The clean Green energy fiasco has reached a new level of incompetence and waste...

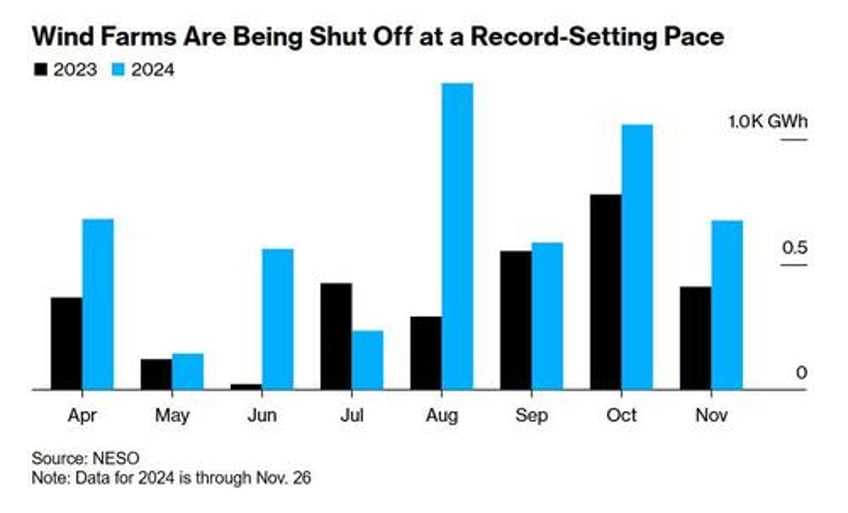

Totally Wasted Wind Power

Bloomberg reports UK Is Paying £1 Billion to Waste a Record Amount of Wind Power

Burgeoning capacity and blustery weather should have driven huge growth in output in 2024. But the grid can’t cope, forcing the operator to pay wind farms to turn off, a cost ultimately borne by consumers. It’s a situation that puts at risk plans to decarbonize the network by 2030 and makes it harder to cut bills.

Crucial to the net zero grid target is a massive build-out of renewable power, particularly from wind. Britain has boosted its offshore fleet by 50% in the past five years and is set to double it in the next five, Bloomberg data show.

But the grid hasn’t expanded at the same pace. As a result, the operator is increasingly paying wind farms, particularly those in Scotland, not to run. So far this year, the UK has spent more than £1 billion ($1.3 billion) in “congestion costs” to turn off plants that can’t deliver electricity because of grid constraints, and switch on others.

Last month for example, when Storm Bert swept across the UK, some of its newest and biggest wind parks were still. Scotland’s £3 billion Seagreen project, owned by SSE Plc and TotalEnergies SE, was shut off. SSE’s Viking development on the Shetland Islands was also closed.

Wind vs Gas

UK generators usually sell output in advance on the wholesale market. But those transactions don’t take into account the physical limitations of balancing supply and demand in real time. To keep the lights on, the operator steps in, paying some plants to turn off and others that are closer to demand centers to fire up.

Often, this means shutting off a far-flung wind farm and starting up a gas-fed plant that’s closer to a city.

Absurd Setup

“It’s absurd that Britain pays Scottish wind farms to turn off when it’s windy, while simultaneously paying gas-power stations in the south to turn on,” said Clem Cowton, director of external affairs at supplier Octopus Energy Group.

I don’t believe we need an energy director to diagnose the complete absurdity of this arrangement.

Which of These Headlines Are Real?

Southern Wife Arrested for Failing to Serve Drinks in Mason Jars

UK Pays Wind Farms $1.3 Billion to Shut Down When It’s Windy

FBI Warns Kash Appointment Could Jeopardize Efforts to Not Release Epstein List

Trump Renews Relations with Castro Regime

It is sometimes very difficult to distinguish between real and fake headlines.

In the above list, only number 2 is real. The others are from the Babylon Bee.

Wind Losses Are Huge

General Electric (GE): GE’s offshore wind business expects to lose about $1 billion in 2023 and 2024. This is due to a number of challenges, including:

Inflation

High interest rates

Supply chain bottlenecks

Rising costs for components

Siemens: Lost nearly $1 billion on wind last year

Vestas: Saw an operating profit decline of 369%

Increased costs: Commodity prices, including for steel and copper, have increased, as well as construction and operating costs

Regulatory process: The regulatory process takes about six years, while other countries are building projects at a faster pace

Lawsuits and disinformation: Lawsuits from advocacy groups and disinformation campaigns from astroturfing groups have slowed development

The above was AI generated.

