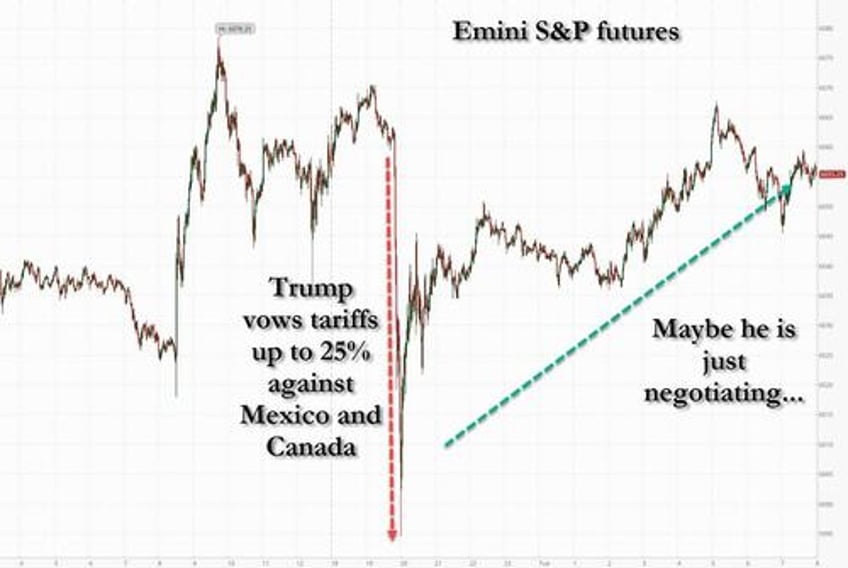

US equity futures are higher even as president Trump pledged to impose tariffs up to 25% on Canadian and Mexican imports as soon as Feb. 1, but held off imposing an immediate China tariff, which according to JPMorgan points "to a more cautious view from Trump on tariff implementation", helping push the USD/CNY lower by -0.7%. The possibility of tariffs on Canada and Mexico on Feb. 1 weighed on futures yesterday evening, if not so much Tuesday morning when S&P futures are near session highs, up 0.4% to 6,060 with Nasdaq futures rising by a similar amount as a more serene mood settled over markets after a rollercoaster session on Donald Trump’s first day in office, with investors looking past the threat of tariffs to the potential boost from fiscal stimulus and tax cuts. Trump also threatened Europe with tariffs unless it buys more American oil, and gave TikTok a 75 day reprieve to sell itself. Other moves included declaring national emergencies on migration and energy, withdrawing from the Paris agreement and WHO, rolling back EV policies, and boosting oil and gas drilling. Elsewhere in markets, the is FTSE flat/DAX -10bps/CAC +5bps/Shanghai -5bps/Hang Seng +91bps/Nikkei +32bps. 10Y yields dropped from their Friday close to trade at 4.58%, down 4bps, as the dollar gained. This week, key macro focus will be Q4 earnings (9% of SPX mkt cap reports) and headlines from Washington. Crude oil dropped after Houthi rebels said they would no longer target tankers transiting the Red Sea. Bitcoin slumped on Monday after Trump failed to mention it even once in his various speeches and addresses. Today, we will hear from KEY, DHI, PLD, SCHW, MMM, FITB pre-open while NFLX, STX, UAL, COF, IBKR, HWC report after the bell.

In premarket trading, US-listed Chinese stocks rise, following gains in Hong Kong peers, as President Donald Trump refrained from announcing any tariffs on Chinese goods on his first day in office. 3M rose 4% as management expects profit to grow this year. Apple falls 2% as sales of iPhones dived 18.2% in China during the December quarter, according to independent research; Jefferies, Loop downgrade on Weak iPhone Demand. D.R. Horton gained 3% after affirming its forecasts for full-year revenue and deliveries. General Motors rose 1% after Deutsche Bank upgraded the automaker to buy on expectations that the automaker will report to the high-end of its guidance range in the fourth quarter.

US stock futures, Treasuries and the dollar all gained as traders chose to focus on the prospects for economic growth and corporate profits under Trump’s second four-year term. Still, the lack of an overall narrative on trade restrictions so far underscores the risk of higher volatility across financial markets.

