In his 1651 work Leviathan, Thomas Hobbes lays out a political philosophy based on the social contract. He depicts the 'state of nature' as a grim, war-torn existence, 'solitary, poor, nasty, brutish, and short', driven by competition, mistrust, and pride. To escape this, people surrender their natural rights to a sovereign, ideally an absolute monarch, forming the 'Leviathan', a powerful, unified authority enforcing peace and stability. Hobbes argues that only an unchallenged central power can prevent chaos, reflecting his view of humans as naturally selfish and conflict prone. Though criticized for its authoritarianism, his theory highlights the trade-off between freedom and security, with the Leviathan symbolizing the necessity of strong governance for societal order.

As the Department of Government Efficiency (DOGE) dismantles parts of Washington, D.C.'s bureaucratic ‘Leviathan,’ job losses will hit the capital and other cities tied to the inefficient U.S. government. Cuts to reckless spending and subsidies, revenue for beneficiaries, will also sting. In theory, shifting resources from government to the private sector boosts long-term productivity, but in the short term (the next year or two), it hampers growth. Laid-off workers by government contractors won’t instantly find new jobs, dragging down confidence and spending. Investors familiar with business cycles know inflation stems from shortages, demand, and shaken confidence, factors worsened by tariffs, trade wars, job uncertainty and imperialistic threats, which will deepen global distrust in public institutions. On the other hand, economic performance drives government approval; Trump’s support will tank if tariffs spark inflation and will collapse entirely if he drags Americans into conflicts to satiate the colonialist property dreams of those now pulling the strings between the White House and Mar-a-Lago.

