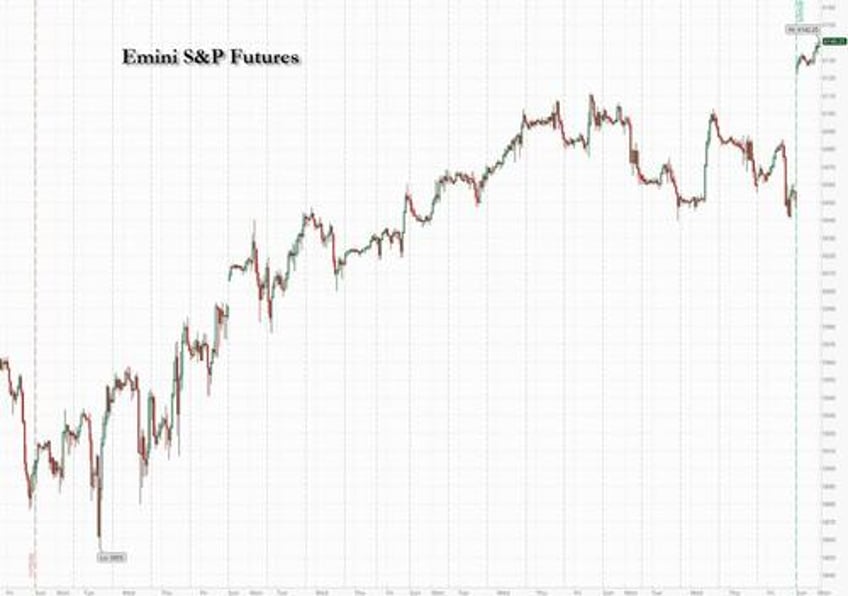

The last full week of 2024 started off with a burst of US exceptionalism which helped US equity futures shrug off downbeat performances in other global markets as traders prepared for a slate of interest-rate decisions by major central banks due later this week. S&P and Nasdaq futures both traded at record high, as did Bitcoin which hit a fresh all-time high of $106,000. As of 8:00am ET, S&P futures were 0.3% higher and Nasdaq futures gained 0.5% as the panic chase of momentum, which pushed the index at an all-time high on Friday, continued. MicroStrategy advanced more than 6% in premarket trading, fueled by its pending inclusion in the index following the software maker’s transformation into a leveraged bet on Bitcoin. Monday’s US stock performance stands in stark contrast with broad losses in Asia and Europe as weaker-than-expected retail data in China weighed on sentiment. A contraction in the euro-area’s private sector also dragged on European equities. Treasuries climb, pushing US 10-year yields down 2 bps to 4.38%. The Bloomberg Dollar Spot Index falls 0.1%. Oil dipped with WTI falling 0.9% to $70.60 a barrel. Today's key macro events are the Empire Fed Manfuacturing index and S&P Global PMI prints for the US.

In premarket trading, MicroStrategy leads fellow cryptocurrency-exposed stocks higher on optimism about the company’s upcoming inclusion of the company in the Nasdaq 100 Index. MicroStrategy (MSTR) +4%, Riot Platforms (RIOT) +2%, Mara Holdings (MARA) +2%. On the other end, Super Micro Computer tumbled 15% after the announcement that the stock is to be removed from the Nasdaq 100 in the annual reconstitution of the index. Here are some other notable premarket movers:

- Axon (AXON) rises 2% as the stock will be added to Nasdaq 100 Index in annual reconstitution of the index.

- Capri Holdings (CPRI) climbs 5% after Women’s Wear Daily reported that the fashion company is working with a bank to find buyers for its Versace and Jimmy Choo brands.

- Edgewise Therapeutics (EWTX) gains 23% after the company said its Phase 2 trial of sevasemten in individuals with Becker muscular dystrophy met its primary endpoint.

- Ford shares (F) falls 2% as Jefferies turns bearish on the automaker, citing concerns ranging from inventory overhang to looming strategic decisions on the company’s European presence.

- Honeywell (HON) advances 3% after saying it’s considering strategic options, including the possible separation of its aerospace business, a month after Elliott Investment Management called for a breakup of the industrial group.

- Red Cat (RCAT) rises 14% after the drone tech company announced a strategic partnership with Palantir Technologies.

- Teradyne, NetApp and Keysight Technologies all rise after JPMorgan upgraded the three tech hardware firms amid growing demand for their products.

