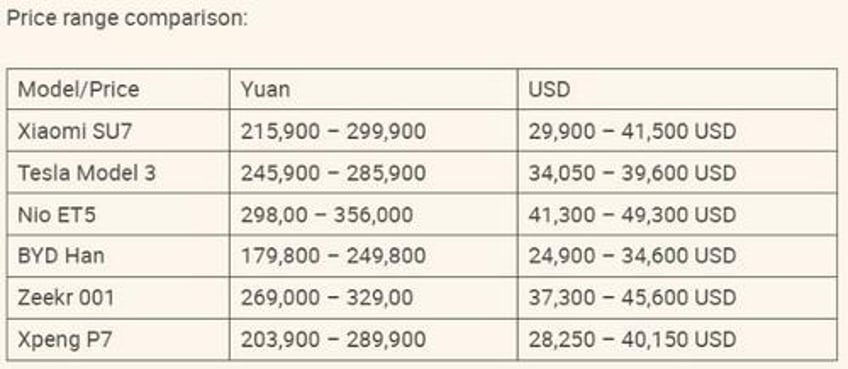

Like Apple, Xiaomi considered manufacturing electric cars. Unlike Apple, it actually brought one to market, one that compares favorably with Tesla's (TSLA) Model 3 in performance.

And Xiaomi is pumping them out of a highly-automated factory.

This illustrates how today's China makes high-quality products at high volume. Combine that with a government that's averse to recessions, and you've got a bullish tailwind for the Chinese market.

Our Two Bullish China Stocks

Xiaomi trades over the counter in the U.S., so there aren't any options traded on it, and it's not particularly cheap, so that wasn't one of the bets my subscribers and I placed on China last month. The two names we did bet on were PDD Holdings (PDD) and Trip.com Group (TCOM). Trip.com is based in Singapore, but does significant business in mainland China.

Why We Picked Them

Both stocks came up on this screen last month, after which we did some additional research on them.

PEG (Next Year) < 1

Has options

RSI < 30

At the time, both were oversold, with Relative Strength Indexes (RSI) below 30; that's no longer the case now, but both are still undervalued. According to Chartmill data, PDD has an overall valuation rating of 8 (on a scale of 0-to-10, with 10 being the best), while TCOM has a valuation rating of 7.

PDD has the better chart, currently, with a technical rating of 8,

While TCOM has a technical rating of 0, but it has a set-up rating of 6, indicating that its share price has been consolidating here...

And TCOM is reporting earnings at the end of the month. It beat on both top and bottom lines last time it reported, so another strong report could give it a bounce.

Our Bullish China Trades

For PDD, we placed two trades:

- A vertical spread expiring on August 30th, buying the $139 strike calls and selling the $140 strike calls for a net debit of $0.30. Since the stock closed at $144.02 yesterday, it's too late for you to tail on that one.

- A vertical spread expiring on December 20th, buying the $140 strike calls and selling the $145 strike calls, for a net debit of $1.60.

What both of those trades have in common, is a potential upside of >200% if the stock closes above the higher strike on the expiration date.

If you'd like to aim for a similar risk-versus-reward on PDD, consider a spread with slightly higher strikes at the December 20th expiration, perhaps $145-150, or $150-$155. Take the lowest $5 spread you can get that you can buy for a net debit of $1.65 or less.

For TCOM we placed one trade:

- A vertical spread expiring on September 20th, buying the $44 strike calls and selling the $45 strike calls for a net debit of $0.33.

That trade you can enter now, for about the same price (that spread is showing a midpoint of $0.35 now).

If You're Concerned About Market Risk

As a reminder, you can download our iPhone hedging app here, or by aiming your iPhone camera at the QR code below. We've lowered the cost of the optimal collar and change expiration date capabilities to $2.99, so be sure to try those out if you haven't already.

If You'd Like A Heads-Up When We Place Our Next Trade

Feel free to subscribe to our trading Substack/occasional email list below. We've got some long and short trades we're researching now.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).