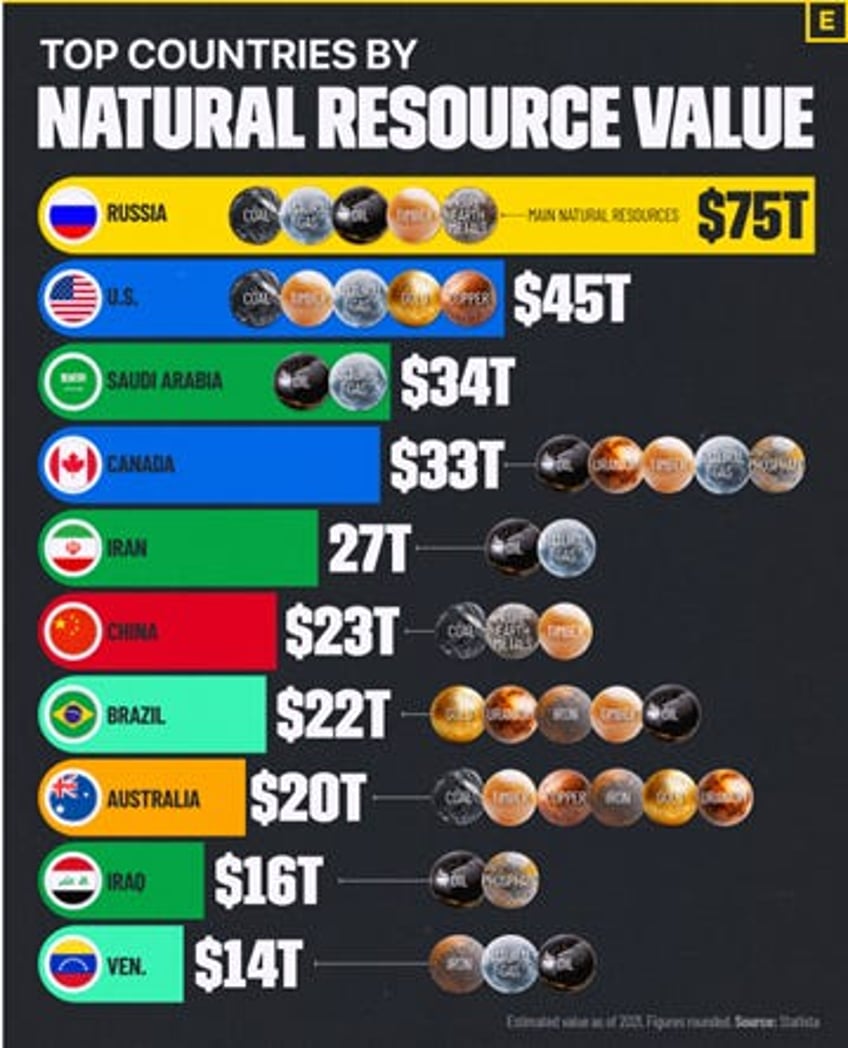

Anyone who understands the business cycle knows that an economy’s stage within it is heavily influenced by commodity price trends and the ability of economic actors to pass higher input costs onto their customers. A quick glance at the geopolitics of commodity supply reveals, no PhD required, that among the ten largest countries blessed with the most commodities, only three (the USA, Canada, and Australia) are not part of the emerging mercantilist Global South, which has begun rejecting the imperialism historically imposed by the increasingly misnamed 'developed markets.

https://elements.visualcapitalist.com/ranked-top-countries-by-natural-resource-value/

Far from the glamorous headlines of Wall Street and its pundits in the financial mass media, the reality of the start of the Jubilee year so far is that the Bloomberg Commodity Index has widely outperformed all the type of financial assets and even the presidential sponsored Crypto currency scam that have been highly recommended by Wall Street bankers when they published their notoriously useless year ahead recommendations.

Year-to-Date performance in USD of Bloomberg Commodity Index; S&P 500 Index; Nasdaq 100 Index; Magnificent 7 Index; Bitcoin; Bloomberg US Treasury Total Return Index.

Digging deeper into the details of this performance, unexpected by the consensus but widely anticipated by those who understand that commodity prices are driven not by Wall Street pundits or retail fever, but by supply-and-demand fundamentals and a long history of policies restraining capital expenditure in the sector, investors will note that the recent surge of the 'commodity leviathan' stems not only from the widely reported strength in precious metals but also from energy and industrial commodities, while soft commodities still lag behind their peers but outperforming the notoriously over-loved and over owned Magnificent 7 and other equity indices.

Year-to-Date performance in USD of Bloomberg Commodity Index; Bloomberg Industrial Metals; Bloomberg Agriculture; Bloomberg Energy; Bloomberg Precious Metals Index.

In this context, it should come as no surprise to anyone who knows that the best indicator of an inflationary environment is, and remains, the trend of the Gold-to-Bond ratio and its movement against its seven-year moving average. Therefore, no one should be surprised that this ratio’s rise above its seven-year moving average strongly correlates with trends in propagandistically manipulated headline CPI and Core PCE.

Upper Panel: Gold to Bond ratio (blue line) 84-Months Moving Average of Gold to Bond ratio (red line); Lower Panel: US CPI YoY Change (green line); US Core PCE YoY Change (yellow line).

Investors who understand that most inflationary pressures stem from commodity price movements should not be surprised to learn that the trend in the Gold-to-Bonds ratio strongly correlates with the Bloomberg Commodity Index and its 12-month rate of change.

Upper Panel: Gold to Bond ratio (blue line) 84-Months Moving Average of Gold to Bond ratio (red line); Bloomberg Commodity Index (green line) ; Lower Panel: 12-month Rate of Change in the Bloomberg Commodity Index (yellow histogram).

Looking at the two previous charts, no one needs to work for a glamorous Wall Street firm to see that the recent rebound in commodities, potentially the early stage of the next commodity bull cycle, will render the FED’s 2% inflation target neither an illusory ceiling nor even a floor, as the U.S. economy is likely to drift further from it once the 'Tariff Executive Orders' begin to noticeably impact everyday American life, fuelling 'Trump-Re-Flation.

Digging deeper into the recent surge of the 'Commodity Leviathan,' in a rare turn of events, the Bloomberg Commodity Index has outperformed oil prices since last summer. Indeed, such a trend has not been seen outside periods of global economic crisis, such as the end of 2008 (the Great Financial Crisis); between June 2014 and September 2015 (financial market flash crashes); Q4 2018 (Taper Tantrum and U.S.-China Trade War); and between December 2019 and March 2020 (COVID crash).

Ratio of WTI Price to Bloomberg Commodity Index (blue line).