Trump threatened tariffs of as much as 25% on Canadian and Mexican imports as soon as Feb. 1, triggering sharp declines in the Mexican peso and Canadian dollar. The currencies were among the worst-performing of 30 major currencies on Tuesday, with the peso trading 1.2% lower and the loonie down 0.9%. Their declines stood out as the worst market fallout from a raft of executive orders signed by Trump, including one that declares a national emergency at the US-Mexico border. However, the yuan jumped almost 1% after Trump refrained from announcing immediate tariffs against China.

Investors had been on edge over the first executive orders to be announced by the White House after Trump vowed to quickly implement his “America First” agenda. In the runup to inauguration day, traders had driven up yields and stoked the dollar to a 13-month high, expecting that sweeping trade tariffs will crimp global growth, lift US inflation and potentially cause the Federal Reserve to refrain from interest-rate cuts this year.

"The fears are sometimes greater than reality,” said Robert Dishner, senior portfolio manager at Neuberger Berman. "The market is going to settle to a cadence of the domestic agenda. For now there is an evaluation.”

Here is a recap of all the main events on Monday:

- Donald Trump was sworn in as the 47th US President, while President Trump said in the Inaugural Address that the golden age of America begins now and he will sign a series of executive orders as widely expected. Trump said he will direct his Cabinet to defeat record inflation and will launch astronauts to Mars, while he added that all illegal entry will be halted and he will reinstate 'Remain in Mexico' policy, as well as send troops to the southern border. Furthermore, Trump said he will declare a national energy emergency and reiterated his 'drill baby, drill' catchphrase, while he will begin an overhaul of the trade system, will tariff and tax foreign countries to enrich US citizens, as well as establish an 'External Revenue Service'.

- US President Trump signed rescissions of 78 Biden-era actions orders and memoranda, while he also signed documents on a federal hiring freeze, mandating workers to return to in-person full-time immediately and the withdrawal from the Paris Climate Treaty. Trump also revoked Biden's 2023 Executive Order on AI policy and Biden's Executive Order that set a target of 50% of new vehicle sales by 2030 as EVs.

- Trump said they will straighten out the deficit with the EU through tariffs or by them buying US oil and gas.

- Thinking in terms of 25% tariffs on Mexico and Canada and thinks that they will do it on February 1st.

- Trump signed the order related to delaying the TikTok ban and said he may do a TikTok deal or may not, but if he does a TikTok deal, the US should be entitled to half of TikTok and if he doesn't sign, then TikTok is worthless. Furthermore, Trump said they could put tariffs on China if they make a TikTok deal and China doesn't approve it, while he floated the idea of universal tariffs on anyone doing business with the US but said they are not there yet.

- A draft Trump trade memo directed federal agencies to investigate and remedy persistent US trade deficits that harm the US economy and seeks to address unfair trade practices and currency manipulation by foreign countries. The trade memo also seeks to ensure trade deals including USMCA prioritise American workers, farmers and businesses, while it seeks to combat the import of counterfeit products and contraband that threaten public health and erode tariff revenues. President Trump is to assess China's adherence to the US-China trade agreement to determine if enforcement or changes are required.

- Trump’s administration sent a new document to Republican lawmakers detailing immediate priorities and it was stated that Trump will announce the America First Trade Policy. It was also announced that Trump will take bold action to secure the border and protect American communities, while he will unleash American energy by ending Biden’s policies of "extremism" and all agencies will take emergency measures to reduce the cost of living.

Meanwhile, fourth-quarter earnings season resumes, with 3M Co., Netflix Inc. and United Airlines Holdings Inc. among US companies set to report on Tuesday. Traders will also also keep an eye on comments from the World Economic Forum meeting in Davos.