An expected quarter-point rate cut from the Federal Reserve on Wednesday could add fresh support and extend US stocks’ outperformance. The S&P 500 has rallied 27% so far in 2024, with strategist expecting the rally to build further steam in anticipation of favorable economic policies under President-elect Donald Trump and strong earnings.

"Central banks have been helpful in 2024 as they start cutting interest rates when the economy was still strong," Marija Veitmane, senior multi-asset strategist at State Street Global Equities, told Bloomberg TV. Going forward, “what we need to rely on is earnings and where they can grow the fastest. In the US, we can still see solid growth.”

Wednesday’s Fed decision will be followed by peers in Japan, the Nordics and the UK over the following day. Swaps traders are now pricing in around three quarter-point rate cuts by the Fed over the next 12 months, whereas they’d seen better than 50/50 odds of a fourth one a week ago.

In Europe, the Stoxx 600 is down 0.3% in the wake of disappointing retail-sales data in China, while traders assess the impact of Moody’s Ratings’ France downgrade. Banks are the best performers while Novo Nordisk boosts healthcare stocks after announcing its Catalent deal got the go-ahead. Automakers and consumer goods are the biggest laggards. France's CAC 40 falls 0.7%, underperforming its regional peers after Moody’s cut the French credit rating on Friday. Here are some of the biggest movers on Monday:

- Novo Nordisk shares rise as much as 2.7% after the Danish drugmaker said it can advance with its acquisition of factories from contract development and manufacturing organization Catalent.

- Basilea shares rise as much as 9.2% after the Swiss pharma company entered into an exclusive distribution and license agreement with Innoviva for the commercialization of Basilea’s hospital anti-MRSA antibiotic Zevtera in the US.

- Johnson Matthey shares rise as much as 6.6%, the most since March, after its largest shareholder, Standard Investments, called on the chemicals company to refresh its board and launch a strategic review of the business following its underperformance in recent years.

- Galderma gains as much as 4.7%, the most since Aug. 6 and hitting a record high, after UBS upgraded the Swiss dermatology firm to buy from neutral.

- DKSH shares gain as much as 3.5%, the most since July, after the Swiss distribution group saw its recommendation raised to outperform from neutral at BNP Paribas Exane, seeing a “potent mix of margin expansion and balance sheet optimization” driving earnings momentum.

- Bunzl shares rise as much as 2.8% after the value-added distributor was upgraded by analysts at RBC Capital Markets, citing a dependable outlook and an undemanding valuation.

- Porsche Automobil Holding SE shares drop as much as 3.3% after the German firm withdrew its current year forecast due to the expected impairment of at-equity carrying amounts of its investments in Volkswagen and Porsche AG.

- Getlink shares drop as much as 3.6%, the most since June, after the travel infrastructure operator warned it has discovered a second fault on its interconnector between France and the UK.

Earlier in the session, Asian stocks also slumped, dragged lower by shares in mainland China after the country’s retail sales data came below expectations. The MSCI Asia Pacific Index declined 0.2%, with China Eastern Airlines and Australian miner Fortescue Ltd among the biggest losers. Hong Kong and mainland China were among the worst performing markets in the region, while the stock benchmark in Taiwan rose. China’s data dump on Monday showed retail sales for November rose 3% on-year, well below an expectation of a 5% gain. That weighed on sentiment at a time when Beijing has been touting more stimulus to support spending. Home prices fell for a third month in a row, although the decline is slowing. Chip makers Taiwan Semiconductor Manufacturing Co and SK Hynix were among the gainers. A gauge tracking Asian IT shares was up around 0.3%.

The retail-sales data “is a reflection of the dire situation there and how the stimulus efforts have prioritized optics over delivering meaningful economic improvements,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore. “Even for a tactical recovery, we need more after a series of false starts and the risk of tariffs ahead.”

“This data really verifies that the headwinds for consumers are still very very high,” said Johanna Chua, head of emerging market economics at Citigroup Global Markets in a Bloomberg TV interview.

In FX, the Bloomberg dollar index was little changed after six days of gains. Wall Street is starting to sour on the dollar as President-elect Donald Trump’s policies and the Fed’s interest-rate cuts will likely put pressure on the greenback in the latter portion of 2025. Roughly a half dozen sell-side strategists are now forecasting the world’s reserve currency will peak as early as mid next year before starting to decline. Euro-area PMIs were mixed and largely ignored with the euro little changed versus the dollar. The pound outperforms, rising 0.2% as investors seemed to focus on the services PMI beat rather than the manufacturing PMI miss.

