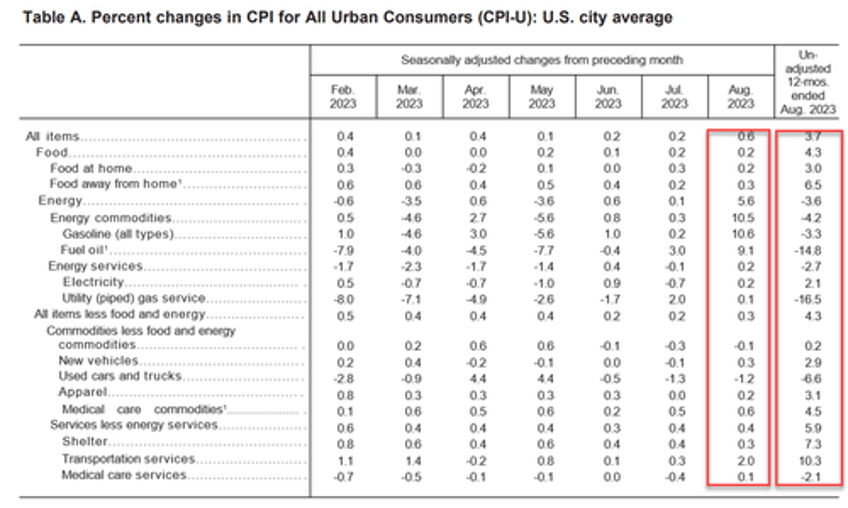

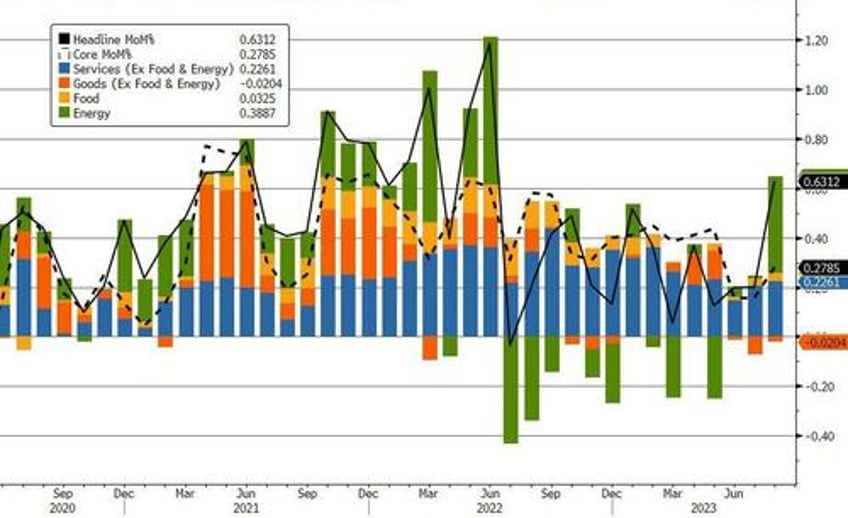

Following July's rebound in headline CPI, August was expected to see that accelerate further (driven by surging energy prices and healthcare methodology changes).

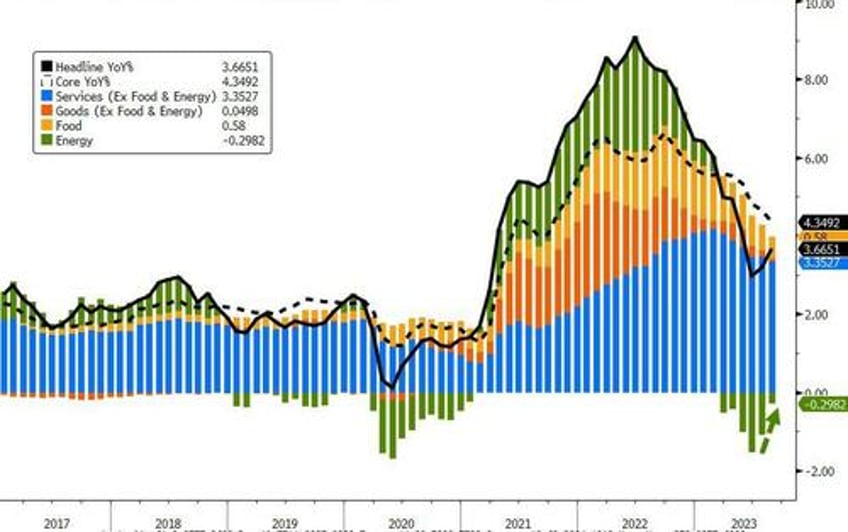

Headline CPI rose 0.6% MoM (as expected), but pushed the YoY change to +3.7% (up from 3.2% prior and hotter than the 3.6% exp). That is the biggest MoM since June 2022...

