The Kate Moss Trade

Over the weekend, The Market Ear wrote about "The Kate Moss Trade", the impact of GLP-1 weight loss drugs on the market. One of the first traders to identify this macro trend and how to capitalize on it goes by the moniker "Citrini" on X. He was gracious enough to let us excerpt his landmark post here. Before we do, a brief disclosure and a trading note.

Disclosure: Long Novo Nordisk

Readers may recall that we post our system's top ten names on our trading Substack each week. One of those top names earlier this year was Novo Nordisk (NVO). Our core strategy is to hold a top name until we get stopped out, and replace it with a new top name. As you might expect, given the new all-time highs NVO has made recently, we haven't been stopped out of it, so we're still long NVO. That's one of the stocks mentioned in Citrini's post below, as Novo Nordisk is the manufacturer of Ozempic.

Trading Note

We've got two more earnings trades teed up for today, if you'd like a heads up when we place them, feel free to subscribe to our trading Substack/occasional email list below.

Upgrading From Overweight

The Effects of GLP-1 Drugs on the Investment Landscape

Are drugs like Ozempic just a fad or the answer to a problem that the Developed world has been seeking for decades?

The Questions: GLP-1 Drugs and Obesity

If you haven’t, please read my article on Thematic Investing & Megatrends here first.

“Ozempic” is now, essentially, a byword for “weight loss drug”. It and similar drugs are dominating social media trends to the point of being mentioned at the Oscars, it has the makings of a cultural touchstone. Perhaps, even, a triumph of modern science over a modern disease that has plagued developed countries for decades. I have been long LLY and NVO because of GLP-1 drugs since early 2022, but as evidence continues to amass in favour of their utility for a large population it’s worth considering - what other implications does this have? It is not an exaggeration to say entire industries have been built on the back of the obesity epidemic, its drivers and its consequences. So, the questions remain….

Do these drugs work?

What are the impacts on the wider economy of a drug that is nearly as effective as bariatric surgery and acts via, primarily, appetite reduction?

Which companies will benefit from those trends, besides the ones producing the drugs?

Which companies and industries will suffer?

Are those industries at risk right now and, if not, when?

What level of pragmatism is called for in tempering expectations?

This isn’t just about a drug that works, it’s about a drug that works for something that has reached the status of epidemic in most developed markets. The CDC estimates that nearly 42% of the U.S. population is obese, and most view it in as a moral failing that will never be cured by science. I don’t know the answer to the first part, but the second part seems unlikely.

As an investor I am keen to be educated on what has the makings of a plausible solution. if you’re out of hand dismissing something that can result in 20-25% weight loss in a year, in a country where about a third of the population is obese and your profession is “projecting trends in how consumers and businesses spend and earn money” well…maybe don’t do that.

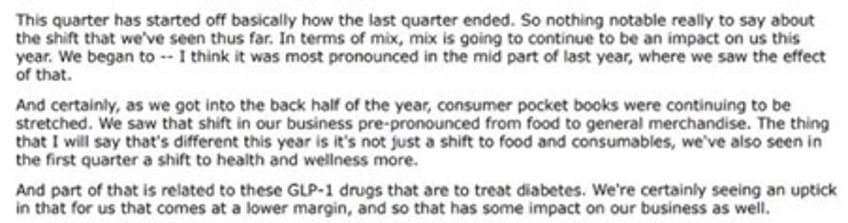

Already, the impact is being felt, as Walmart attested in their latest earnings call:

This article will hopefully serve as a primer for not just GLP-1’s, but a springboard for a discussion on potential secondary knock-on effects in both patients taking them and the wider economy. Additionally, background, some current arguments around these drugs and their effects, some information in general on peptide medicines is provided (due to various behavioral oddities instilled in me during my short time at medical school, this article will have legitimate academic sources) and, of course, there is a basket of stocks which I believe are either positively impacted, negatively impacted or should simply be mentioned.

Is it finally time to bet against the American Eater?

Let’s find out…

(Paywall below)

Introduction

View & Download a spreadsheet of the Thematic Equity Basket, including tickers & weightings, which is discussed in this article here

There are 5 FDA approved drugs for weight loss, currently: orlistat, phentermine-topiramate, naltrexone-bupropion, liraglutide, and semaglutide. A sixth, tirzepatide, is expected to be approved soon. Currently, Saxenda (Liraglutide - NVO) and Wegovy (Semaglutide - NVO) are the two GLP-1 drugs approved for weight loss by the FDA. Both drugs are delivered via subcutaneous (beneath the skin) injection using autoinjectors (patients can self-administer the injection at home). While oral preparations are in development, currently the subcutaneous autoinjectors are the primary delivery method - a boon for companies like Stevanato (STVN) which has managed to take market share from Beckton Dickinson (BDX) in the area.

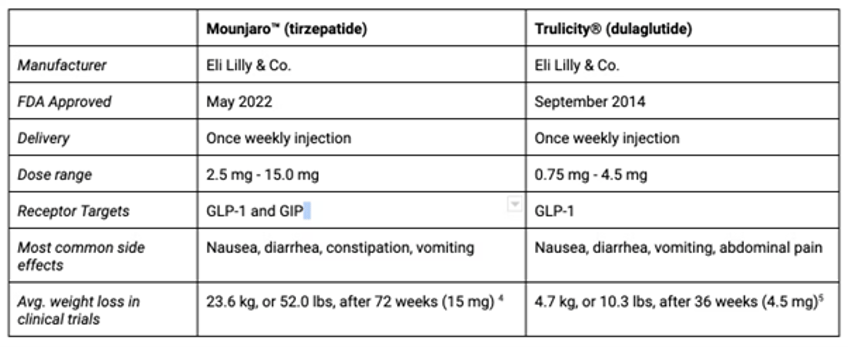

Saxenda injections are taken once daily and Wegovy once weekly. Eli Lilly, the maker of the drug Mounjaro (Tirzepatide - LLY), said it expects the medication could be approved by the U.S. Food and Drug Administration (FDA) for weight loss as early as the end of the year 1. The company made this prediction on the timing of FDA approval as it announced top-line results of a Phase 3 study showing a nearly 16% overall weight loss over a 17-month period among people who have both Type 2 diabetes and obesity 1. The FDA has not said when it would announce a decision about weight loss approval for Mounjaro, but consensus expectations place it sometime in Q4 23 = Q1 24.