In rates, treasuries hold small gains, tracking bigger rallies in bunds and gilts after mixed European PMI readings and recovering some of last week’s steep loss. US yields are richer by 1.5bp to 3bp across maturities with gains led by front-end and belly, steepening 5s30s spread by ~1bp. 10-year is back around 4.37% after topping 4.4% Friday for the first time since Nov. 22. OATs also lag their German counterparts, widening the 10-year yield spread to around 79 bps, after France was downgraded unexpectedly by Moody's on Friday. Treasury coupon auctions this week include $13 billion 20-year bond reopening Tuesday and $22 billion 5-year TIPS reopening Thursday. US session includes Empire manufacturing survey and US PMIs, with November retail sales ahead Tuesday before Wednesday’s Fed rate decision. Oil trades lower, also supporting Treasuries.

In commodities, oil prices declined, with WTI falling 0.9% to $70.60 a barrel after rising 6.1% last week. Spot gold adds $12 to around $2,660/oz. Bitcoin rallies to a record high.

Today's US economic data calendar includes December Empire manufacturing (8:30am) and S&P Global US manufacturing and services PMIs at 9:45am

Market Snapshot

- S&P 500 futures little changed at 6,061.50

- STOXX Europe 600 down 0.1% to 515.69

- MXAP down 0.2% to 185.09

- MXAPJ down 0.2% to 584.05

- Nikkei little changed at 39,457.49

- Topix down 0.3% to 2,738.33

- Hang Seng Index down 0.9% to 19,795.49

- Shanghai Composite down 0.2% to 3,386.33

- Sensex down 0.4% to 81,777.79

- Australia S&P/ASX 200 down 0.6% to 8,249.48

- Kospi down 0.2% to 2,488.97

- German 10Y yield down 1 bp at 2.25%

- Euro up 0.1% to $1.0516

- Brent Futures down 0.7% to $73.97/bbl

- Gold spot up 0.4% to $2,657.85

- US Dollar Index down 0.19% to 106.81

Top Overnight News

- US DHHS nominee (under President-elect Trump) RFK Jr. is to attempt to win over the Senate by playing down the vaccine topic and sticking to Trump's messaging: WSJ

- Nasdaq announced that Palantir Technologies (PLTR), MicroStrategy (MSTR), and Axon Enterprise (AXON) will be added to the index, while Illumina (ILMN), Super Micro Computer (SMCI), and Moderna (MRNA) will be removed as part of the annual reconstitution of the Nasdaq-100 Index, which will become effective prior to market open on Monday, December 23rd: RTRS

- WSJ's Timiraos writes, ahead of this week's FOMC, "Investors widely expect a third-in-a-row rate cut this week. Officials are ready to slow—or even stop—lowering rates after that."

- A surprise retail slowdown in China highlighted the urgency for Beijing to further boost consumer spending. Sales growth slowed sharply last month, though industrial output improved. BBG

- China’s regulators pledged to boost efforts to stabilize the housing and equity markets, as well as conduct more effective fiscal policies. Several branches weighed in after a major leadership meeting last week ended in calls for greater stimulus. BBG

- Eurozone flash PMIs for Dec are mixed, with an inline manufacturing reading (45.2, flat vs. Nov and a tiny bit below the consensus of 45.3) and upside services number (51.4, up from 49.5 in Nov and above the consensus of 49.5). S&P

- The European Central Bank is likely to continue to lower its key interest rate as the threat of U.S. tariffs clouds already weak growth prospects, President Christine Lagarde said Monday. WSJ

- French stocks struggled after Moody’s downgraded the country’s credit rating. New PM Francois Bayrou met with Marine Le Pen, who felt “listened to” but is unsure if the talks were useful. BBG

- Apple plans to introduce new iPhones (including thinner models and foldable ones as well) as the firm prepares to offer more radical design changes to help accelerate growth. WSJ

- Slumping office values are prompting smaller US banks to modify more CRE loans, Moody’s data show. About $500 billion of such mortgages are set to mature in the next year and many are expected to default. Potential losses and fire sales may further pressure property prices. BBG

- Bitcoin briefly topped $106,000 — a fresh record — buoyed by optimism about MicroStrategy’s inclusion in the Nasdaq 100. BBG

- Tesla (TSLA) has raised the price of the Model S to USD 79,990 from USD 74,990 in the US and the price of the Model S Plaid to USD 94,990 from USD 89,990, according to its website.