Europe's Stoxx 600 shook off early weakness to rise 0.2% as Trump repeated his call on the European Union to buy more American oil and gas if the bloc wants to avoid tariffs. Tariff and policy concerns still weighed on the region’s mining, automotive and renewable stocks. Here are the biggest movers Tuesday:

- Avanza shares rise as much as 11%, hitting a three-year high, after full-year results topped expectations at the Swedish retail-trading platform. The report should help drive upgrades, Citi says

- Abrdn shares rise as much as 9.6%, the most since April 2020, after the investment company posted assets under management and net inflows ahead of expectations

- Truecaller gains as much as 12% to trade at the highest since Sept. 2022, after Carnegie raised its price target on the Swedish caller ID platform by a fifth, highlighting several major catalysts ahead

- Komax shares soar as much as 12%, the most in almost three years, after the Swiss machinery manufacturer posted better-than-expected order intake and sales figures

- Alphawave IP shares soar as much as 16% after the semiconductor firm reported a surge in orders in the final quarter of 2024, while raising expectations for FY adj. Ebitda

- Shares in lenders with UK motor finance exposure jump following a report that Chancellor Rachel Reeves could intervene in a car finance mis-selling case in order to protect car loan providers

- Orsted shares fall as much as 18%, hitting their lowest in more than a year, after the Danish offshore wind developer pre-released impairments that were greater than analysts estimated

- Schott Pharma falls as much as 8.8%, the most since December, after Bank of America downgrades the German drug delivery systems manufacturer to underperform from buy

- The Stoxx 600 basic resources index is among Tuesday’s biggest decliners as base metals fell after US President Donald Trump said he would likely enact tariffs on Mexico and Canada by Feb. 1

- European automakers decline on Tuesday after US President Donald Trump ended his first day in office saying he would put 25% tariffs on goods from Mexico and Canada by the beginning of next month

- Greggs shares drop as much as 4.2% after Panmure Liberum downgraded the UK baker and slashed its price target to a new Street-low. Analysts trimmed their profit estimates after becoming more cautious

- DocMorris shares drop as much as 6.9%, reversing an earlier gain of 3.2%, after analysts highlighted the Swiss pharmaceutical products retailer’s lower-than-expected sales in the fourth quarter

Earlier in the session, Asian stocks whipsawed early on Tuesday as traders parsed comments from newly sworn-in US President Donald Trump to gauge impact on markets in the region. The MSCI Asia Pacific Index was up 0.2% after swinging between gains and losses earlier. While Trump said he planned to enact previously threatened tariffs of as much as 25% on Mexico and Canada by Feb. 1, he avoided committing to a plan for additional levies on China and said he would be having “meetings and calls” with President Xi Jinping. Chinese stocks rose more than 1% in Hong Kong as Trump avoided committing to a plan for tariffs on goods from China. But Trump also indicated that he could impose taxes on Chinese goods if Beijing blocked the sale of the social media app TikTok to a US entity.

“There is a lot to digest. But one thing to flag here is that I think at the moment, the equity market is not too concerned about US-China tensions,” Kinger Lau, chief China equity strategists at Goldman Sachs, said in a Bloomberg TV interview. China should be able to digest 20% tariffs, “so from markets standpoint we are still forecasting 20% rise in Chinese equities over next 12 months.”

Elsewhere, Indian stocks dropped amid slowing corporte earnings. The stock market correction may have room to run as weak earnings and high valuations will likely weigh on sentiment in the near-term.

In fx, the Bloomberg Dollar Spot Index climbs 0.6% while the Mexican peso fell and along with the Canadian dollar, was among the worst-performing major currencies after US President Trump threatened both countries with tariffs on his first day in office. US 10-year yields fall 6 bps to 4.57%. Cable is down 0.6% against the greenback following weak job numbers, matching a fall in the euro.

In rates, treasuries rally as fears that Trump’s policies will fuel inflation eased. The 10-year TSY around 4.58% is more than 4bp richer on the day after falling to 4.528% during Asia session; long-end-led gains flatten 2s10s, 5s30s spreads by 2.5bp and 1bp vs Friday’s close. Gilts are steady after mixed UK jobs data did little to shift bets on interest-rate cuts by the Bank of England. Bunds outperform Gilts with German 10-year yields falling 1 bps.

In commodities, oil prices decline, with WTI falling more than 2% to $76.40. Spot gold climbs $14 to $2,722/oz. Bitcoin trades near $103,000.

Looking at today's calendar, US economic data calendar includes January Philadelphia Fed non-manufacturing activity (8:30am). Fed officials are in communications blackout ahead of Jan. 29 policy announcement; swaps market prices in around 6bp of combined easing over the January and March meetings and 37bp over the course of this year.

