Submitted by QTR's Fringe Finance

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter on May 31, 2024, with updates on macro and his fund’s positions.

Mark is a recurring guest on my podcast and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

In his most recent letter he offers new takes on his favorite long, his favorite short and his outlook on the market.

Mark on Macro

We remain very net short. This month’s small gain was due to a decline in the price of Tesla (which we’re short) combined with an increase in the price of our long position in Volkswagen (after accounting for it having gone ex-dividend), offset by an increase in the S&P 500 (which we’re short via various ETFs). I discuss VW and Tesla later in this letter, so let’s talk about the S&P, which is very expensive.

The U.S. economy seems to finally be cracking. This month a slew of retailers (off the top of my head: Target, Lowe’s, Macy’s, Kohl’s, Best Buy and Foot Locker) reported negative year-over-year sales comps, and that’s before adjusting for the inflation that makes them 3% to 4% more negative in “real” terms. Others (Dollar General and Burlington) reported same-store sales comps in the +2% range, but that too was negative when adjusted for inflation, while Walmart and Nordstrom comps managed to roughly keep pace with inflation, but were unable to exceed it. (To its credit, Costco comps did handily beat inflation—I wish I’d bought that damn stock 15 years ago!)

Corroborating the poor retail sales data, final Q1 GDP growth (released May 30th) came in at just 1.3%, primarily because of the weakening consumer, while pending home sales plunged. At some imminent point in time, this stock market will switch from "bad news is good news" to "bad news is bad news" as it suddenly realizes that there's a HARD economic landing coming and sticky inflation (3.6% core CPI and 2.8% core PCE ) driven by massive federal budget deficits prevents the Fed from cutting enough to compensate for it. That's what we remain positioned for.

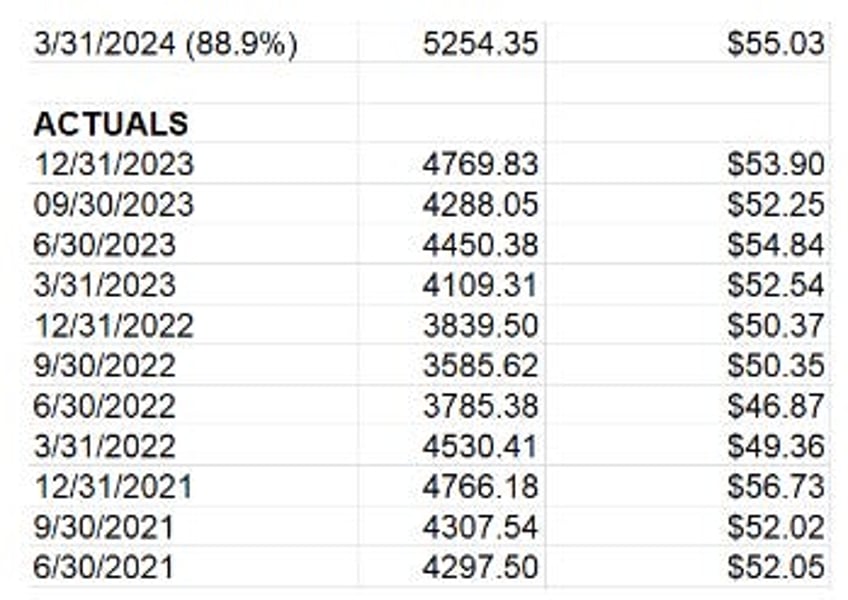

In the far-right column below from Standard & Poor’s are the 12 most recent quarterly operating earnings for the S&P 500 (with Q1 2024 estimated with 88.9% of companies having reported) and, in the middle column, the price of the S&P 500 as of that date. (The S&P 500 is now at 5277.)

As you can see, nominal earnings have barely grown in the last three years, and although Q1 2024 earnings were up 4.7% year-over-year, that’s only around 1.2% CPI-adjusted. Additionally, those latest earnings are lower “nominally” and much lower “inflation-adjusted” than they were way back in Q4 2021 (when stock prices were much lower). In fact, adjusting for inflation, Q1 2024 earnings came in lower than every quarter of 2021! Annualizing those Q1 2024 earnings to $220.12 ($55.03 x 4) and putting a long-term market average 16x multiple on them would bring the S&P 500 all the way down to just 3522 vs. May’s close of 5277. Even an 18x multiple would bring the S&P down to just 3962 vs. the current 5277. And then what happens to those earnings when we get a recession?

The consensus is now for either “no landing” or a “soft landing,” yet before even the worst recessions the consensus is nearly always for a “soft landing”; for example, here’s just one headline of many from August 2007:

In fact, for reasons I clearly lay out below, I still strongly believe that the U.S. economy is headed for a hard landing. Why do I believe so strongly that we face a “hard landing”? For the same reasons I’ve been stating since the Fed started raising rates in 2022:

There’s no way an “everything bubble” built on over a decade of 0% interest rates and trillions of dollars of worldwide “quantitative easing” can not implode when confronted with 5% U.S. rates and quantitative tightening plus tighter money from the ECB (even with a tiny expected June cut), BOJ and other central banks.

And contrary to the belief of equity bulls with short memories, when an asset bubble unwinds, lower inflation and lower interest rates won’t immediately ride to the rescue. When the 2000 bubble burst and the Nasdaq was down 83% through its 2002 low and the S&P 500 was down 50%, the rates of CPI inflation were 3.4% in 2000, 2.8% in 2001 and 1.6% in 2002, and the Fed was cutting rates almost the entire time.

Yes, a nasty recession was delayed due to a combination of interest rate lag effects, leftover “Covid cash” (which has finally run out), and consumers loading up on credit card debt, but a hard landing will soon arrive as household debt delinquencies are now surging while personal savings have collapsed, and shipping freight data is already recessionary. Yet despite myriad lurking dangers—both economic and geopolitical—the stock market is completely disconnected from a scenario involving any landing. Here are a few exhibits that perfectly capture this...(READ THIS FULL LETTER HERE).