Submitted by QTR's Fringe Finance

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week.

I believe Larry to truly be one of the muted voices that the investing community would be better off considering. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q4 2023. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 1 of this letter, Part 2 will be published tomorrow.

QUARTERLY OVERVIEW

It was an interesting quarter. There was a whiff of deflation as the Dow Jones, S&P 500 and NASDAQ all declined in value. But this was not matched by the prices of crude oil and commodities, both of which were strong, and the bond market had a bad quarter as rates continued to rise across the curve. A slowing economy, falling stocks and bonds, and rising commodity inflation spell one thing very clearly to us: STAGFLATION.

In the third quarter of 2023, the Fund increased in value slightly by 0.5% and picked up considerable ground (over 10% outperformance) on our benchmark index the Gold Stock Juniors ETF (GDXJ). A big piece of this outperformance occurred due to our large position in Lavras Gold which we profile on page 21. As we have said before, we manage the Fund aggressively, and in bear markets for gold stocks, we expect that we will do worse than GDXJ. However, we also want to point out that the converse is true in bull markets; in 2019 EMA was up 98% vs. the GDXJ which was up 40%, and in 2020 EMA was up 122% vs. the GDXJ which was up 33%. We believe that when this market turns, the results will be similar.

US FISCAL DOOM LOOP GETS WORSE

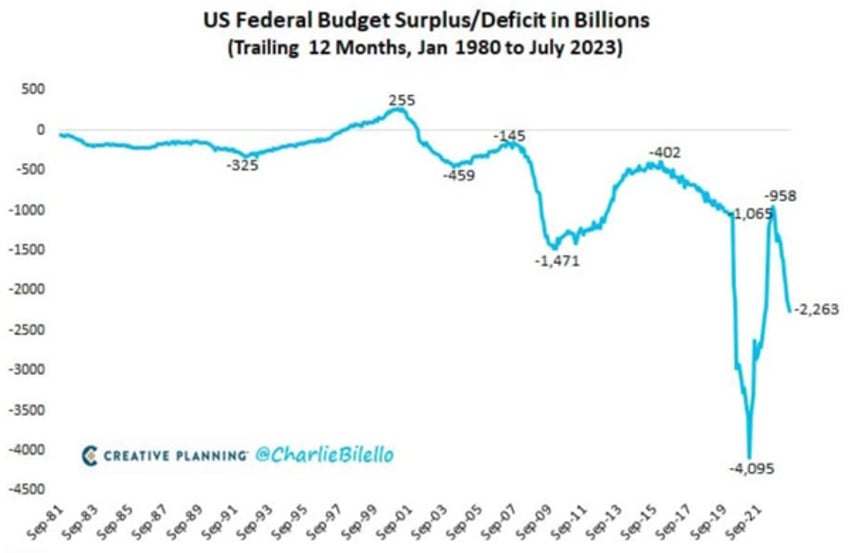

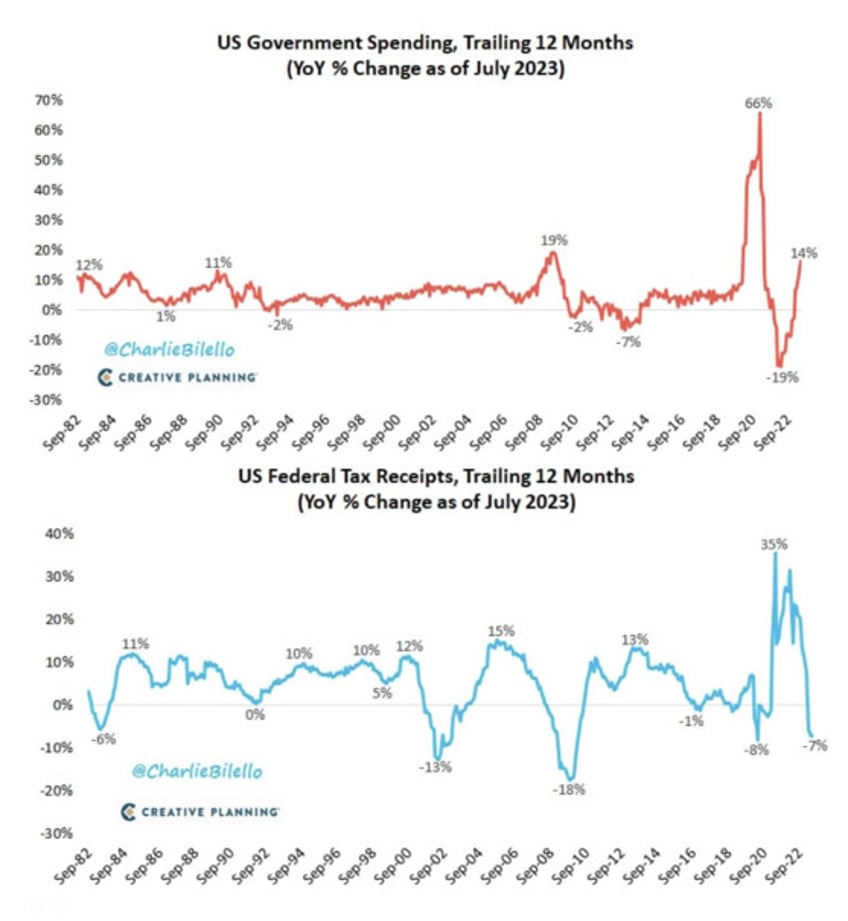

In our view, the biggest elephant in the room is the US Fiscal Doom Loop. To refresh: US Government spending is out of control, and there appears to be very little political will to stop it. As the chart below shows, Government spending is up 14% yoy and tax receipts are down 7% yoy. Fiscal year ended September 2023 is projected to have a deficit of over $2 Billion (or roughly 8% of GDP). In the past, deficits of this magnitude only materialized during significant downturns like the bursting of the Dotcom Bubble, the 2008 GFC and the COVID crisis. It is unprecedented to have deficits of this magnitude with the economy and employment being relatively strong.

One can only imagine where the deficit goes when the FED’s monetary jihad of rapid rate increases tips the economy over. Past economic downturns typically have increased the deficit/GDP ratio by 8-14%.

So as the economy moves into recession in 2024 (as we believe), the US could be looking at deficits as high as 20% of GDP ($5 Trillion) if the economy slows dramatically.

The reason we see it as a “doom loop” is that...(READ LARRY'S FULL LETTER HERE).