- Meta (META) has urged the California Attorney General to stop OpenAI (MSFT) from becoming for-profit: WSJ.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks saw an uninspiring start to the week following the mixed session on Wall Street on Friday and ahead of this week's risk events including the final FOMC, BoJ, and BoE meetings of the year. ASX 200 saw gold miners pressured by the recent pullback of the yellow metal towards USD 2,650/oz levels, with sentiment also weighed on by the downticks in prelim. Aussie PMIs. Nikkei 225 swung between modest positive and negative territory throughout the session as the index oscillated the 39,500 level, whilst the Japanese Flash PMI highlighted "stubborn inflation" with "anecdotal evidence placing particular emphasis on the impact of the weakness of the yen in relation to inputs sourced from abroad." KOSPI conformed to the broader risk tone with little sustained move after South Korean MPs successfully voted to impeach President Yoon in their second attempt. Hang Seng and Shanghai Comp fluctuated between modest gains and losses with little initial reaction seen to the Chinese activity data, which saw a marked miss in Retail Sales whilst Industrial Output saw a modest surprise uptick. Furthermore, Chinese markets failed to garner much support from weekend reports that China has room to further cut the RRR, according to PBoC officials on Saturday via CCTV.

Top Asian News

- IDC expects China's smartphone shipments to increase to 289mln in 2025, +1.6% Y/Y

- China has room to further cut the reserve requirement ratio (RRR), according to PBoC officials on Saturday via CCTV.

- China's Central Financial and Economic Affairs Commission deputy director said the country's GDP is expected to grow by about 5% this year, with foreign exchange reserves remaining above USD 3.2tln. He added that China's contribution to global economic growth is expected to be close to 30% and that employment and prices in China are expected to remain stable, according to Reuters.

- Chinese Stats Bureau stated that China is on track to achieve key economic targets in 2024, but more efforts are needed to promote continued economic recovery in 2025. It added the trend of recovery in consumption remained unchanged and that more policies would be implemented to expand domestic demand. It noted that while new policies had gained more traction, the external situation had become more complex and severe. The Bureau expects further improvement in the property market, emphasises the need to stabilise employment and increase incomes to boost consumption capacity, and anticipates that China's CPI will maintain modest increases. It also noted that China's economy is generally stable in November and sees increasing positive changes, according to Reuters.

- China Financial and Economic Affairs Commission says China will increase the size of government bonds, including local special bonds, in 2025, via Xinhua. Will promote stable household income growth next year through increasing direct fiscal support to consumers and improving social security. Will implement "appropriately loose" monetary policy to effective lower interest rate on local government debt. China still has big room for investment.

- PBoC injected CNY 753.1bln via 7-day reverse repos with the rate maintained at 1.50%.

- Moody's raised China's 2025 GDP growth forecast to 4.2% from 4.0%, according to Reuters.

- The US Treasury has told Nippon Steel (5401 JT) that the panel vetting its proposed acquisition of US Steel (X) has not reached a consensus on how to mitigate security risks, according to the FT.

- New Zealand NZIER Consensus Forecasts show that the economic growth outlook remains broadly unchanged relative to the previous release; GDP forecasts continue to suggest sluggish growth in the year to March 2025 before picking up to 2.2% in the following year.

South Korea News

- South Korean MPs have successfully voted to impeach President Yoon in their second attempt, amid backlash following his brief move to impose martial law, according to BBC. Yoon was suspended from official duties at 19:24 local time on Saturday while PM Han is to continue as acting president, according to Yonhap.

- South Korea's acting president Han vowed to leave no vacuum in state affairs, build a solid security posture, and ensure the cabinet works hard to maintain trust with the US, Japan, and other partners. He also pledged efforts to operate financial and forex markets smoothly, according to Yonhap. Acting President Han said the country will maintain preparedness to prevent North Korea from stirring up provocations, secure national interests ahead of the new US administration, and prioritise national security above all else, according to News1 and Yonhap.

- South Korea's opposition leader Lee Jae-myung said the party has decided not to proceed with the impeachment of acting president Han, according to Reuters.

- Bank of Korea stated it is necessary to respond more actively to the economic impact compared with past impeachment periods, given heightened challenges in external conditions. It also said it will use all available policy instruments, in conjunction with the government, to respond to and avert escalation of volatility in financial and forex markets, according to Reuters.

- South Korea's Finance Minister said the government will continue to swiftly deploy market-stabilising measures as needed, seek more support measures for vulnerable sectors, and actively communicate with parliament to keep the economy stable. The minister also confirmed that the bi-annual economic policy plan will be announced before the end of the year, according to Reuters.