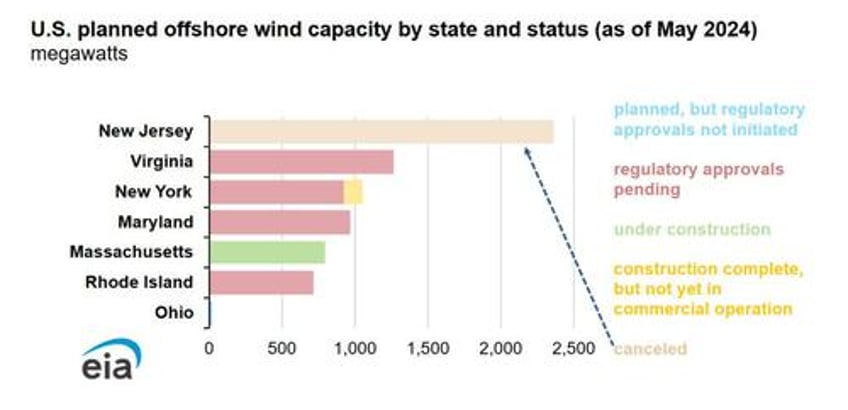

Offshore Wind Projects

Image is from the US Energy Information Agency, EIA article Cancellations Reduce Expected U.S. Capacity of Offshore Wind Facilities.

The amount of offshore wind generating capacity that is under construction or planned in the United States is in flux after two projects in New Jersey were canceled last year. Of the 7,200 megawatts (MW) of capacity reported in May in EIA’s latest Preliminary Monthly Electric Generator Inventory, projects totaling about 2,400 MW have been canceled since last December while others totaling 4,800 MW remain active in various stages of development.

Cancelled Projects

In late 2023, developer Orsted canceled the 2,400-MW Ocean Wind 1 and 2 projects in New Jersey, citing rising interest rates, high inflation, and supply chain delays.

In January, Orsted withdrew from commitments to the Maryland Public Service Commission to build the Skipjack 1 and 2 projects, totaling 966 MW, but is still continuing with advanced development and permitting.

Late last year, the developer of the 20-MW Icebreaker Wind project on the Ohio coast of Lake Erie halted the project amid rising costs and loss of funding.

Jones Act Impact on Offshore Turbines

Trump should Kill the Jones Act but will he?

Another significant hurdle for offshore wind development in the U.S. involves a century-old law known as the Jones Act.

The Jones Act requires vessels carrying cargo between U.S. points to be U.S.-built, U.S.-operated and U.S.-owned. It was written to boost the shipping industry after World War I. However, there are only three offshore wind turbine installation vessels in the world that are large enough for the turbines proposed for U.S. projects, and none are compliant with the Jones Act.

That means wind turbine components must be transported by smaller barges from U.S. ports and then installed by a foreign installation vessel waiting offshore, which raises the cost and likelihood of delays.

Trump failed to kill the Jones Act in his first term. Will he do so now?

Because of the Jones Act, the US has the highest shipping costs in the world.

Dear DOGE, please look into this. It’s a high-priority item for reasons other than turbines.

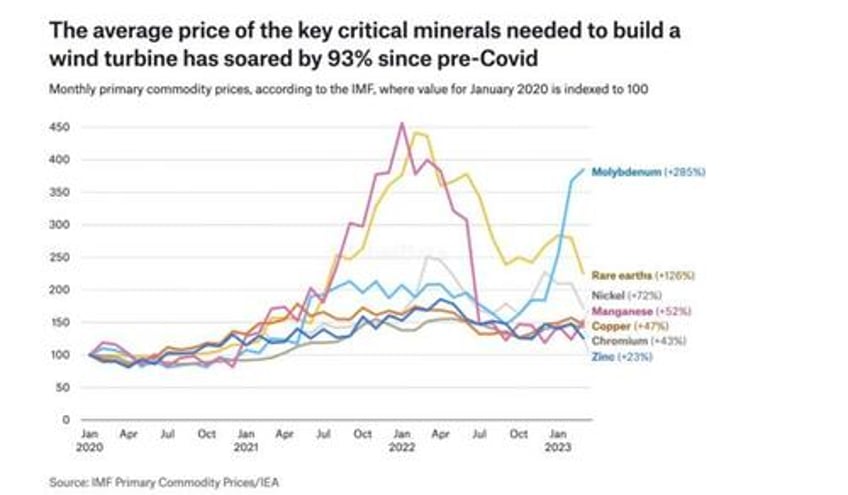

Wind Turbine Average Price of Key Critical Materials

The Biden administration set a goal to install 30 gigawatts of offshore wind capacity by 2030. Bloomberg reports the actual number will be closer to half that.

Bloomberg: “As the price of construction climbs, developers are rapidly revising their plans — at great cost.“

Material costs have risen, labor costs have risen, the cost of money has shot up, and opposition to projects has risen.

Cancellations show these projects, at least the offshore ones, are hugely unprofitable even with big subsidies.

Has anyone truly factored in the mineral costs, concrete needed, and environmental impacts on birds and marine life, especially whales?

Mish Economic Rule

Except in cases of genuine national security interest, if a project cannot post a profit without subsidies, then it is not economical and should not be undertaken.

Wind turbines are not a national security item. Thus, developers should proceed at their own risk, not US taxpayer risk.

Dear DOGE request #2. Please cancel all subsidies.

Addendum

Speaking of fiascos with much more economic and global trade implications, pleased see my post: China Halts Rare Exports Used by US Technology Companies and the Military

Thus, Trump’s 50 percent tariff threats on China will do one of two things, perhaps both: Block all rare earth exports from China or start WWIII.

Good luck with that.

Oh, I forgot to add: Trade wars are good and easy to win.