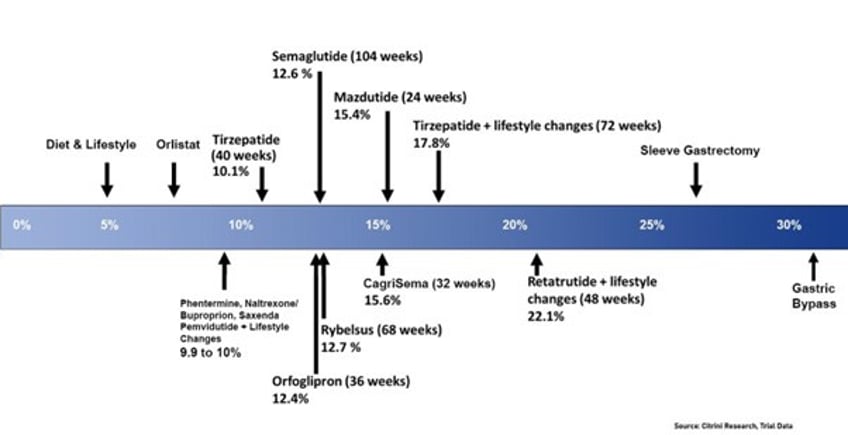

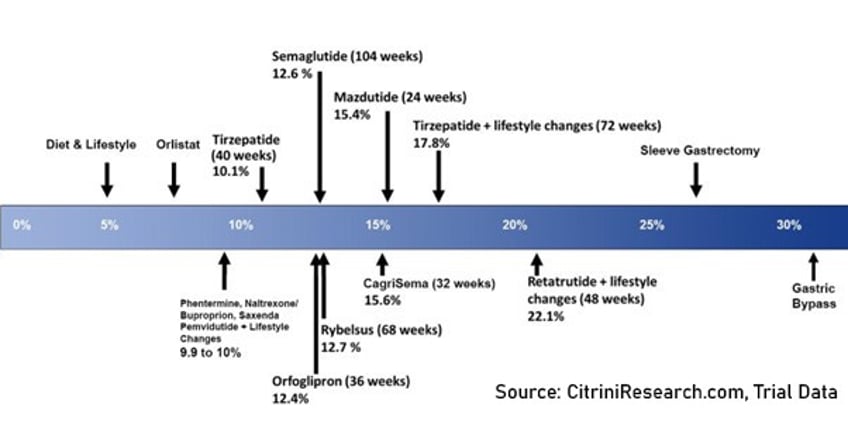

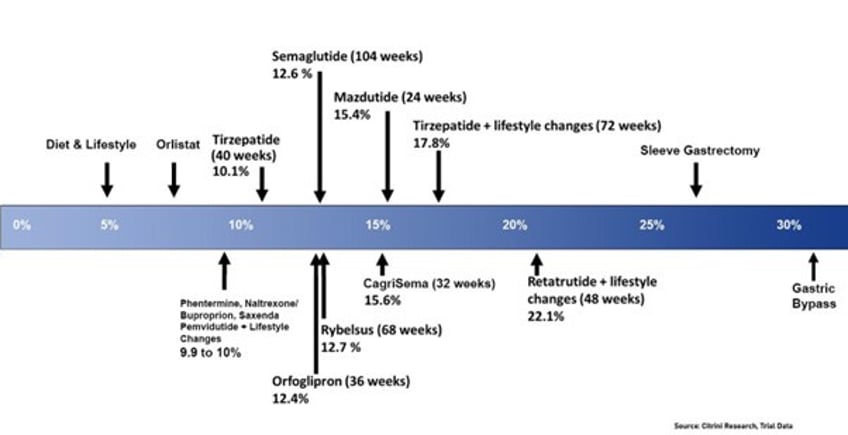

Mounjaro injections are also taken once weekly and, despite only currently being approved by the FDA for diabetes, have shown the most impressive weight loss numbers of any GLP1 drug approved by the FDA in general. Recent data from LLY on Retatrutide (as well as other promising solutions presented at the American Diabetes Association conference) have made me consider something that seems inevitable on the surface, but the timeline of which may be greatly accelerated: obesity may have a cure (specifically - “diabesity”, the word for diabetes and obesity as comorbidities) in these new medications. Regardless of whether this very optimistic statement is true, what is true is that these drugs are effective for most patients who are obese in causing significant BMI reductions that previously would only be achievable with gastric bypass or sleeve gastrectomy.

Misconceptions & Assumptions

1) The biggest “gotcha” on social media surrounding these drugs seems to be some sort of vague speculation that they will melt your insides or otherwise have some horrific side effects a decade later. While there are certainly side effects to these drugs, which we will expand on later, GLP-1 drugs have been on the market for almost two decades. The first GLP-1 (glucagon-like peptide-1) agonist drug approved by the FDA was exenatide. It was marketed under the brand name Byetta and got approval in 2005. GLP-1 drugs are hardly some experimental medicine.

a) Trulicity was approved in 2014 and has been a significantly popular treatment for T2D since. Consistent with other GLP1R agonists, nausea, diarrhea and vomiting are common side-effects, with no long-term harms noted from Trulicity over its 9 year use in the markets. To say that. when it comes to weight loss, these drugs have improved since then is a bit of an understatement:

2) GLP-1 drugs do not “allow you to eat whatever you want”. In fact, it’s quite the opposite. Eli Lily has been one of my largest single stock long positions since 2021 and I have, as you do with any large position, built up a number of channel checks (that is to say, operators and those exposed first hand to the businesses). That includes endocrinologists. Anecdotally, I have heard him say that he has to go as far as recommending protein supplementation to patients who are clearly not eating more than 500 calories a day, simply because they do not have the appetite to. Patients who, before they were on these drugs, consumed upwards of 5000 calories a day. This is a significant concern for businesses who might be adversely affected by lower volumes of food sales to obese individuals. Not because they won’t eat fast food or junk food anymore, but simply because they will not eat as much of it.

3) Some believe these drugs will not see widespread adoption because they are most effective subcutaneously (administered via an autoinjector as pictured here): While a certain subset will always have a phobia of needles, it’s worth considering the lengths that people have gone to in the past to lose weight (taking pills with tapeworms in them, for example). BofA polls show that 70% of patients are comfortable with the autoinjector. Subjectively I believe there is a significant difference when it comes to a fear of needles when it’s a syringe vs. an autoinjector. Think of an epiPen - you don’t actually see the needle. I think this is an overblown concern

.

4) While it’s probably not a “miracle drug”, it’s not unreasonable to look out in a decade or so and see that we have solved the problem of obesity. Will there still be unhealthy people, with unhealthy habits? Absolutely. But the level of obesity in the US is absolutely a public health crisis, presents massive costs on both a personal and societal level and in large part seems to perpetuate as a disease state (Metabolic Syndrome etc) - it’s completely reasonable to think that modern science can cure this condition which is largely a symptom of modern lifestyles anyway. I think it overly pessimistic to view it as impossible and as an investor believe it may represent a significant shift in the preferences, behaviors and consumption habits of a large portion of the population.

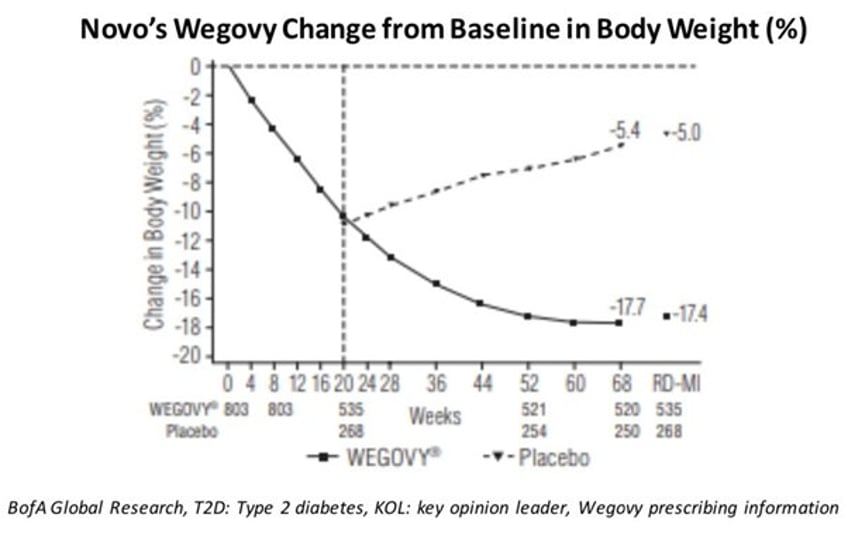

On Wegovy, patients lost an average of 17.4% of their body weight over the 68 week trial. It is even more significant in Mounjaro (tirzepatide) which will likely be FDA approved by the end of the year for weight loss.