Market Snapshot

- S&P 500 futures up 0.4% to 6,055.25

- STOXX Europe 600 little changed at 524.20

- MXAP little changed at 181.03

- MXAPJ little changed at 571.20

- Nikkei up 0.3% to 39,027.98

- Topix little changed at 2,713.50

- Hang Seng Index up 0.9% to 20,106.55

- Shanghai Composite little changed at 3,242.62

- Sensex down 1.6% to 75,823.52

- Australia S&P/ASX 200 up 0.7% to 8,402.39

- Kospi little changed at 2,518.03

- German 10Y yield little changed at 2.51%

- Euro down 0.6% to $1.0355

- Brent Futures down 0.9% to $79.41/bbl

- Gold spot up 0.5% to $2,722.98

- US Dollar Index down 0.62% to 108.67

Top Overnight News

- The dollar rebounded after President Trump touted plans to impose 25% tariffs on Canada and Mexico by Feb. 1, while the Hang Seng rallied as he delayed a reckoning with China. The loonie and peso slumped, and some hedge funds re-entered bullish dollar option trades. BBG

- President Donald Trump did not immediately impose tariffs on Monday as previously promised but said he was thinking about imposing 25% duties on imports from Canada and Mexico as soon as Feb 1. He directed federal agencies to investigate persistent U.S. trade deficits and unfair trade practices and alleged currency manipulation by other countries. RTRS

- US President Trump said they will straighten out the deficit with the EU through tariffs or by them buying US oil and gas: AP

- Trump revoked offshore oil and gas leasing bans that had effectively blocked drilling in most US coastal waters. He expects the US to stop buying oil from Venezuela, and reiterated a call for the EU to buy more American oil and gas to avoid tariffs. BBG

- US Speaker Mike Johnson’s tax adviser Derek Theurer is expected to take a job in the Treasury Department - he would play a "key role" in shaping Republican tax plans: Punchbowl.

- China indicated that sanctions on US Secretary of State Marco Rubio wouldn’t impact official exchanges, a sign that Beijing seeks to negotiate with the Trump administration. BBG

- South Korean President Yoon Suk Yeol denied wrongdoing as he branded himself as a firm believer in democracy in his first appearance at an impeachment trial. BBG

- UK wage growth beat in the three months through November from a year earlier. December employment fell more than expected, reinforcing the case for more BOE rate cuts. BBG

- The ECB will probably cut rates 3-4 times in a row, with the first reduction all but certain next week, Governing Council member Peter Kazimir said. Francois Villeroy said it’s plausible the central bank will act at each meeting, bringing the deposit rate down to 2% by summer. BBG

- In Germany the expectations component of the ZEW survey slumped to 10.3 in Jan, down from 15.7 in Dec and below the Street consensus of 15.1. BBG

- BofA January Global Fund Manager Survey states investors are bullish on the USD and equities, bearish everything else (most underweight bonds since October 2022).

- JPMorgan executive Erdoes says US banks under President Trump are "in the beginning of go-mode" and "animal spirits are alive", via FT citing Davos remarks; adding, it is "hopeful" that his regulatory approach would boost the US economy.

- Tariffs: Goldman is lowering its odds of a universal tariff this year to 25%. If President Trump ultimately implements a tariff affecting all countries, the bank believes it is more likely to be targeted at “critical imports” (between 10-20% of total US imports) or otherwise narrower than the “universal” tariff Trump proposed during the campaign. However, while this as a risk, for now Goldman does not include it in its base case.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as the initial broad-based risk-on sentiment after US President Trump refrained from imposing tariffs on the first day of his return to the White House, was ultimately soured after he later flagged potential 25% tariffs on Canada and Mexico which could be imposed from the start of February. ASX 200 was led higher as outperformance in the top-weighted financials sector and gold miners helped pick up the slack from the weakness in energy and defensive stocks. Nikkei 225 briefly wiped out its opening gains with price action largely influenced by tariff rhetoric and a firmer currency. Hang Seng and Shanghai Comp were mixed after the recent tariff-related fluctuations in asset classes, while President Trump also floated the idea of universal tariffs on anyone doing business with the US but added that they are not there yet.