- South Korea's financial regulator said it will expand market-stabilising funds if needed to boost liquidity in bond and short-term money markets and expects financial markets to stabilise as recent political events are temporary shocks, according to Reuters.

European bourses began the European session on a modestly mixed footing, with indices generally trading on either side of the unchanged mark. As the morning progressed, sentiment slipped a touch to display a slightly negative picture in Europe. Today's EZ PMIs strengthens the case for further ECB easing, but had little impact on the complex. European sectors hold a strong negative bias, with a clear defensive tilt given the risk tone. Healthcare takes the top spot, after heavyweight Novo Nordisk (+1.9%) gains after it announced regulatory approval for Catalent deal. Autos parks itself at the foot of the pile, weighed on by losses in Porsche SE (-1.7%) after the automaker withdrew guidance. US equity futures are very modestly on a firmer footing, with sentiment a little better vs in Europe. The NQ marginally outperforms vs peers.

Top European News

- Moody's cut France’s rating to "Aa3" from "Aa2", outlook stable, in an unscheduled rating revision, citing political fragmentation. Moody's said its view is that France's public finances will be substantially weakened over the coming years. The agency noted that France's political fragmentation is more likely to impede meaningful fiscal consolidation and said there is now a very low probability that the next French government will sustainably reduce the size of fiscal deficits beyond next year. However, France's local- and foreign-currency ceilings remain unchanged at AAA, according to Moody's.

- ECB Holzmann said it would be wrong to cut rates just to help the economy, according to Reuters.

- ECB's Lagarde says more rate cuts are to come and the direction of travel is clear, via Bloomberg; risks around inflation are two sided. "The ECB is also moving through its monetary policy cycle, and we are now at a stage where the darkest days of winter look to be behind us, and we can start to look forward instead."

- ECB's de Guindos says "our confidence that inflation will converge to target in 2025 is reflected in our monetary policy". US tariff increases could result in inflationary pressures.

- EU reportedly presses for new powers to combat threat of Chinese import surge and amid fears Brussels will struggle to fight back in a global trade war, according to FT.

- Norges Bank to purchase NOK and sell foreign currency to fund transfers to the government for FY24.

- SNB has adjusted the remuneration of sight deposits, lowers the threshold factor from 22 to 20 as of 1st February 2025.

FX

- DXY is flat and has been trading within a very tight 106.75-92 range for much of the European morning. As it stands the index currently trades towards the bottom end of Friday’s 106.71-107.18 range; and quite a bit away from its 21 DMA at 106.47. US Flash PMIs due later.

- EUR is flat vs the Dollar, with price action fairly choppy as traders react to a slew the EZ PMI metrics dotted throughout the morning. ECB President Lagarde spoke today, with her commentary very much in-fitting with her remarks made at her press conference. EUR/USD traded choppily to the French figures, but ultimately edged a little higher on the German release. Since, the upside has been pared to reside around 1.05.

- JPY is essentially flat, but is the G10 laggard thus far. Overnight, the Japanese PMI release showed manufacturing rebounding and services improving. USD/JPY sits in a very tight 153.31-96 range, a touch above Friday’s 153.79.

- GBP is on a stronger footing, in reaction to the region’s PMI release which saw the Services figure above expectations and further into expansionary territory, while Manufacturing was a touch softer. Cable currently trades at the top end of today’s 1.2609-72 range, with today’s peak coinciding with its 21 DMA at 1.2670.

- Antipodeans are marginally firmer vs the Dollar; the Kiwi outperforms vs the Aussie. AUD currently trades at the mid-point of a 0.6348-82 range, and just within Friday’s confines. NZD/USD on the other hand, has topped the best from Friday and currently trades just off the day’s best at 0.5786.

- Norges Bank said it is to purchase NOK and sell foreign currency to fund transfers to the government for FY24. This helped to strengthen the NOK, with EUR/NOK slipping from 11.7440 to 11.7130 over the course of eight minutes; thereafter, extended to a session low of 11.7030 before paring almost the entire move.

- S&P affirmed Mexico "BBB" foreign currency and "BBB+" local currency long-term rating; Outlook remains Stable.

- Brazilian President Lula has been discharged from the hospital and has recovered well and can resume normal work activities but is to avoid long-haul flights, according to the medical team.

- PBoC set USD/CNY mid-point at 7.1882 vs exp. 7.2769 (prev. 7.1876)

Fixed Income

- USTs are rangebound in a tight 109-27+ to 109-31+ band ahead of Flash PMIs from the US but with the focus firmly on Wednesday’s FOMC. Given contained action for the benchmark yields are also relatively steady but are lower across the curve, which itself is marginally flatter.