Will patients keep the weight off if they go off the drug? So far, with wegovy, patients gain back about half of the weight they lose. In early 2024, we’ll find out how Mounjaro stacks up against this. I think it’s important to note, however, that this does not invalidate the initial weight loss or the potential popularity of these drugs - nor the chances that patients may stay on them indefinitely. It’s worth considering: will patients with Erectile Dysfunction be able to get erect if they don’t take viagra (or another PDE5 Inhibitor)? Will patients with hypothyroidism be able to function normally if they stop taking Levothyroxine? Of course not. That doesn’t change much when it comes to the net effects.

Commentary on Wegovy and expectations for the SURMOUNT Mounjaro trial from LLY management has been:

“Once they stop the medicine. And what you'll see here is the rate of weight regain is about half the rate of weight loss...That's what I would expect. I would expect it's more similar than different to this graph.”

5) There have been significant supply chain issues with all GLP-1 drugs as supply has not kept up with demand. I outline a way to play the “picks and shovels” of this issue, but it is also indicative of the fact that there is significant demand and further impact to be had for this theme - simply put, not enough people are on it yet. But they will be, if history is any indication.

Affordability

Ozempic is very expensive. Will it be less expensive / why will GLP-1s have a significant second order impact worth paying attention to if it does not span across socioeconomic backgrounds to reach the largest demographic of obesity? This is a valid concern, and it is indeed possible that these drugs stay expensive for the next couple years due Eli Lilly and Novo Nordisk’s duopoly, but I think to underestimate the impact they will have because of any delay is short sighted. Even if, in the first couple years of Mounjaro and Wegovy both being approved for the weight loss indication, the impact from just those taking it who can afford it/have the insurance for it can be significant. Over time, factors will conspire to make it more widely covered and cheaper.

Consider this: Viagra, also known by its generic name sildenafil, was approved by the FDA in 1998. At the time of its launch, the average cost of Viagra was approximately $88 per pill. Over the last two decades, sildenafil experienced a drastic price reduction from a peak of $88.45 per pill for the branded version (Viagra 100 mg),11 , 12 to $1-$4 a pill for a generic version. Five or six years after it was first released, it was a drug that was certainly not cost prohibitive for anyone with insurance. Now, even without insurance, most people in the US with ED can afford a prescription. Affordability for drugs in markets with significant demand is typically accelerated. Indeed, if tirzepatide and other GLP-1 drugs for weight loss become subject to mandatory discounting through the Inflation Reduction Act (by 2031, or sooner if their developers attempt to reduce prices in anticipation of this deadline) or similar regulation, their prices would be directly reduced, making them more affordable. Beyond this, there are several other factors that could contribute to increased affordability over the next 5 years:

Competition: Other companies like Viking Therapeutics and Altimmune are developing their own GLP-1 drugs. An increased number of available drugs in this class could drive prices down due to competition.

Insurance Coverage: If tirzepatide is approved by the FDA for weight loss in 2023, insurance companies are more likely to cover it, which would reduce out-of-pocket costs for patients. As more and more data becomes available, the cost benefit analysis of these drugs will become impossible to ignore for health insurance companies.

Generic Drugs: While it could take more than 5 years, eventually patents on GLP-1 drugs will expire, leading to the introduction of generic versions. Generics are typically sold at a fraction of the cost of brand-name drugs. Liraglutide’s patent expires this year in the US and Europe,

Price Negotiation: With more options available in the market, insurers and pharmacy benefits managers may be able to negotiate lower prices with drug manufacturers.

Economy of Scale: As these drugs become more widely used via more delivery mechanisms, manufacturers may achieve economies of scale, reducing production costs and potentially lowering prices.

Right now, Novo has a monopoly on GLP-1 drugs that are FDA approved for weight loss. Although, anecdotally, it is no secret that Mounjaro is already being prescribed to patients without T2D for weight loss and the comorbidity of T2D and obesity blurs the line, once Mounjaro is approved I believe it will begin reducing the average out of pocket costs for these drugs. Lilly’s approval for Mounjaro in Obesity will result in a duopoly in the space, with clinical stage biopharma (mentioned below) likely 2 years from having a drug on the market. Mounjaro has butted in a bit with coupon programs, but still only was approved by health insurers 50% of the time for off label indications. This dynamic makes it simple to own NVO & LLY for the initial duopoly while owning smaller concentrations of the clinical stage companies for the option value once the duopoly is busted.

Still, even as they become more affordable, I believe there are plenty of catalysts in this area to sufficiently propel their manufacturers revenues. If tirzepatide gets approved for additional indications like NASH, sleep apnea, CKD, heart failure, pre-diabetes, etc., it could significantly increase the market opportunity for Eli Lilly. These are all large market diseases with high unmet needs. Particularly, NASH and CKD are areas where successful drug development has been challenging, and a new effective treatment could be a significant revenue driver. Successful drugs often come with high margins, and the successful development and commercialization of tirzepatide and other drugs could drive margin expansion. Further, Eli Lilly could potentially see operating leverage as higher sales spread out the fixed costs of their operations, similar to what occurred with Viagra and Pfizer. Oral GLP-1 options can greatly improve patient compliance and expand the total addressable market. Retatrutide also represents a new class of drugs that could have broad applications, further expanding Eli Lilly's market opportunity.

The endocrinologist I have spoken with regularly about this has mentioned that semaglutide is more muscle sparing than Mounjaro, which raises interesting points about how wide this market may be in terms of each modality perhaps retaining a market share for a very specific type of body composition requirement. Here’s commentary from Lily management:

“There's no doubt in my mind, Geoff in five years, as I said, we're going to have a lot more data and we're going to see these drugs as foundational medical treatment for many chronic diseases, and with outcomes to hard outcomes data that moves the cost curve in populations.”

“And eventually the Venn diagram of seniors who have obesity or overweight and other conditions, diabetes, of course already we have access in many plans there, but we'll be adding to that pie. And then the question of is there straight chronic weight management in the elderly becomes less important over time?”

“And so, this [reimbursement] will play out over time on both as we look at data and outcomes to drive further expansion of access.”

I think the affordability aspect is simply a matter of time. Whether through insurance coverage or competition or both, these drugs solve a problem too widespread to remain expensive, the opportunity is simply too lucrative. Additionally, even if it does stay more expensive than some other drugs, it’s also worth considering that it’s the kind of drug people are probably willing to pay a bit more for.

The Reflexive Nature of a Successful Weight Loss Drug

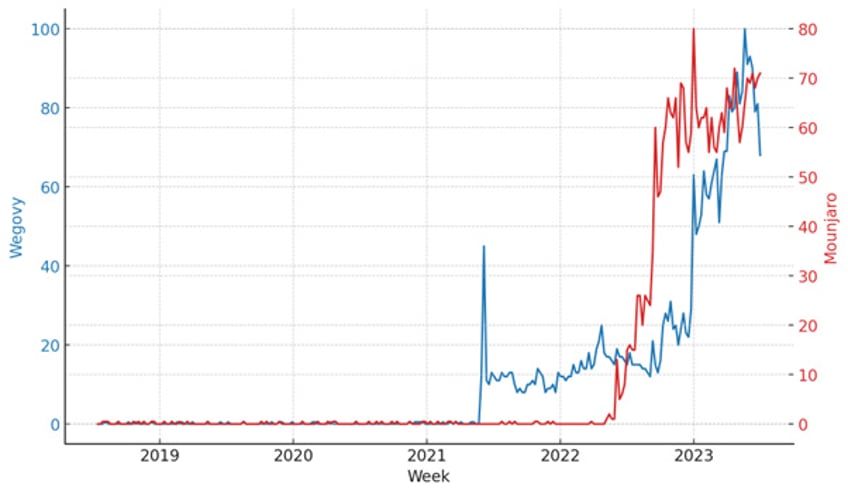

The exponential rise in search trends for terms related to these drugs (GLP-1, Wegovy, Mounjaro, Ozempic) speaks to a reflexive relationship that is catalyzed by the nature of social media.. Since the re-release of Wegovy in 2021, both have rapidly become the talk of the digital town, turning the wheel of a virtuous cycle that has propelled them into the global spotlight.