Source: Bloomberg

There was a big turn-around in airline fares. They rose 4.9% after dropping 8.1% in each of the previous two months. But Gasoline's 10.5% MoM jump dominated...

Core CPI rose 0.3% MoM (more than the 0.2% expected) but the YoY declined to 4.3% (as expected) from 4.7% prior...

Source: Bloomberg

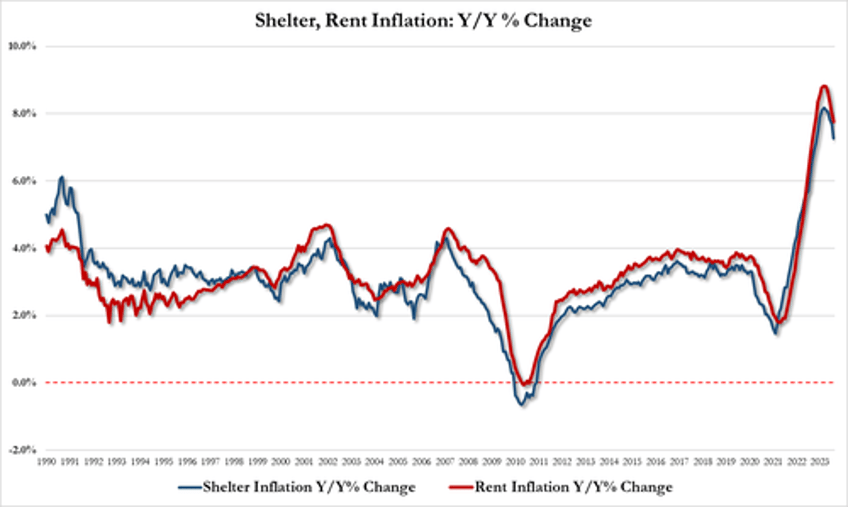

Shelter inflation slumped...

August Rent Inflation 7.76% YoY, down from 8.03% in July and lowest since November

August Shelter inflation 7.27% YoY, down from 7.69% in July and lowest since November

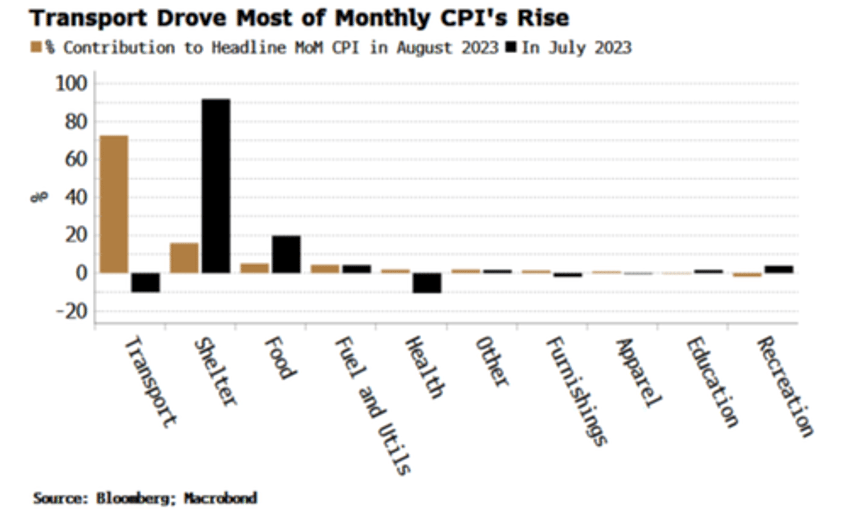

But Transport beats out Shelter for the first time as largest driver of core CPI. As BBG notes, "A re-rise in transport CPI would be a problem for stocks and bonds as it has been the primary driver of inflation’s fall over the last several months."

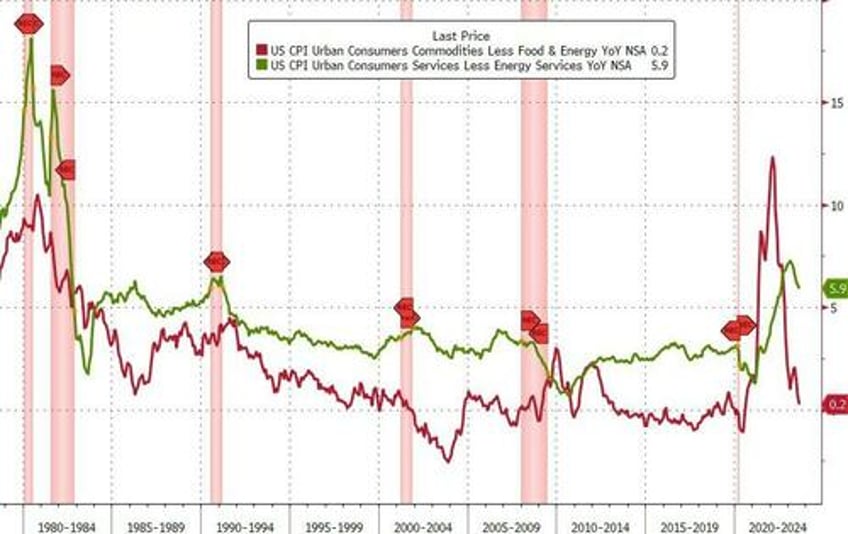

And perhaps most importantly, The Fed's new favorite inflation signal - Core Services CPI Ex-Shelter surged 0.53% MoM (most since Sept 2022) and YoY remains above 4%...