- Bunds are pressured, but yet to deviate significantly from the unchanged mark in a tight 134.43-73 band. PMIs sparked modest two way action with the net read being bearish as the German economy fares better than expected in some areas. Into the EZ-wide release, Bunds edged a little higher but the poor manufacturing situation saw Bunds pare back those gains. As it stands, Bunds reside just in the red as the dust settles post-PMIs and remarks from ECB speakers thus far are yet to move the dial; ahead, the often influential Schnabel is scheduled.

- OATs are softer and moved in tandem with EGBs on the German metrics after being relatively unreactive to their own PMIs which focused firmly on political uncertainty. As a reminder, and weighing, Moody's downgraded France a notch with the outlook stable, due to increased political uncertainty and a low probability that the gov’t will succeed in reducing the deficit.

- Gilts are a touch firmer but little changed overall into the UK Flash PMI release, which was mixed but in a delayed reaction weighed on Gilts, given services strength and inflationary internals, pressuring them from a 94.50 high back towards but not testing earlier 94.24 lows.

Commodities

- WTI and Brent began the session modestly in the red before slipping further as the European session got underway given the tepid risk tone for the region. Brent'Feb 2025 sits just shy of USD 74/bbl.

- Gold is firmer and at the top-end of parameters for today. XAU found itself under pressure in APAC trade and slipped to a USD 2643/oz base before bouncing back and residing at USD 2662/oz highs.

- Base metals are mostly on the back foot, given the risk tone; Copper is a little more contained, not really deriving any direction from the morning’s PMIs or before than from China activity data and commentary.

- Marathon's Detroit refinery (140k BPD) union workers voted to ratify a pay deal following a three-month strike, according to a union post on X.

- Damage to two tankers in the Black Sea caused an oil products spill, according to Interfax.

- Nigeria's maritime agency reported an oil spill at the Shell loading terminal in Nigeria's Delta region after a pipeline ruptured, according to Reuters.

- Libya's NOC declared force majeure at its Zawiya facility following clashes, according to Bloomberg.

- Nornickel CEO Potanin said the company will move to positive free cash flow in 2025 and, until then, shareholders will need to be patient with dividends, according to Russian media RBC.

- Some Japanese aluminium buyers agree to a January-March premium of USD 228/t, +30% from the current quarter, according to Reuters sources.

Geopolitics: Middle East

- "Progress in the negotiations of the exchange deal and may be completed after the Jewish holidays at the end of this month", according to Al Jazeera citing an informed source via Israeli press.

- US President-elect Trump and Israeli PM discussed the Gaza hostage deal bid and Syria on Sunday, according to Reuters.

- Israeli PM Netanyahu’s government approved a plan to expand settlements on Israeli-occupied Golan Heights. The statement said Netanyahu acted “in light of the war and the new front facing Syria” and out of a desire to double the Israeli population on the Golan, according to Reuters.

- Russia is pulling back its military in Syria but is not withdrawing from its main military bases, Syrian sources say, according to Reuters.

- Trump's Middle East envoy has met with the Saudi crown prince, according to Axios.

- "Syrian media: Strong explosions in the countryside of Tartous and Latakia resulting from an Israeli attack" according to Asharq News. Note: Russia has two bases in Syria – a naval base in Tartous and the Khmeimim Air Base near the port city of Latakia..

- "US sources to Alarabiya English: US army carried out strikes against Houthi sites in Yemen", according to Al Arabiya.

Geopolitics: US-China

- US Treasury Secretary Yellen said the Treasury continues to warn China about the potential for bank sanctions over transactions aiding Russia's war effort in Ukraine and will not rule out sanctions on Chinese banks. She noted that the largest Chinese banks are wary of the consequences. Yellen also said the US aims to reduce Russia's energy revenues, with options such as lowering the oil price cap and imposing more sanctions on 'dark fleet' tankers being considered. She emphasised the need for clear communication channels at all levels between the US and China, stating that leader-to-leader discussions alone are insufficient. Yellen added that the next US Treasury Secretary is likely to continue pushing back on currency manipulation if evidence is found.

Geopolitics: Other

- Russian President Putin says "is concerned about US development and deployment of short and medium-range missiles"; "we are not brandishing nuclear weapons, it a policy of nuclear deterrence".