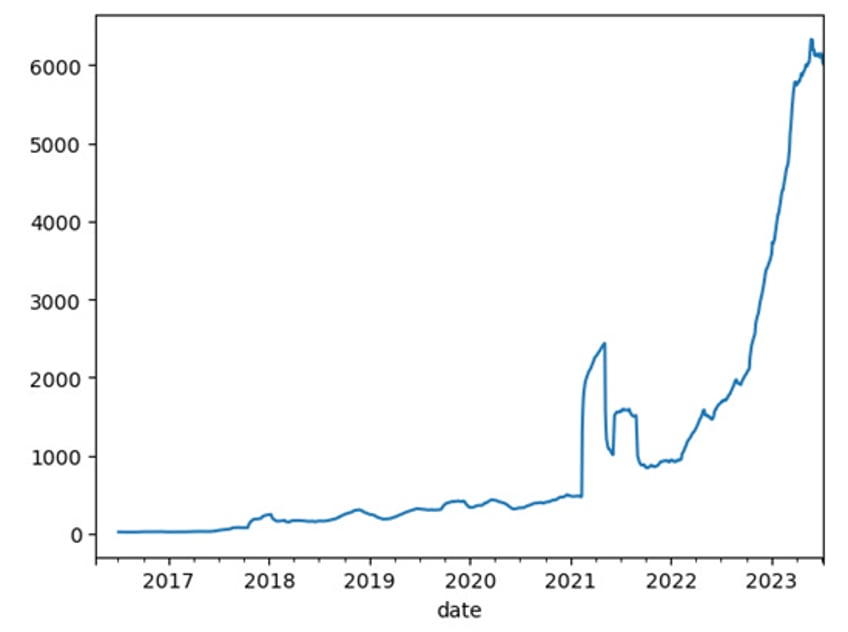

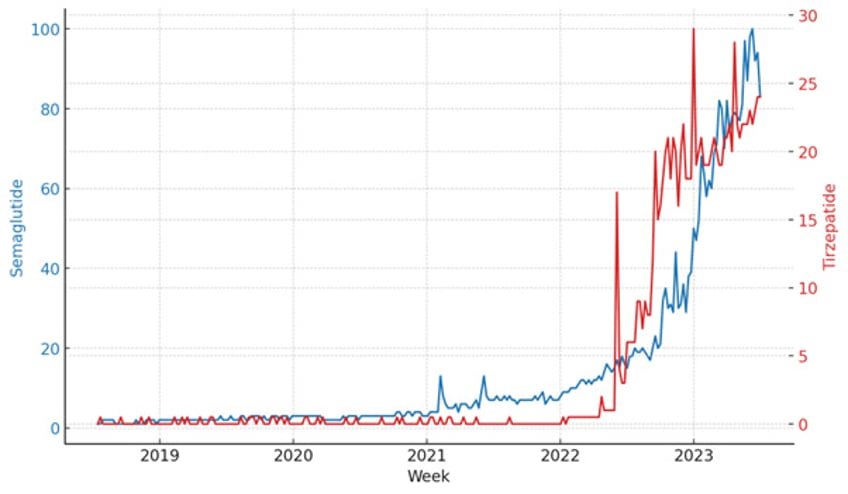

Wikipedia Trends for “Semaglutide”:

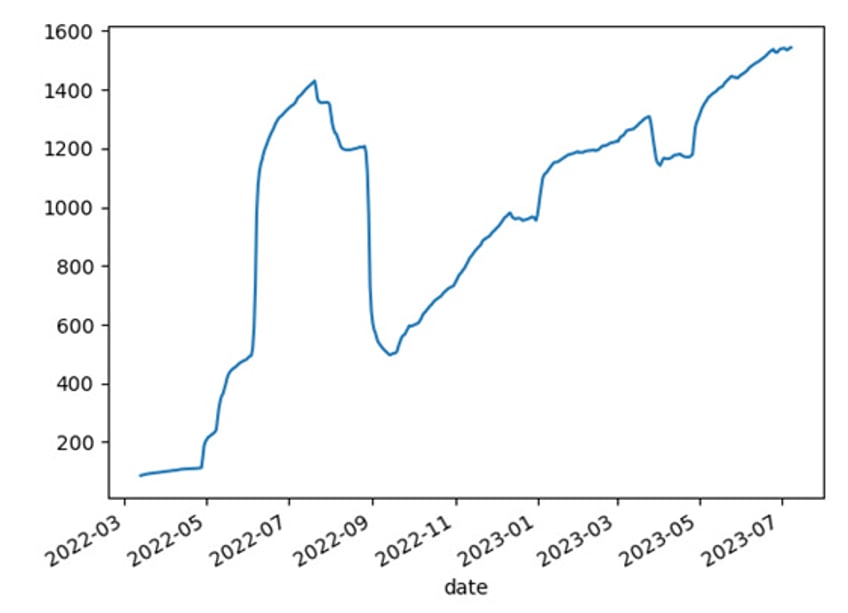

Wikipedia Trends for Tirzepatide, which had a coupon program around its release in early Summer 2022. Despite the program ending, it rebounded in interest:

Google Search Trends for various GLP-1 Drugs:

The data paints an intriguing picture. According to Google Trends, searches for "Wegovy" and "Ozempic" have skyrocketed since 2021. In fact, the increase hasn't been linear—it's been exponential. From curiosity-seekers trying to understand these new options to individuals actively seeking weight-loss solutions, a wide swath of internet users have been part of this surge.

But why the sudden interest? The answer lies in the confluence of science and social media. People are no longer just passive consumers of health information. They're turning into active participants in a global conversation about weight loss and health

Picture this: A patient stumbles upon a TikTok video of someone sharing their positive experience with Wegovy. Inspired, she tries the drug and finds it works for her. Then, she posts her before-and-after photos on Instagram, attributing her success to Wegovy. Her followers—moved by her story and noticeable transformation—start their research, with "Wegovy" and "Ozempic" becoming their keywords. Consequently, the search trend climbs. And as more people share their experiences, this reflexive cycle continues, spiraling the search trend upward. Maybe she’s prescribed Ozempic instead, or Mounjaro. This sparks discussions on social media surrounding pharmaceutical solutions that don’t really happen (outside of illicit drugs), to the point where Ozempic was mentioned at the Oscars in 2023.

The significance of this trend extends beyond the digital realm. The popularity of Wegovy, Mounjaro and Ozempic on social media platforms is spurring real-world effects. It's shaping people's perceptions about weight loss, transforming attitudes towards obesity treatments, and most importantly, it's driving demand.

