The rise in interest is attributed to Federal Reserve interest rate hikes

Missouri secretary of state threatening to remove Biden from ballot

Missouri Secretary of State Jay Ashcroft (R) on his efforts to respond to Democrats pushing to remove Trump from ballot and being targeted as the latest swatting victim

On the first business day of the new year, Missouri Treasurer Vivek Malek began accepting applications for about $120 million of state-subsidized, low-interest loans to small businesses, farmers and affordable housing developers.

Within six hours, Malek had so many requests for the money that he had to cut off applications.

"The demand is huge, and it is real," Malek said.

MISSOURI'S FIRST NON-WHITE TREASURER VIVEK MALEK TAKES OFFICE

Missouri's situation, though extreme, is not entirely unique. From New York to Illinois to Montana, states have seen surging public interest in little-known programs that use state funds to spur private investment with bargain-priced loans. The programs have taken off after a series of key interest rate hikes by the Federal Reserve made virtually all loans more expensive, whether for farmers purchasing seed or businesses wanting to expand.

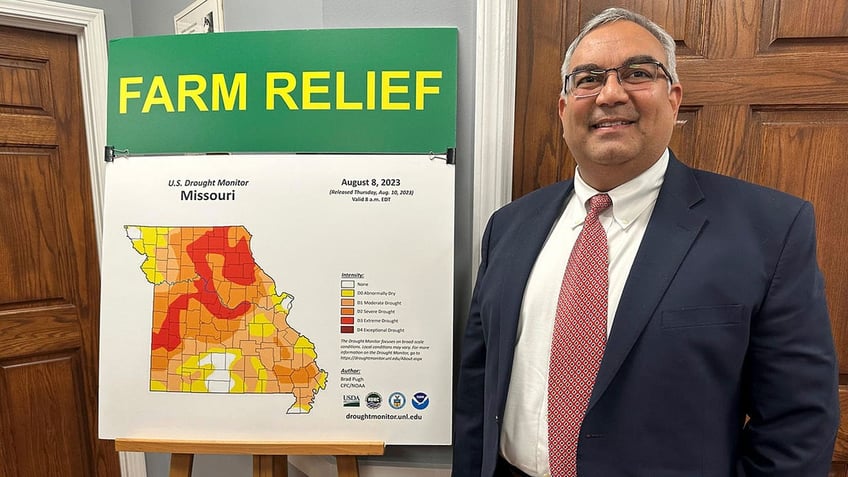

Missouri Treasurer Vivek Malek stands near a poster promoting state aid programs on Jan. 4, 2024, at his Capitol office in Jefferson City. Several categories of businesses can receive low-interest loans, and participation in such programs has grown in various states. (AP Photo/David A. Lieb)

To combat inflation in consumer prices, the Fed raised its benchmark interest rate 11 times from March 2022 to last July, setting it at a two-decade high.

Under so-called linked-deposit programs, states deposit money in banks at below-market interest rates. Banks then leverage those funds to provide short-term, low-interest loans to particular borrowers, often in agriculture or small business. The programs can save thousands of dollars for borrowers by reducing their interest rates by an average 2-3 percentage points.

MISSOURI HOUSE PASSES DIVERSITY SPENDING BAN, PROPOSAL LIKELY ILL-FATED IN SENATE

States typically cap the amount of money available for such discounted rates at either a flat dollar amount or a percentage of their total fund balances, because the programs result in less earnings for the state. Many states have built large surpluses from pandemic-era revenues, meaning they have more money available to deposit in banks.

Though most states don't currently offer such programs, some that shelved them when interest rates were low are now considering whether to revive them to aid financially-strapped businesses and residents.

"I can say in talks with other state treasurers that there is a definite increased interest in treasury money, whether that is through a linked-deposit program or a different vehicle," said Illinois Treasurer Michael Frerichs, who is president of the National Association of State Treasurers.

Illinois has nearly $950 million of deposits linked to low-interest loans for farmers, businesses and individuals. That's up substantially from past years. In 2015, Frerichs said, the state's agricultural investment program had just two low-interest loans. By 2022, that had grown to $51 million of loans. Last year, Illinois made $667 million of low-rate deposits for agricultural loans.

With rising demand, Frerichs recently raised the program’s overall cap from $1 billion to $1.5 billion.

Though smaller in scope, New York's program also has seen an explosion of applicants.

In 2022, New York had 42 applications for state deposits in financial institutions linked to $20 million in low-interest loans. Last year, that rose to 317 applications linked to more than $220 million of loans, said Rafael Salaberrios, a senior vice president who manages capital access programs at Empire State Development, New York's economic development agency.

"As the banks see the benefit, they are inundating us with applications – and that’s a good thing," Salaberrios said. "The linked deposit has allowed for the growth of small businesses to continue even during these high (interest) rate environments."

Because of rising demand, Missouri's linked-deposit loan program neared its statutory cap of $800 million last May. After some existing loans expired, the treasurer's office was able to reopen applications at 10 a.m. on Jan. 2. By 4 p.m. that day, it had approached the cap again – receiving 142 applications totaling over $119 million – and closed the application window.

About half the applications came on behalf of customers of just two financial institutions – OakStar Bank and FCS Financial, a leading agricultural lender. FCS Financial had over 100 additional applications in line to submit when applications were cut off, said Brian Zimmerschied, vice president for its commercial crop lending team.

BTC Bank in rural Bethany, Missouri, had planned to turn in about dozen applications on behalf of its customers. But it missed out entirely because of the quick cutoff, bank CEO Doug Fish said.

Among those left disappointed was Jason Bernard, a farmer near Bethany who had hoped for a low-interest loan to help purchase this year's supply of seed, fertilizer and chemical spray.

With higher interest rates, "it’s a lot harder to make it, just because your payments," Bernard said.

The Missouri treasurer's office is backing legislation to raise the program's cap from $800 million to $1.2 billion, which would mark a 50% increase in capacity. The expansion could cost the state $12 million of potential earnings, though that could be partly offset by the economic activity generated from those loans, according to a legislative fiscal analysis.

In Montana, lawmakers last year authorized a new program to address a shortage of affordable housing. The Montana Board of Investments launched a linked-deposit loan initiative in October that received $77 million of applications within two months, reaching a self-imposed cap and forcing it to close applications sooner than expected.

Republican state Rep. Mike Hopkins, who sponsored the housing incentive legislation, was thrilled with the response.

"We’re in a bit of a jam in the state of Montana" for affordable housing, Hopkins said, and "we were able to get money out the door as quickly as possible."

TOP MISSOURI LAWMAKER MOVES TO CUT FUNDING OF PUBLIC LIBRARIES BY $4.5M

Officials in Iowa, Kansas and Ohio also told the AP they had increased demand for programs that deposit state money in banks to provide low-interest loans. The number of such loan recipients in Kansas tripled from 2022 to 2023. In Ohio, the amount of money provided for those loans rose by two-thirds during that time, to more than $600 million.

Oklahoma's linked-deposit program has been dormant since 2010 amid low interest rates, but at least two banks recently contacted the treasurer's office about the possibility of restarting it, said Deputy Treasurer Jordan Harvey.

Texas Agriculture Commissioner Sid Miller said he hadn't approved any linked deposits for low-interest loans since taking office in 2015 – until last year, when he approved his first two.

"There wasn’t much need because interest rates were cheap," Miller said.

"But now that the rates are up," Miller added, "it could be a viable program, and we could help some people."