US Event Calendar

- 08:30: Dec. Empire Manufacturing, est. 10.0, prior 31.2

- 09:45: Dec. S&P Global US Services PMI, est. 55.8, prior 56.1

- 09:45: Dec. S&P Global US Composite PMI, est. 55.1, prior 54.9

- 09:45: Dec. S&P Global US Manufacturing PM, est. 49.5, prior 49.7

DB's Jim Reid concludes the overnight wrap

This morning we will publish our 2025 survey results with lots of interesting answers. Your two favourite Xmas films are quite violent though so that's the demographic of the responses! Long-time readers of the EMR will be wondering where time is going when I tell you that our belovedly wayward dog Brontë, who used to play a starring role in the EMR, was 10 over the weekend. Brontë is the most affectionate, good natured, people dog you can imagine but has zero recall. So in the first 2-3 years when we were trying to get used to having a dog, with extensive gun dog training included, we lost her on probably 7 or 8 occasions on walks. One of which was followed by my wife uttering (or shouting) the word "divorce" when I lost her on a motorway service station in France in the dark while my wife was feeding a very young baby around 8 years ago. She was seen crossing the motorway at one point before returning to the petrol pumps tired, bedraggled, and hungry two hours later. Since then she's not been off the lead, and I saved my marriage by having our garden fortified. As she gets older, the calmer she doesn't get. Happy birthday Brontë.

As we hit the last full week of the year, the natural winding down of activity will be punctuated by bursts of activity, centred around the Fed (Wednesday), the BoJ (Thursday) and the BoE (also Thursday) meetings. In terms of data, the highlights are the global flash PMIs today, US retail sales (tomorrow) and inflation prints from the US (PCE on Friday), Canada (tomorrow), UK (Wednesday), and Japan (Friday). Outside of that, today’s German government vote of no confidence should almost certainly pave the way for a February 23rd election and tomorrow’s CDU/CSU manifesto announcement will help shape the campaign (more later). Another thing to watch is France where Moody’s surprisingly cut France late on Friday night in a rare unscheduled move, albeit one that brings it in line with S&P and Fitch (also more below).

Let’s expand on some of these highlights now and start with the Fed. Our economists’ preview is here but in brief they expect a 25bps cut and then for them to be on hold for the entirety of 2025 as the SEP should show meaningful revisions to the 2024 economic forecasts, with growth and inflation revised higher and the unemployment rate lower. The median dot is likely to show three additional rate cuts but we think Powell will likely deemphasis this signal in the press conference and be as data dependant as he can be. Powell will also likely emphasise that it is still too early for officials to build any major policy changes from the new Trump administration into their outlook. The long-run dot will likely continue its upward migration, rising to 3.1%. Our economists' estimates of neutral are notably above the Fed’s and we think they will likely continue to move this higher.

The BoJ meeting on Thursday is more uncertain, but most economists expect no change and with only a 16% probability of a hike priced in. Our Chief Japan economist previews the meeting here and goes against consensus in seeing a rate hike as the most likely scenario. One of the reasons why a hike might wait until January though is that MP Ishiba is trying to push a stimulus plan through parliament this month and the BoJ may prefer to avoid political interference and delay the hike.

On Thursday our UK economist expects a BoE hold, with a 9-0 vote decision, keeping the rate at 4.75%. The full preview of the meeting is here. The Riksbank is expected to cut rates 25bps on Thursday in a busy last full week of the year for central banks.

For core PCE on Friday our economists believe it comes in a little soft at 0.16% mom versus 0.27% previously with subcomponents in last Thursday's PPI and Friday's import price data, that feed into this number, on the weaker side. However, the year-over-year rate for core PCE should still tick up from 2.8% to 2.9%.

In Germany, Chancellor Scholz's vote of confidence today is scheduled to start at 1:00 pm CET. The expected loss will likely clear the path to early elections on February 23. More importantly tomorrow sees the CDU/CSU publish their manifesto at 11.30 CET. According to current polls the CDU is likely to lead the next government, and the manifesto could give clearer signals on their economic policy priorities, even if the coalition agreement after the elections could result in policy compromises. The key question is whether the CDU will formally signal an openness to reforming the debt brake at this stage. Recently signalled openness by Merz to discuss reforms might just be intended to create optionality for potential compromises in coalition talks. However, a leaked draft of the CDU election manifesto late last week saw a continued commitment to the debt brake which at this stage is not unexpected and corroborates what our economists expect.

