Submitted by QTR's Fringe Finance

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter on Friday.

For years, I have been posting Larry’s take on the economy and gold and silver - and featured him on my podcast - because I believe he sees the state of the economy and finance in general accurately. I think his letter today - as gold and silver continue to break out and the economy gets closer to a breaking point - is a more important read now, than ever.

Larry was kind enough to allow me to share his thoughts heading into Q4 2024. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 1 of this letter with Larry’s take on macro and the economy. Part 2 - highlighting gold and silver - will be published in coming days.

Q3 WRAP UP

July started ominously. Global markets were volatile and a massive rally in the Japanese Yen (Japan hinted at raising rates) triggered an unwind of the “Yen Carry Trade”. The S&P 500, oil and commodities broadly were down 10% or more. However, in early August, global central banks began to jawbone the markets back up as the Bank of Japan turned more dovish – putting out the fire.

August and September saw rallies across most major asset classes, with the exception of oil and some other commodities. On September 18, the Fed reduced the Fed Funds rate by 50bps which was aggressive considering the U.S. stock market had just achieved a new record high. Worldwide, other central banks were also cutting rates, and gold, in particular, reacted very favorably (rising 13% in the quarter). Its rise was also driven by strong demand from BRICs countries and Central Banks.

FISCAL DOMINANCE

The biggest story of the quarter was the way in which the Federal Government spending continued to grow at a break-neck pace. This led to a stronger than expected economy with GDP growth of 3.0% and record highs in the US Stock market, which have continued here in October.

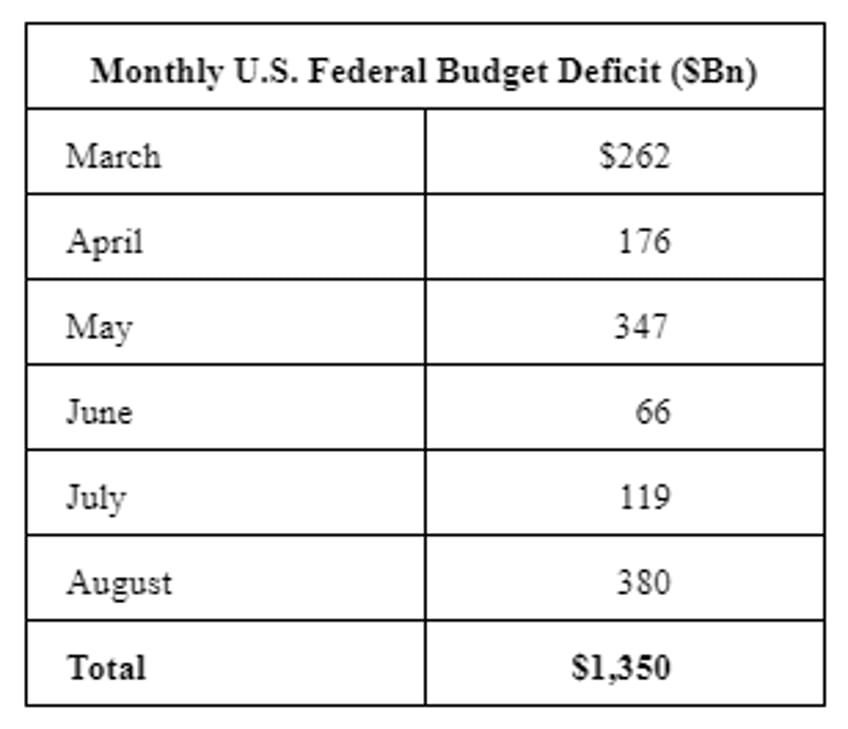

To see what we mean, consider the following:

A total deficit of $1.35 Trillion in just six months is much larger than originally projected. The September results have not been released yet, but we expect them to be similarly bad. The CBO estimates that the deficit for fiscal year ended September 2024 will be $1.9 Trillion; however, through the eleven months ended August 31, the recorded deficit is already $1.9 Trillion, and it seems unlikely that it did not grow in September.

Although we do not know the...(READ THIS FULL ARTICLE HERE).