Top Asian News

- China's Vice Premier says China's stable economic growth will provide strong impetus for global economic development. "China does not pursue a trade surplus". "China's door of opening up will not close". "Sincerely welcome more foreign companies to invest into China"

European bourses (Stoxx 600 +0.1%) opened with a strong negative bias, with only a couple of indices remaining afloat. As the morning progressed, sentiment in the complex gradually improved, to currently display a mixed picture in Europe. European sectors are mixed vs initially opening mostly in the red. Trump's inauguration has sparked some considerable moves across sectors in Europe; Autos, Basic Resources and Utilities have all been hampered thus far. The latter is in focus after Trump said he will end leasing to some wind farms.

Top European News

- EU is to reportedly raise concerns with the US over its decision to restrict exports of AI chips from the likes of NVIDIA (NVDA) to some member states, according to Bloomberg sources.

- ECB's Villeroy says "if the pace of rate cuts is steady, there is no need to make them bigger", via Bloomberg TV; in terms of easing, it will be entirely data dependent. No question on the neutral rate; if ECB carries on, can be at 2% neutral rate by summer. Perspective of inflation is quite assured. On growth, is slightly positive thus far but not enough.

- UK Chancellor Reeves backs plans for looser limits on mortgage lending and favours proposals by the financial regulator for banks to take more risks to boost home ownership, according to FT.

- UK Chancellor Reeves reportedly intervenes in a car finance mis-selling case to protect lenders in which she launched an effort to shield car loan providers from multibillion-pound payouts, according to FT.

- ECB's Kazimir said a rate cut next week is all but certain and two to three more will probably follow, while he added that recent data suggest 25bps back-to-back rate cuts should continue although heightened uncertainty means the ECB must remain nimble in case things change, according to Bloomberg.

- EU's Commissioner Dombrovskis said the EU and US are strategic allies, while he added they need to preserve the EU-US trade relationship and they are ready to defend the EU's economic interests.

- EU finance ministers agreed to stay united in the approach to the new US administration and stated that a more competitive EU economy is the best answer to potential economic challenges from the US, while they also agreed it is in the EU and US interests to develop a strong economic relationship.

- German Car Association VDA says in discussion with the new US President, it is clear that showing economic strength is the best answer

FX

- The dollar is showing a resurgence after yesterday's heavy selling pressure which was triggered by news that President Trump refrained from imposing tariffs on day one of his Presidency. That being said, optimism on the trade front was dashed overnight after Trump remarked that he is thinking of 25% tariffs on Mexico and Canada and thinks that they will do it on February 1st. DXY made an incremental new low overnight at 107.86 before returning to a 108 handle and rising as high as 108.79.

- EUR is notably weaker vs. the USD following a particularly strong showing yesterday amid relief that Trump refrained from enacting tariff action on day one of his Presidency. That optimism has faded somewhat following Trump's threats on Canada and Mexico overnight as well as him stating that the US will straighten out the deficit with the EU through tariffs or by them buying US oil and gas.

- JPY is softer vs. the USD but to a lesser extent than peers given that more cyclically exposed currencies were hit overnight following Trump's tariff threat. USD/JPY delved as low as 154.79 overnight, finding support just above its 50DMA at 154.77.

- GBP is on the backfoot vs. the broadly firmer USD and marginally softer vs. the EUR. This morning's UK jobs data saw the unemployment rate tick higher to 4.4% from 4.3% as expected (usual data caveats apply), whilst headline wage growth picked up to 5.6% from 5.2% as expected. Cable currently sits towards the middle of yesterday's 1.2161-1.2345 range.

- Antipodeans are both on the backfoot as some of yesterday's trade optimism faded overnight following the aforementioned report of Trump considering tariffs on Mexico and Canada. AUD/USD yesterday was able to propel itself from a 0.6189 base to a 0.6286 peak (highest since 7th Jan). However, a bulk of this move was pared during the APAC session with the pair delving as low as 0.6209.

- After some reprieve yesterday, both the Loonie and Mexican Peso are notably lower vs. the USD following comments from US President Trump that he is thinking of 25% tariffs on Mexico and Canada and thinks that they will do it on February 1st. ING notes that "at this point, there is more downside room for CAD and MXN to fall should Trump follow through with the tariff threat".