A look at the evolution of the Oil-to-Bloomberg-Commodity-Index ratio and the Gold-to-Bonds ratio, and specifically their positions relative to their seven-year moving averages, shows that from the early 1990s through September 2024, the Gold-to-Bonds ratio’s stance above or below its seven-year moving average has been closely aligned with the Oil-to-Bloomberg-Commodity-Index ratio’s position relative to its own seven-year average. In this context, investors will note that since last September, while the Gold-to-Bonds ratio has remained well above its seven-year moving average, the Oil-to-Bloomberg-Commodity-Index ratio has dipped below its seven-year moving average, making this recent divergence additionally intriguing for savvy investors.

Upper Panel: Gold to Bond ratio (blue line) 84-Months Moving Average of Gold to Bond ratio (red line); Lower Panel: Oil to Bloomberg Commodity Index ratio (green line); 84-Months Moving Average of Oil to Bloomberg Commodity Index (red line).

Examining the S&P-to-Oil ratio’s movement around its seven-year moving average, the most reliable indicator of the U.S. economy’s health between boom and bust, anyone who can read a chart will notice that over the past 40 years, whenever the Oil-to-Bloomberg-Commodity-Index ratio falls below its seven-year moving average, the S&P 500-to-Oil ratio tends to fall below its seven-year moving average in the next 12 to 18 months, signalling an economic bust across the 50 states.

Upper Panel: S&P 500 to Oil ratio (blue line) 84-Months Moving Average of S&P 500 to Oil ratio (red line); Lower Panel: Oil to Bloomberg Commodity Index ratio (green line); 84-Months Moving Average of Oil to Bloomberg Commodity Index (red line).

Savvy investors, tuning out Wall Street’s noise, recognize that since the start of the decade, the U.S. has been caught in a monetary illusion. While nominal equity returns have attracted investors, the reality is negative returns in gold terms. Notably, whenever the S&P 500-to-Gold ratio drops below its seven-year moving average—as it has since the 47th U.S. president took office—the Oil-to-Bloomberg-Commodity-Index ratio has fallen below its seven-year moving average.

Upper Panel: S&P 500 to Gold Ratio (blue line); 84-months Moving Average of S&P 500 to Gold Ratio (red line); Lower Panel: Oil to Bloomberg Commodity Index ratio (green line); 84-Months Moving Average of Oil to Bloomberg Commodity Index (red line).

As DOGE intensifies the pressure of tariffs on the U.S. economy and inflationary pressures heat up under 'Trump-Re-Flation,' anyone with even a basic grasp of the business cycle should see that it’s only a matter of months, not years, before the U.S. shifts from the current inflationary boom into an inflationary bust. While some might find this puzzling, numbers and charts, unlike economists and Wall Street bankers, don’t lie. It’s a fact that the Bloomberg Commodity Index’s 12-month rate of return consistently strengthens during periods of inflationary bust, as seen in the most recent one from January 2022 to October 2023.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Middle Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: Dow Jones 12-months Rate of Change (yellow histogram); Lower Panel: 12-Months Rate Of Change of Bloomberg Commodity Index (yellow histogram).

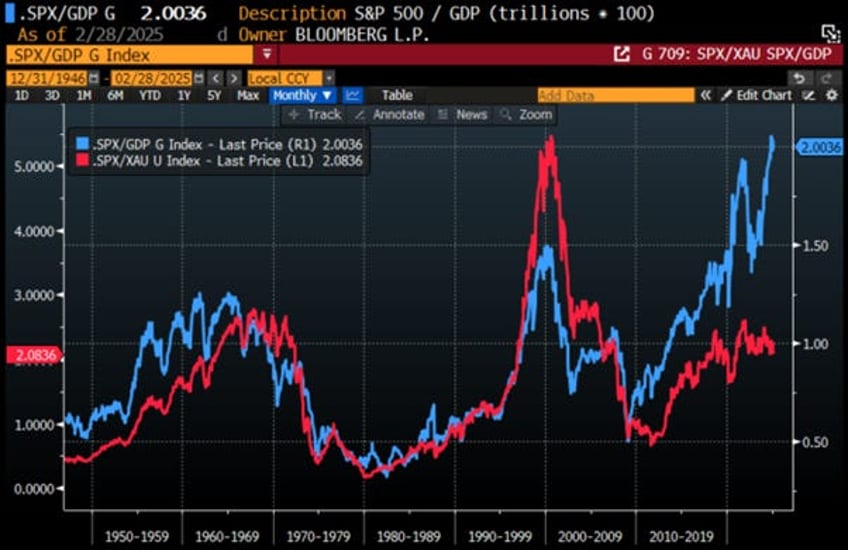

Savvy investors track the S&P 500 to Gold ratio against its 7-year moving average as a key market and economic signal. The last similar topping pattern occurred when Nixon ended the gold standard. While history may not repeat exactly, the US stock market cap-to-GDP ratio, now at a century-high 2.1x, suggests another potential peak if gold is a guide. On February 28, the SPX equalled 2.08 ounces of gold, resembling 1971, except today’s stock market is far more inflated.