The Beneficiaries of GLP-1 Drugs Across Industries

Health Insurers and the Cost of Obesity

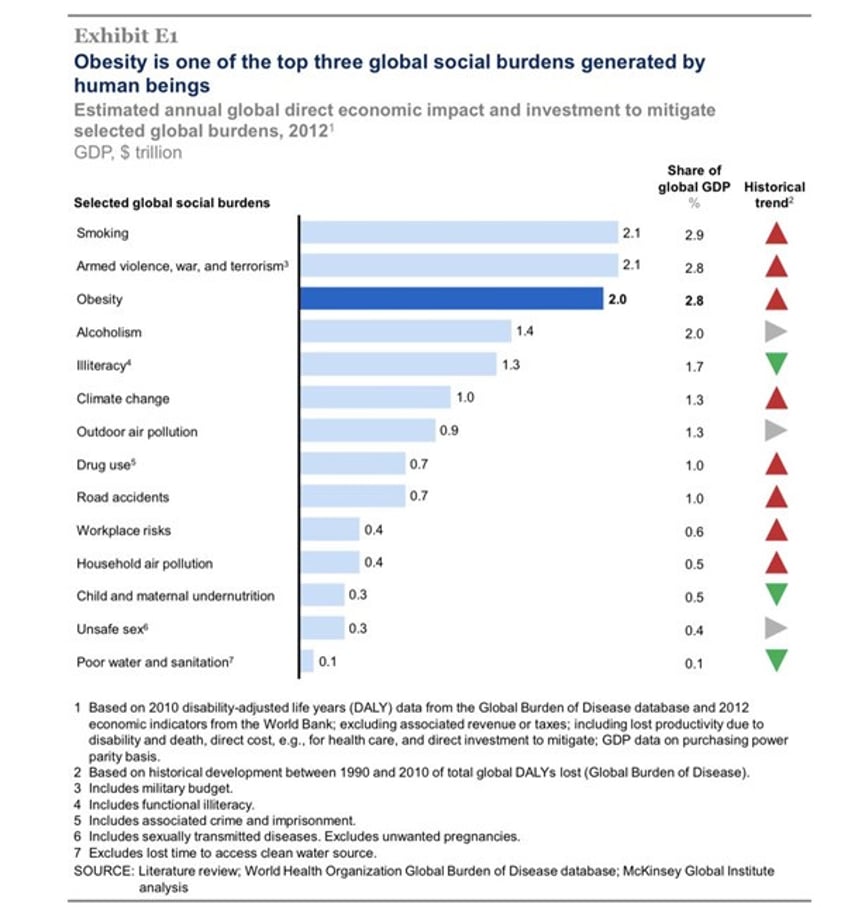

Source: McKinsey[1]

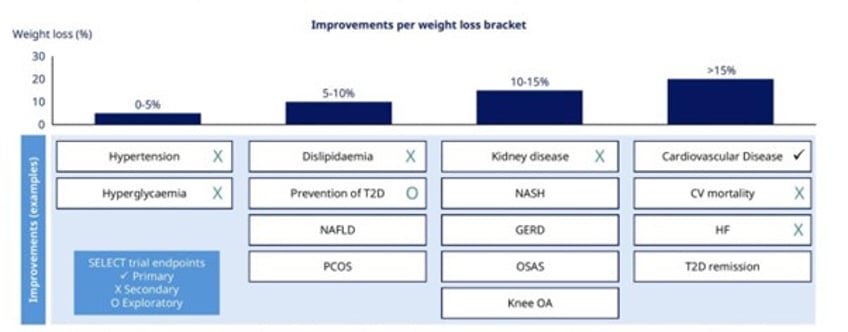

Although weight loss has been the main focus in the analyses of these drugs so far, it is important to bear in mind that with them comes the improvement in other measurements of health, such as blood glucose levels, cardiovascular parameters, cholesterol and triglyceride levels.

Source: Novo Investor Day 2022[2]

Estimating the costs associated with diseases are inherently imprecise and noisy due to difficulties in normalising the difference between individual circumstances and lifestyles, but for the sake of providing ball-park figures, some studies have found that excess medical spending on obesity for adults is around 260 billion USD [3] or around 1800 USD excess per person in 2019[4]. Conservative estimates for the medical costs associated with overweightness and obesity in China have been projected to 61 billion USD[5]. Obesity is obviously not restricted to the US; another study in has estimated that costs in Australia, Brazil, India, Mexico and Spain range from 20-40 billion dollars in 2019[6]. .

Costs associated with obesity compound, since obese patients also become more susceptible to other diseases. The highest comorbidity (Presence of two or more health conditions at once in the same person) associated with obesity is T2DM. Diabetes is associated with retinopathy (Which can lead to problems in vision), nephropathy (Kidney problems) and coronary heart disease [7]. Direct costs for treating diabetes globally have been estimated to be around 860 billion USD per year, and 150 billion USD per year in the U.S.[8].

Obesity also increases the risk of cardiovascular disease, where 5 kg increases in weight in adults is associated with an 11% higher risk of death from cardiovascular disease[9] (strokes, coronary heart disease, myocardial infarction etc…). An increased risk of NAFLD (Non-alcoholic fatty liver disease) is seen in obese patients, with annual burdens in the treatment of NAFLD estimated to be in the hundreds of billions for the US[10]. Specific forms of cancer are seen at a higher incidence and are associated with poorer survival rate in obese patients, including colorectal, breast, kidney, esophageal adenocarcinoma, endometrial and gallbladder cancer [11],[12],[13]. Consequences of obesity also extend to psychological effects, where depression and anxiety have been shown to be associated with obesity[14]. With the caveat that not all people with diabetes, cardiovascular disease, NAFLD or cancer are obese, reductions in the prevalence of obesity would be expected to also reduce the prevalence of these diseases as well.

Outside of direct medical and health insurance costs, improvement of health alleviates drags on economic productivity by reducing death, days absent from work and disabilities (from joint issues). Among the overweight, a 10% reduction in body weight lowers lifetime medical costs by nearly 35%, while going from obese to overweight can result in halving the costs over a lifetime. A 2021 report published by the National Library of Medicine revealed that adult obesity is associated with average annual increased medical costs per person of $1,861. And severe obesity was associated with additional costs of $3,097 per adult.