- PBoC set USD/CNY mid-point at 7.1703 vs exp. 7.2888 (prev. 7.1886).

Fixed Income

- USTs have been gradually fading from best throughout the morning as we prepare for Trump’s first full day back in office. As it stands, USTs are holding around Monday’s 108-24+ best. Monday price action was fairly contained up until the WSJ piece (re. tariffs) drove USTs to a 108-24+ peak.

- Gilts are trading in-line with European peers, specifics for the Gilt market focused on the UK labour report which saw the wage metrics increase but largely as expected while the unemployment and payroll measures both point to the market loosening. Metrics which helped Gilts gap higher by 21 ticks at the open, however the overnight rally in USTs was likely the main driver behind this with Gilts playing catch up this morning. Gilts currently in 91.51-79 parameters.

- Bunds began the morning modestly in the green with yields slightly softer by extension but largely contained with newsflow light so far. German ZEW came in mixed with a significant miss in the Economic Sentiment metric while Current Conditions eclipsed the forecast range, but remained at very low levels; accompanying commentary was, unsurprisingly, downbeat. Action which leaves Bunds towards the lower-end of 131.82 to 132.15 parameters.

- France saw over EUR 100bln of demand for its syndicated bond sale, via Reuters citing lead manager.

- Spain has mandated a 10yr benchmark bond, via Reuters citing lead manager.

- Germany sells EUR 0.945bln vs exp. EUR 1bln 2.10% 2029 and EUR 908mln vs exp. EUR 1bln 2.30% 2033 Green Bund.

- UK gets record of GBP 119bln in orders for 2040 gilt syndication, via Bloomberg TV.

Commodities

- Softer trade across the crude complex this morning as markets digest Trump's executive orders alongside implications of the new administration for the oil market over the next four years, with the Dollar also on a firmer footing following yesterday's slide. On energy, Trump said he would declare a national energy emergency and reiterated his 'drill baby, drill' catchphrase. Furthermore, US President Trump signed an order on unleashing energy production and repealed Biden's 2023 memo barring oil drilling in some 16mln acres in the Arctic, according to the White House. Brent trades in and at the bottom of a USD 78.90-80.46/bbl range.

- Mixed trade across precious metals amid the tentative mood around markets as Trump was sworn in as the 47th President yesterday. Spot gold steadily extended on yesterday's gains and currently trades in a USD 2,702.81-2,733.06/oz range after topping the peak set last Thursday (USD 2,724.78/oz).

- Base metals lower across the board following Trump's latest tariff-related rhetoric dampening demand in the base metal space.

- Saudi Aramco's Chief says he still sees a healthy oil market, when asked about US President Trump's energy comments, via Reuters. Will wait and see how sanctions on Russia translate into tightness in the market, still at an early stage. Expecting additional oil demand this year of around 1.3mln/bpd. On LNG, we are working with our partners and looking at expanding our position.

- Uniper (UN0 GY) CEO says it is positive if US President Trump sends more gas to Europe.

Geopolitics: Middle East

- Israeli Military says forces have begun an operation in the West Bank city of Jenin.

- Hamas said a second batch of hostages will be released on Saturday as planned.

Geopolitics: Russia-Ukraine

- Ukraine's Military says it hit Russian oil depot in Voronezh region for the second time in a week

- Ukrainian President Zelenskiy said US President Trump's peace through strength policy is an opportunity to achieve just peace and he looks forward to active and mutually beneficial cooperation with Trump.

- Falling Ukrainian drone triggered a new fire at an oil storage depot in southern Russia's Voronezh region, according to the regional governor.

Geopolitics: Other

- Russian President Putin tells Chinese President Xi that he "thinks last year was a very fruitful year for us". Putin says China ties are "self sufficient"

- South Korea said the denuclearisation of North Korea must still be the goal for world peace, following a report US President Trump said that Pyongyang is a nuclear power.