Source: Bloomberg

Owners’ equivalent rent, motor-vehicle insurance, medical care, and personal care as pushing up core.

Lodging away from home, used cars and trucks, and recreation pushed it down.

Both Goods and Services inflation slowed (with the former at its lowest since July 2020). Services remains extremely hot though...

Source: Bloomberg

The index for gasoline was the largest contributor to the monthly all items increase, accounting for over half of the increase. Also contributing to the August monthly increase was continued advancement in the shelter index, which rose for the 40th consecutive month, but is now rapidly declining.

The energy index rose 5.6 percent in August as all the major energy component indexes increased.

The food index increased 0.2 percent in August, as it did in July. The index for food at home increased 0.2 percent over the month while the index for food away from home rose 0.3 percent in August.

The index for all items less food and energy rose 0.3 percent in August, after rising 0.2 percent in July.

The shelter index increased 0.3 percent over the month, after rising 0.4 percent in each of the preceding 2 months.

The index for rent rose 0.5 percent in August, and the index for owners’ equivalent rent increased 0.4 percent over the month.

The lodging away from home index decreased 3.0 percent in August, its third consecutive decrease.

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy.

Among the other indexes that rose in August was the index for motor vehicle insurance, which increased 2.4 percent after rising 2.0 percent the preceding month.

The indexes for airline fares, personal care, new vehicles, and household furnishings and operations also increased in August.

The medical care index rose 0.2 percent in August, after falling 0.2 percent the previous month.

The index for hospital services increased 0.7 percent over the month, and the index for physicians’ services rose 0.1 percent.

The prescription drugs index rose 0.4 percent in August. The index for used cars and trucks fell 1.2 percent in August, after decreasing 1.3 percent in July.

The recreation index declined 0.2 percent over the month, and the communication index declined 0.1 percent.

The index for all items less food and energy rose 4.3 percent over the past 12 months. The shelter index increased 7.3 percent over the last year, accounting for over 70 percent of the total increase in all items less food and energy.

Other indexes with notable increases over the last year include motor vehicle insurance (+19.1 percent), recreation (+3.5 percent), personal care (+5.8 percent), and new vehicles (+2.9 percent).

On a MoM basis, energy cost increases dominated the increase. Gasoline contributed to more than half of the gain in US CPI in August.

Source: Bloomberg

But, on a YoY basis, Energy deflation is helping (but less and less so).

Source: Bloomberg

Turning from the cost of things to the ability to pay, 'real' wages

Source: Bloomberg

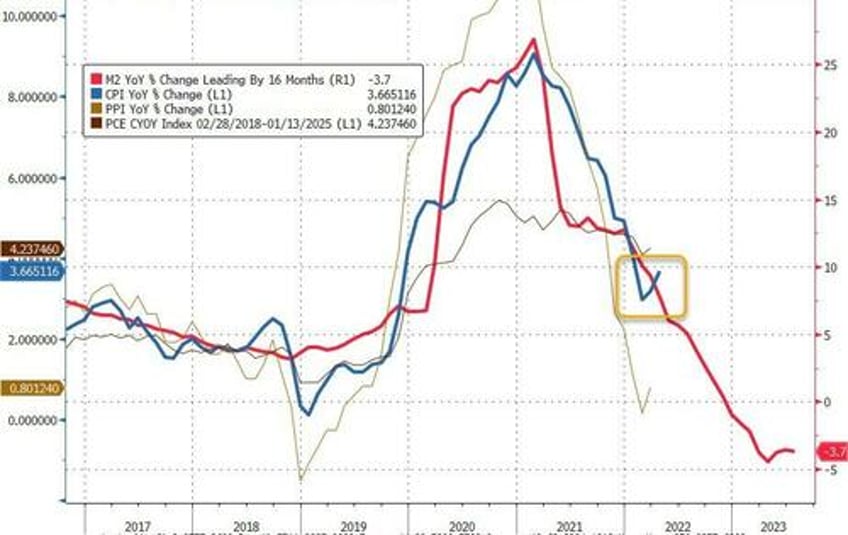

Is this second straight monthly increase in CPI YoY an inflection point? Or is M2 still leading the trend?

Source: Bloomberg

Is the over-optimistic view of the world heading for a disinflationary soft-landing about to crash on the shores of commodity's reality island?