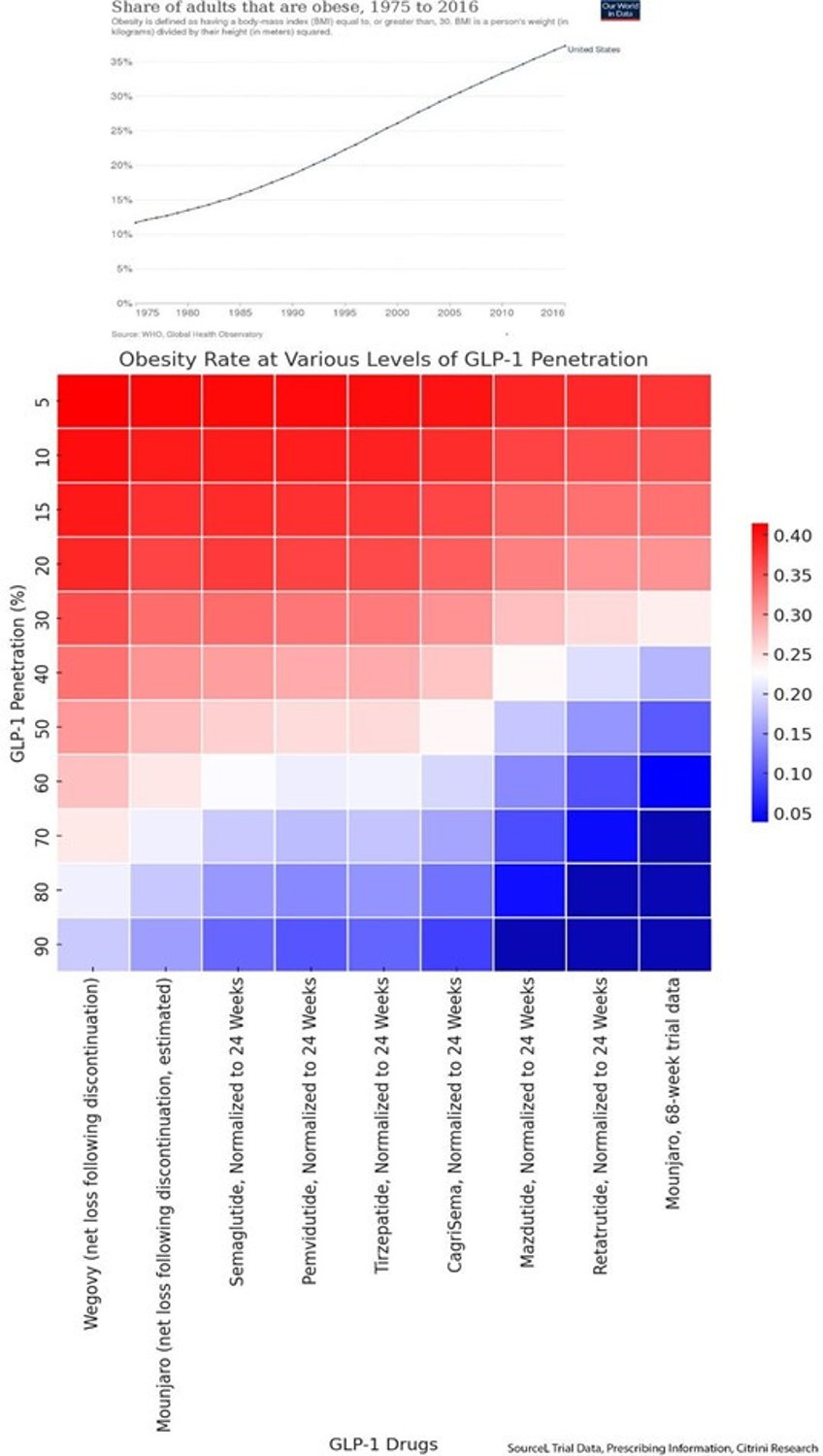

Again, currently, the obesity rate in the U.S. is currently almost 43%. Using some naive assumptions here (that the average weight loss required for the average obese person’s BMI to be below 30 and thus not categorized as obese, assuming x% of obese people take the drug and all experience the average reduction in body weight), we can see a picture emerge that shows the potential to disrupt a trend that’s been forming for the past 50 years. At a 50% penetration rate, a 68-week course of Mounjaro would (in this ideal, naïve assumption) bring the obesity rate to the lowest level it’s been since 1981. Assuming everyone took it, made no lifestyle changes and gained back more than half of the weight after discontinuation with no use as a maintenance drug afterwards, utilizing a very pessimistic penetration rate of 15%, even then it would be enough to have the obesity rate correct lower by more than 6%.

That would be the first downtick in a generation…

While the benefits to mortality and, by extension, life insurers may be apparent, I think it’s important to give credit to just how skilled life insurance companies are at estimating when you will die. Life insurers can indeed adjust your premiums based on your height, weight and comorbidities. Health insurers, however, cannot. Under the Affordable Care Act (ACA), health insurance companies can't deny you coverage or charge you higher premiums on the basis of weight. Thus, the real winners in the long term here will likely be health insurance companies. This works both ways, once the data is sufficiently acceptable the cost-benefit analysis for the insurers is impossible to ignore, and the benefit to the patients will show up in terms of savings. Of course, there will be complex interplay and it won’t at all be pleasant (this is health insurance in the U.S., I don’t know what else you’d expect?) but overall it will be a net positive.

Genuinely effective obesity drugs, as GLP-1s appear to be, should have a positive impact on the bottom line of US health insurers like Cigna (CI), United Healthcare (UNH), Humana (HUM) and Centene (CNC).

The economic implications of obesity and diabetes are significant both in the real economy and in the revenue of large companies, with $1 out of every $4 in US health care costs is spent on caring for people with diabetes. It’s not just about diabetes treatment either, it’s about the impact of reducing the prognosis for those with obesity who have developed prediabetes and will, without intervention, develop Type 2 Diabetes. Mounjaro Ph3 trial SURMOUNT showed 95.3% of patients on Mounjaro with prediabetes at baseline reverted to normogylcemia by week 72.

This is a significant consideration for companies like Tandem Diabetes (TNDM), which generate revenue through the sale of insulin pumps or other diabetes care related devices.

Looking here we can see that Retatrutide results are only about 4-5% shy of Sleeve Gastrectomy, an honest-to-god surgical procedure requiring anesthesia. This will likely make it very difficult going forward for companies relying on increased bariatric surgery volumes for growth, like Teleflex (TFX).

Furthermore, significant weight loss can tend to lead to complications that require cosmetic surgery such as abdominoplasty, breast reduction/augmentation and gluteal lifts to name a few. With the percentage of patients undergoing efforts at weight loss who are likely to be successful, there is a significant likelihood of increased business for a company like InMode (INMD) which sells products used to improve muscle tone after abdominoplasty.

Weight Watchers (WW)

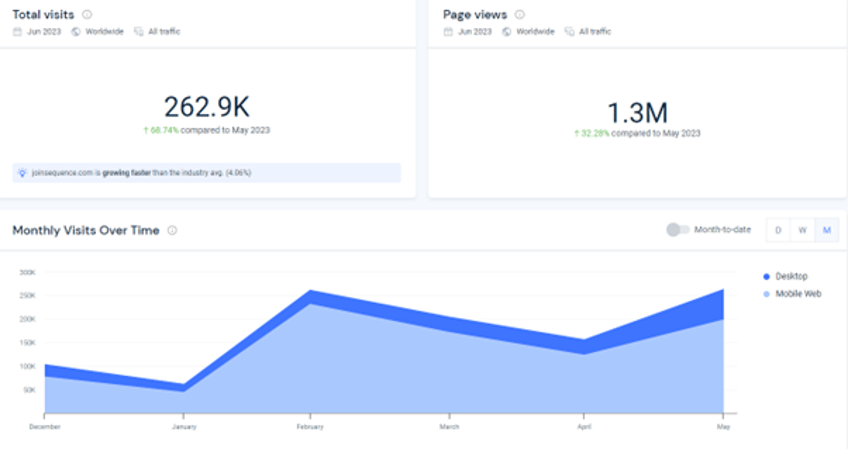

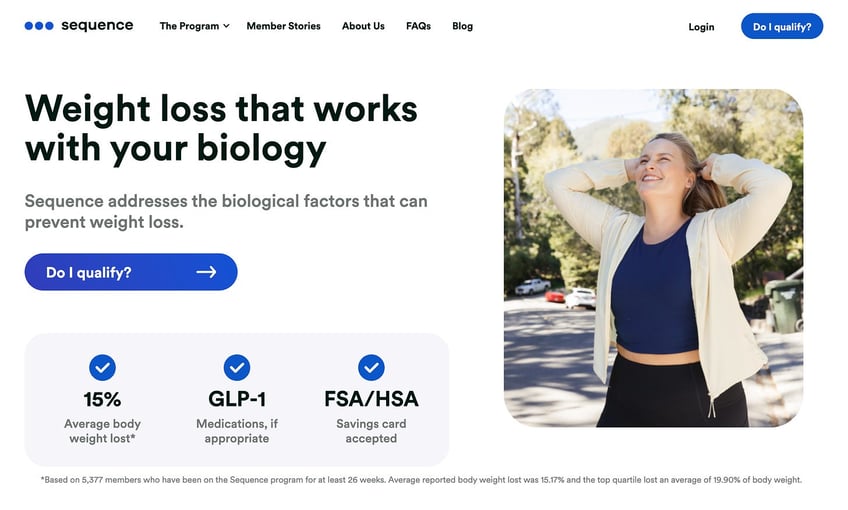

Source: SimilarWeb

WeightWatchers is a company with a concerning balance sheet that may potentially continue to catch a tailwind from GLP-1s due to one smart decision: acquiring Sequence Health. Sequence is a telehealth provider solely focused on GLP-1 prescriptions. What would have originally probably been the death knell for this long suffering company now may become its turnaround story.