S&P 500 Market Capitalization to US GDP Ratio (blue line); S&P 500 to Gold Ratio (Red line).

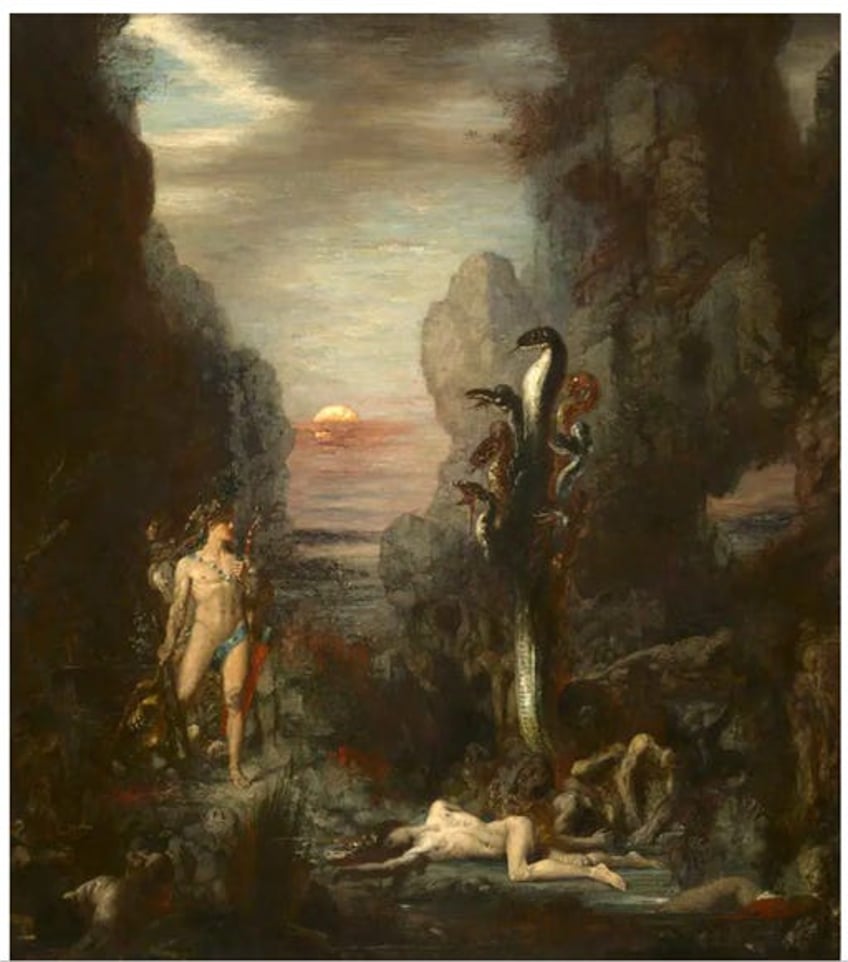

From ancient to modern times, 'leviathan' can denote anything of monstrous scale, maritime power, or mythic force. The name 'Leviathan' originates in the ancient Middle East, but it has wormed, or perhaps 'wyrmed', its way into modern English. As a general noun, the word now applies to any entity that is exceptionally large and powerful, carrying a hint of the terrifying and turbulent in its usage. Abstract concepts, such as dominant economies or vast bureaucracies, can be described as leviathans. In financial markets, where most investors focus on glamorous stocks or supposedly mundane fixed-income assets, the true leviathan is and remains commodities, which not only underpin everything investors and consumers use in daily life but also drive the business cycle, as savvy investors understand. Gold and oil, in this context, are akin to the mythic Hydra of Lerna, the two-headed serpentine water monster that Hercules slew in the second of his Twelve Labors

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/unleashing-the-commodity-leviathan

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.