US Event Calendar

- 08:30: Jan. Philadelphia Fed Non-Manufactu, prior -6.0, revised -3.4

DB's Jim Reid concludes the overnight wrap

It was Blue Monday here in the UK yesterday as it is deemed to be the most depressing day of the year (always third Monday in January). My kids have just been taught about it and were asked to add some colour to their school uniform for the day to battle the blues. One of my twins wore one of my red work ties and I now know exactly what he had for lunch as a result!

Meanwhile it was red Monday in Washington DC as Trump's inauguration ceremony took place. The subsequent speech didn't really contain any substantive surprises, and in fact was probably more traditional than many of his previous speeches. He did detail a list of executive orders and policy reversals that are imminent across immigration, ending green incentives, promoting the oil and gas sector and pushing back against the DEI movement. A lack of immediate moves on tariffs supported the market mood yesterday, but this has partially reversed overnight as late in the day Trump renewed an immediate threat of 25% tariffs on Canada and Mexico, which could be announced as soon as February 1st.

In my chart of the day yesterday we pointed out how Trump signed Executive Orders at the fastest rate of any President since Jimmy Carter, who left office in 1981. But if we look further back in history, it’s still well below that seen in the first half of the 20th century, peaking under Franklin Roosevelt who had to deal with the Great Depression and WWII. Given Trump's recent rhetoric we could go back to the first half of the twentieth century levels of executive orders in his second term.

US markets were closed for a public holiday yesterday as the inauguration took place, but the biggest moves of the day came after the WSJ reported that Trump wouldn’t impose new tariffs on his first day in office. The story said that Trump would issue a memorandum on trade, but not impose tariffs yet. So that raised hopes that Trump would initially try and reach a deal with US trade partners, with tariffs as a potential point of leverage, rather than something to be used immediately.

That report led to a clear rally for bond and equity futures, whilst the US dollar index weakened -1.16% on the day, marking its biggest move lower since the very bad jobs report in August. US Treasuries were closed yesterday for the holiday, but overnight the 10yr yield has come down -8.9bps.

However, the more positive take on trade risks has reversed overnight after Trump commented to reporters that he’s thinking of imposing 25% tariffs on Canada and Mexico on February 1st, again citing the flow of undocumented migrants and drugs into the US. He also commented the he is considering a universal tariff but that he’s “not ready for that yet.” The Canadian dollar and Mexican peso slumped by as much as -1.5% following the comments before partially recovering, while the broad dollar has recovered around a third of yesterday's losses. S&P 500 futures have also given up more than half of yesterday's gains (+0.36% at Europe’s close yesterday). See our economists' piece here from late November where they said a 25% increase in tariffs on Mexican and Canadian imports would increase inflation by up to 1 percentage point in 2025. So although at this stage this was an off the cuff comment to reporters last night, markets should be pretty concerned about the headlines.

Before all this, in European trading markets had been earlier buoyed by the tariff news (or lack of), with a clear advance for those sectors most exposed to trade. As an example one of the biggest sectoral advances came for Automobiles & Parts (+1.08%). That helped the German DAX (+0.42%) to outperform and hit another all-time high, with BMW (+2.80%) as the top-performer in the index. And given the weakness in the US Dollar, that meant the Euro strengthened +1.39% on the day, marking its biggest daily advance since November 2023. This move will be under threat this morning with the Euro already giving up around a quarter of its gains in Asia from yesterday. Let's see how European autos react.

The WSJ story also led to a clear rally for European sovereign bonds, with 10yr bund yields paring back their earlier increase to close -0.5bps lower. That pattern was echoed across the continent, with yields on 10yr OATs (-1.0bps) and BTPs (-2.7bps) moving lower as well. There was a bit of hawkishness from the ECB’s Holzmann in a Politico interview, who said that a January rate cut was “not a foregone conclusion for me at all”, but Holzmann is one of the most hawkish members of the Governing Council, so investors remained confident that the ECB were still on course to cut rates next week.

Asian equity markets are volatile this morning albeit within a relatively small range as the tariff yo-yo story has impacted sentiment. The Hang Seng (+0.83%) remains higher but is off the highs while Chinese and Japanese equities have dipped lower as I type.

To the day ahead now, and data releases include UK unemployment for November, the German ZEW survey for January, and Canada’s CPI for December. From central banks, we’ll hear from the ECB’s Centeno. Finally, earnings releases include Netflix.