Staying at the centre of Europe, the Moody’s downgrade of France late on Friday night to Aa3 from Aa2 with a stable outlook was unscheduled and will surprise many when European markets reopen this morning. Their commentary on future deficits is quite damning but the fact that it’s a stable outlook for now, and that this just brings the rating in line with S&P and Fitch, will likely mean that this is more headline grabbing than massively market moving for now. OAT futures are only a little lower in Asia trading. France’s new Prime Minister Francois Bayrou will meet with far-right leader Marine Le Pen and Jordan Bardella (head of National Rally) at 9am CET this morning to start the process of agreeing a budget. So we may see some headlines post the meeting. For all the rest of the week's events, see the full day-by-day week ahead at the end as per usual.

Asian equity markets are falling this morning with Chinese stocks weak after disappointing retail sales data (more below). As I check my screens, the Hang Seng (-0.75%) and the CSI (-0.51%) are lower with the S&P/ASX 200 (-0.56%) and the Nikkei (-0.18%) also dipping. Elsewhere, the KOSPI (-0.39%) has erased its opening gains following the impeachment of President Yoon Suk Yeol over the weekend. In overnight trading, US equity futures are flat with 10yr UST -1.5bps lower.

Coming back to China retail sales unexpectedly slowed in November, rising +3.0% y/y (v/s +5.0% expected) and marking a sharp slowdown from the +4.8% growth in October. November industrial production rose by +5.4% from a year ago, accelerating from a climb of +5.3% in the prior month and in line with expectations. Fixed asset investment (Ex rural), reported on a year-to-date basis, rose by +3.3% through November on an annual basis, missing the forecast of 3.5%. The figure had risen by +3.4% in the period from January to October. However, new-home prices "only" fell -0.2%, the smallest decrease in 17 months, indicating a fragile stabilisation in China’s real estate market. Values of used homes dropped -0.35%, the least since May 2023. Yields on 10yr Chinese government bonds are -5.1bps lower, trading at a record low of 1.72% with longer-tenor yields also tumbling.

Looking back at last week now, markets struggled to keep up their momentum thanks to the combination of underwhelming data and an ECB decision that whilst dovish was less so than many hoped for. That meant risk assets slipped back, with the S&P 500 falling -0.64% last week (-0.003% Friday to be very precise), whilst the STOXX 600 fell -0.77% (-0.53% Friday). In fact for both indices, the moves ended a run of three consecutive weekly gains, although Japan was a relative outperformer as the Nikkei rose +0.97% (-0.95% Friday). In a remarkable metric of the weakening breadth of momentum in US equities, Friday marked the tenth session in a row that more stocks fell than rose within the S&P 500, the longest such run since 1996.

US inflation data didn’t really help matters, as it raised fears that inflation might be proving sticky above the Fed’s target. To be fair, it wasn’t so bad as to prevent a December rate cut in investors’ eyes, but the longer-term trends were of concern. Indeed, US monthly core CPI has been running at +0.3% for four consecutive months, so it doesn’t look like a temporary blip anymore, and the 3m annualised pace of core CPI now stands at +3.7%. In the meantime, headline PPI inflation also surprised on the upside, with the year-on-year rate moving up to +3.0% for the first time since early 2023. As we mentioned in the core PCE preview above, some of the sub components were weak but we're about to enter the more seasonally unfavourable H1 period for US inflation so there are concerns that inflation hasn't behaved well enough in the seasonally dovish H2 period this year.

Concerns about the inflation outlook contributed to a selloff among US Treasuries last week, with the 10yr yield up +24.4bps last week to 4.40% (+6.9bps Friday). That’s its biggest weekly jump since October 2023, and the 2yr yield was also up +14.2bps (+5.4bps Friday) to 4.25%. Over in Europe, government bond yields also moved higher after the ECB’s latest decision. They cut rates by 25bps as expected, but there was some disappointment among investors that the tone wasn’t more dovish, as President Lagarde described inflation risks as “two-sided”. In fact yields on 10yr Italian BTPs were up +20.0bps (+4.3bps Friday), in their biggest weekly jump since July 2023. And yields on 10yr bunds were up +15.0bps (+5.2bps Friday) in their biggest rise since March.

Although equities and bonds both struggled last week, there was a stronger performance among several commodities. For instance, Brent crude oil prices rose +4.74% (+1.47% Friday) to $74.49/bbl, and gold prices were up +0.56% (-1.42% Friday) to $2,648/oz. Meanwhile in the FX space, it was another good week for the US Dollar, with the dollar index moving up for the 10th time in the last 11 weeks.