I made the notation during the Tucker Carlson interview that Russian President Vladimir Putin knows everything below in this article about Russian Sanctions and the formation around a dollar-based U.S. CBDC. Unfortunately, Tucker Carlson does not know the specifics of how it is being constructed.

As I continue deep meetings and very granular discussions about the lessons within the EU that can be applied to the USA, it is worth revisiting this previously password protected post.

I went to the EU, because deep inside all of my research on Russia, things did not make sense. I was very prepared and organized to expect everything sketchy, and what I found surprised me. Putting boots on the ground, I now have a completely clear and different view.

Let me start by saying everything we have read about the Western sanctions against Russia is false. What sanctions might exist do not have any impact, and Eastern Europe has no intention to anger Putin. When Brussels threatens to kick Hungary out of the EU/NATO, I can almost hear Viktor Orban saying, “Don’t threaten me with a good time.” Hungary doesn’t even use or rely on the €uro for domestic financial transactions; they still retain their own national currency, the Hungarian forint or HUF.

First things first with the Western financial sanctions- specifically the SWIFT exchange. It is true you cannot use VISA, Mastercard or any mainstream Western financial tools to conduct business in Russia; however, the number of workarounds for this issue are numerous. One of those tools is the use of a cryptocurrency like Bitcoin; and within that reality, you find something very ominous about the USA motive.

Crypto users are likely familiar with stories like Binance and the US regulatory control therein. Factually, outside the USA Binance is being used to purchase and trade crypto without issue, but inside the USA it is regulated. That brings me to the MEXC crypto exchange, a Mexican version, again available globally but not allowed in the USA. The same applies to Metamask, used all over Europe but not permitted in the USA. Start to ask yourself, why all these crypto exchanges are available to the rest of the world but not the USA, and you start to suspect the Russian sanctions, just like the Patriot Act, are something else entirely.

Then there’s app wallets. You might be familiar with Apple Pay as a process to handle transactions from your iPhone. Apple Pay is linked to your bank account. Well, the “wallet feature” exists on other apps also, like Telegram; however, you can find the wallet feature, but if you try to use it from a USA cell phone… “This feature is not allowed in your region.” Why are digital wallets available for the rest of the world but blocked by the U.S. government?

This brings me to several crypto conversations in the EU at various cafes with people who have a deep understanding.

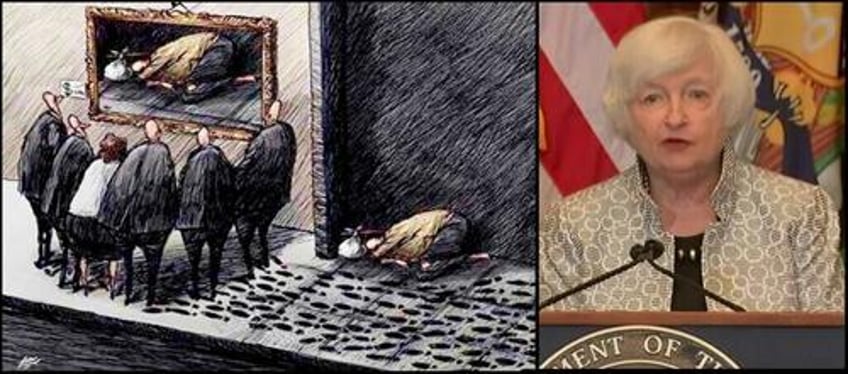

The commonly accepted bottom line, the Western sanctions, organized by the Biden administration and US Treasury, were not intended to put financial walls around Russia; they were designed to put control walls around the USA.

Russia was the useful justification.

Here’s how it really looks from the outside looking at the USA. The same way the Patriot Act was not designed to stop terrorism but rather to create a domestic surveillance system. So too were the “Russian Sanctions” not designed to sanction Russia, but rather to create the financial control system that will lead to a USA digital currency.

Now, does the exploding debt and seeming govt ambivalence take on a new perspective? It should, because that unspoken motive explains everything. This is not accidental folks.

Again, the western sanctions against Russia are not having an impact against Russia; they are having a quiet impact in the USA that no one is permitted to talk about.

LOGISTICS

Despite popular opinion to the contrary, it is entirely possible to travel all over Europe without being tracked. If you pick an entry point into the EU (Schengen Area), once inside, you can travel without any national checkpoints or passport checks. It is also entirely possible to fly all over the EU without ever giving a passport number when you book the flight. The trick is to know which airline. You are a name on a passenger manifest, nothing more.

Bottom line, travel around the EU is less controlled, tracked and monitored, than travel inside the USA.

Yes, let me emphasize; freedom of travel is greater in the EU than it is in the USA. This was completely unexpected.

GROUND REPORT

You might ask how I know the Russian sanctions are ineffective – here’s an example.

After doing advanced research, I went to three separate banks as a random and innocuous customer. I put my reason in the kiosk at each bank, got my ticket number and sat down to listen to the conversations. When my ticket number came up on the digital board, I just ignored it and sat for hours listening to conversations. No one ever noticed or questioned me – not once.

At every one of the banks, the majority of the customers, at the “new account” desk, were foreign nationals asking about setting up business accounts to trade with Russia. In every bank the conversations were friendly and helpful, with the bank staff telling the customers exactly how to set up their account to accomplish the transactions. No one was saying no; instead they were explaining how to do it in very helpful detail.

Within Russia, there are now 3rd party brokers with international accounts, an entirely new industry, which creates a layer of transactional capability for the outside company to sell goods into Russia. A Samsung TV travels from South Korea to the destination in the RU with the financial transaction between manufacturer and retailer now passing through the new ‘broker’ intermediary. Essentially, that process is what was happening in the banks for small to medium sized companies.

Back to the crypto and digital wallet angle. In addition to financial/transactional brokers for durable goods into Russia, there is now an entire industry of selling telephone id’s with EU phone numbers to process the transactions that are blocked by the USA sanction regime.

Meaning, a person could buy a phone and register a phone number from within the EU, and then go back to the USA and access all the blocked/restricted financial processes [Binance (non-US), Metamask, MexC, Telegram digital wallet etc]. This would permit them to do untracked financial transactions into and out of Russia from the USA without the USG knowing about them (sanction workaround).

[DISCLAIMER: in the interest of my own legal risk, I did not do this; I’m just explaining.]

I am not smarter than the U.S. intelligence community, so what does this mean?

This means the U.S. government knows exactly why the Russian economy is thriving, the Ruble is stronger against the dollar, and there is nothing -not one thing- visible or different on the ground in Russia that an ordinary Russian citizen would notice. In fact, the Russian economy is doing fine, better than before the Ukraine conflict initiated, albeit with new financial industries created by the sanctions.

If the US government knows this, then why the sanctions?

Asked and answered.

The Western sanctions created a financial wall around the USA, not to keep Russia out, but to keep us in.

The Western sanction regime, the financial mechanisms they created and authorized, creates the control gate that leads to a U.S. digital currency.

In essence, the Ukraine war response justified a system that creates a digital dollar.

I will have more, but for now just think about this aspect.