With Sequence, WeightWatchers International is in possession of a database of email addresses and contact information not just for people who are overweight or want to lose weight, but of people who are overweight and have demonstrated the fact that they will pay money to change that. Now, that list has value considering the synergy in which they are converted to Sequence customers (and given something that is very likely to work).

WW is not something I’d bet the farm on, but with the stock at eight bucks, it is reminiscent of other highly operationally levered companies in industries that experience sudden and sustained tailwinds like UAN, RIG or (more recently) AAOI. It’s been struggling, for sure, but this might be the tailwind it needs to make it attractive again, especially with up to 6 million lapsed members that have expressed willingness to pay to lose weight and who could be brough back in by marketing campaigns like this below (combined with the general social media reflexivity noted above with GLP-1 drugs):

Dating Sites & Apps

It’s perhaps uncomfortable to confront but with nearly a third of every single person in the U.S. over 30 BMI (combined with the fact that the majority of them do not want to be) and being slim / in-shape viewed as generally attractive, it’s likely that successful weight loss drugs increase demand for dating apps like Tindr, Bumble, Hinge etc. Obesity has been found to lead to higher rates of depression and isolating behavior - something that is not conducive to dating. While I already like MTCH from a valuation standpoint, I think that this provides another tailwind for both Match Group (MTCH) and Bumble (BMBL) simply from people feeling better about the way they look and being more open to dating.

Clothing, Apparel and Fashion

When exploring the second-order effects of a reduction in the astronomical obesity rate, it’s natural to stop at the plus-size clothing retailers. Companies like Destination XL (DXLG) or Torrid (CURV). On twitter when I mentioned I was writing this article, some suggested they’d be shorts. I believe it’s a bit more complex than that. As we’ll see later when we go into the data, this still is not a magic shot - it’s worth noting that it still takes nearly a year for these outcomes to happen (and likely many patients will be n “maintenance doses” as they continue to lose weight beyond those timeframes). If you lose 20% of your body weight in a year, you’re going to be doing a lot of clothes shopping unless you want to look like someone threw a sheet on top of you and you decided that was dressing. I think that, especially in the beginning (right now) as these drugs are gaining notoriety and seeing increased usage, it’s tough to say but in the short-term, those plus-size clothing stores may actually see an increase in demand. As people who are losing weight need to purchase new clothes that fit their changing bodies, this could result in a temporary surge in revenue for clothing retailers, including plus-size specialists who often cater to a broad range of sizes. Additionally, as noted earlier, there is a risk that there is a rebound in weight.

Most fashion forward brands do not make plus-size clothing, to the point where there are common discussions on TikTok about larger brands that replicate certain looks. Luxury brands and fashion have a place in conspicuous consumption that is simply unavoidable and it’s not unreasonable to say that if you can’t fit into a designer brand, at some point you probably want to.

recently wrote an article that touched on this, and her comment rwas:

I think luxury retail has potential to benefit from this trend. If you’re into clothes, there’s certainly the chance that you find luxury excessive or impractical but besides that, there’s only two reasons someone wouldn’t buy from their favorite designers - they can’t afford it or they can’t fit in it. While GLP drugs certainly won’t bring the price point down, they may make it easier to fit into next seasons’ Celine pants which may drive a structural boost for the demand of luxury goods from those who could afford them but didn’t like how they fit prior to their regimen on the new drugs. LVMH (LVMHF) is an obvious beneficiary, as they own many designer brands with notoriously tight-fitting clothes (Celine, Dior, Givenchy etc.). Kering is another one that should benefit from these sorts of tailwinds, with brands like Gucci and Yves Saint Laurent, amongst others. I also think brands like Moncler (MONRY) and Prada (PRDSY) could see tailwinds as they are popular amongst the luxury demographic and if there turns out to be pent up demand from price inelastic consumers, luxury may catch a significant bid as people who use GLPs to lose weight find themselves able to purchase an entirely new wardrobe.

Again it’s worth reiterating that the potential patient population for these drugs is 42% of the population. Trends in consumer purchases have been accomplished with much less. Since persistent demand for luxury goods was already in my top 3 mega trends for 2023, I am comfortable including these names.

The Victims of GLP-1 Drugs Across Industries

Figure 2, Average Weight Loss Across Treatments (%)

CPAP Machines, Sleep Apnea & Obesity

Obstructive sleep apnea (OSA) is a common problem among obese patients (around 40% of obese patients suffer from OSA), while around 70% of OSA patients are obese[15]. 20% decreases in body weight have been associated with halving in the severity of sleep apnea metrics (AHI)[16]. Decreases in OSA would be expected to lead to improvements in sleep quality and thus mood and productivity.

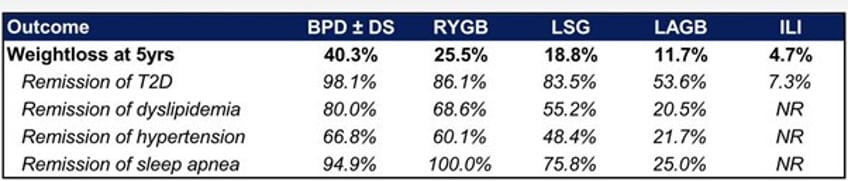

Let’s look at the remission data for sleep apnea and some other chronic conditions after various bariatric interventions:

LSG (Sleeve Gastrectomy) resulted in a 75.8% remission rate for sleep apnea. Sleeve Gastrectomy is only marginally more effective, on average, than what we’ve seen above with Retatrutide. Obese patients comprise 41% of all Total Knee Arthroplasty surgeries in the US and roughly 3/4ths of all patients receiving CPAP therapy for sleep apnea. Additionally, CPAP compliance is typically not excellent. I believe that sales for a company like ResMed (RMD), within 5 years, could be cut in half - and there will be very little they can do about it. Lily’s SURMOUNT-OSA trial will begin in March 2024 to evaluate the effect of Mounjaro on sleep apnea. Most of the overall revenue from CPAP machines is not made on the machine itself, but on the provision of things like masks, tubes and humidifiers which need to be replaced regularly. There is simply no way that these drugs do not end up harming both the top and bottom line for these companies, as the expected duration of OSA decreases alongside the expected percent of the population suffering from it. Inspire Medical Systems (INSP), AdaptHealth (AHCO) & Quipt Home Medical (QIPT) all, additionally, face challenges.

For the medical device industry, the consequences of the GLP-1 revolution could be devastating indeed. Yet ResMed still trades at a 36x P/E.

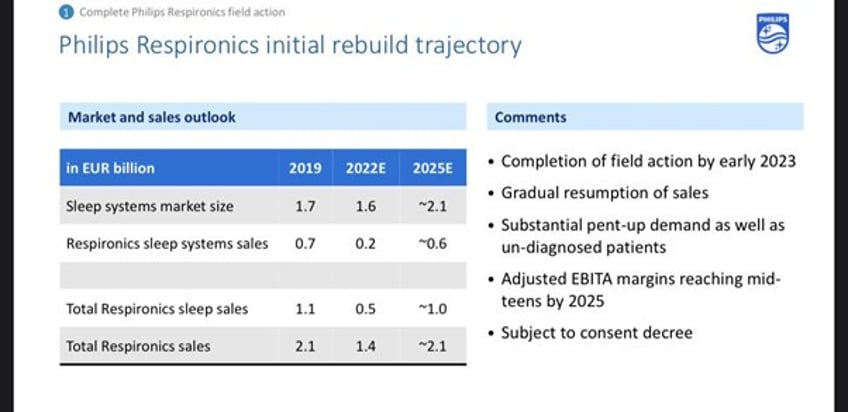

Koninklijke Philips NV (PHG) has invested significantly in a rebuild of its Respironics division, which suffered a recall. You can see here, it expects sales to return to pre-recall levels as a result of those efforts by 2025. PHG is up 44% Year to Date as the writing of this piece.

Figure 3, Source: PHG Earnings Report

To be as endearingly direct as the Dutch tend to be - I think not. I personally believe that, of all the potentially negatively affected companies here, the CPAP machine ones are by far at the most risk.

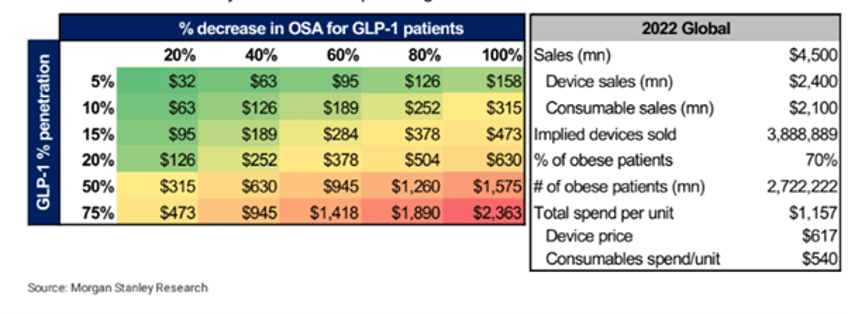

This scenario analysis done by Morgan Stanley on the potential impact is staggering if you consider the arguments laid out earlier about the reflexive nature of a successful weight loss drug and the eventual deflation in popular pharmaceuticals to be accurate.

It cannot be underestimated how momentous something like this, if easily accessible, could be.

Why? Because it’s extremely unlikely that it occurs as is. During a maximum of 9 years’ follow-up, 1283 men and 2245 women attained normal body weight. In simple obesity (body mass index = 30.0–34.9 kg/m2), the annual probability of attaining normal weight was 1 in 210 for men and 1 in 124 for women, increasing to 1 in 1290 for men and 1 in 677 for women with morbid obesity (body mass index = 40.0–44.9 kg/m2).[17] The cold, hard fact of the matter is this:

Without a solution like GLP-1 drugs, the obesity rate will likely continue climbing. Nobody wants to be obese, just like nobody wants to have erectile dysfunction, the hedonic desire to look good is something that should be factored in here. I think that once Mounjaro is approved for weight loss at the end of 2023 this trend will gain steam in a significant way, which would likely reflect in Q2-Q3 2024 earnings for PHG, RMD etc.

Fast Food

Although difficult to measure precisely, since measuring individual consumption of fast food requires self-reporting, a questionnaire in Michigan showed that the prevalence of obesity rises from 24.1% in people who consume fast food less than once a week to 32.2% in people who consume fast food twice a week[18]. Other meta-analyses of cohort studies show that there tends to be an association between fast-food consumption and weight gain, although it is difficult to parse out the direction of causality from these studies alone[19].

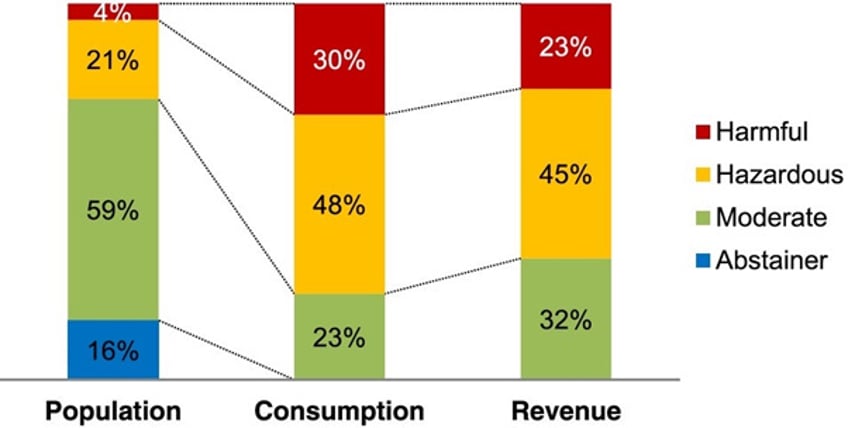

On a less precise & scientifically accurate note, I consider the following - when we look into the revenue breakdown of companies that sell alcoholic beverages, a somewhat disturbing trend becomes apparent: it is alcoholics and binge drinkers who, despite making up a minority of the population, make up a significant portion of consumption and revenue:

I think it is not far-fetched to consider that the trends in the fast food industry are similar. Obese persons are likely responsible for an outsized percentage of sales by volume, and it’s not uncommon to meet someone with obesity who consumes fast food twice a day. Anecdotally, from my endocrinologist expert, Mounjaro tends to create an almost visceral aversion to fast food. I think it’s not unreasonable to assume that among fast food restaurants, widespread access and use of these drugs and future drugs for weight loss in this category will result in a threat to revenues. Mind you, I am not being optimistic here, this is not a “everyone will make better choices in their diet” assessment. This is, simply put, lower volumes. You just can’t spend $40 a day at a fast food joint if you’re eating 500 calories before you feel sick. I’m almost certain it would be literally impossible.

It’s easy to see an executive of a fast food company in the future, on an earnings call, with something along the lines of “GLP-1s affect sales? No, people eat at Heart Attack Burger because they enjoy our quality ingredients, friendly service and fresh preparations!” or something. I don’t think I need to go into why it’s not a stretch to imagine someone who is, quite literally, pathologically consuming this food to develop an aversion to it once the cycle is broken.

I believe I have collected an assortment of publicly listed fast food companies that would suffer most from this volume reduction and potential behavioral aversion in their most significant customers. They are YUM Brands (YUM), Domino’s Pizza (DPZ), Brinker International (EAT), Restaurant Brands (QSR) and Darden Restaurants (DRI). While it may or may not belong here I think it also prudent to mention DoorDash (DASH) due to a business model that likely thrives on reduced mobility & demand for fast food, although I don’t have any breakdown to support this, so I have put it into the Honorable Mentions category with the other potentially controversial names.

Health and Wellness

Planet Fitness’ (PLNT) business model and demographic is very specific. If you’re very passionate about going to the gym and physical fitness, you probably don’t work out at Planet Fitness. In fact, PLNT is more so in the business of selling subscriptions that only get used once or twice than it is in the business of fitness. From a pragmatic point of view, a successful weight loss drug that doesn’t require you to diet and exercise probably isn’t great for all the guilt sign ups powering PLNT’s ability to make a buck (although I fully support people changing their diet and exercise, there is the question of “if they were going to do that they wouldn’t have needed the drug in the first place”...). In a similar manner, products which serve the sole purpose of helping you to lose weight don’t really have a big place in this new paradigm, so a company like MediFast (MED) or Herbalife (HLF) could have issues. Medifast likelty

The Science & The Future of GLP-1 Drugs

You can read the rest here.

And you can subscribe to Citrini's Substack below.