US home prices rose for the 5th straight month in July (the latest data from Case-Shiller), jumping 0.9% MoM and shifting into the green (+0.1%) on a year-over-year basis for the first time since February, hitting a new record high...

Source: Bloomberg

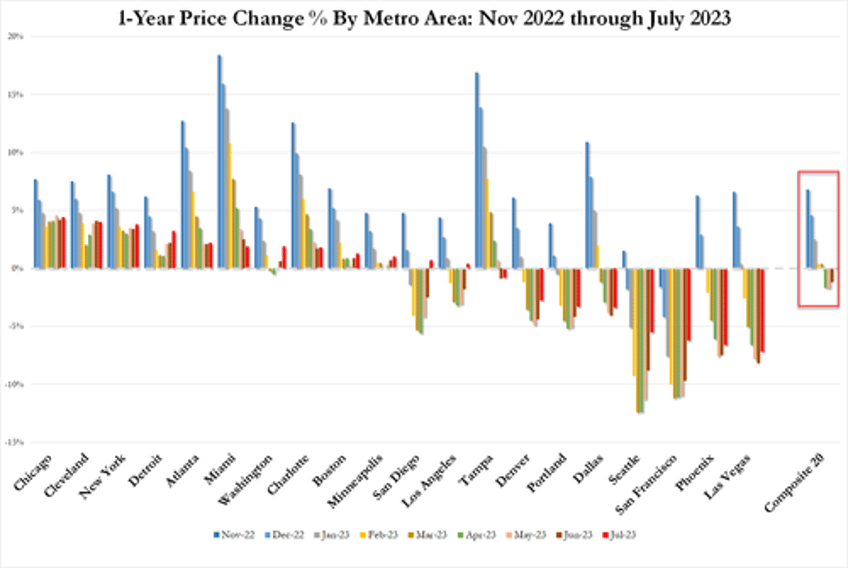

“That said, regional differences continue to be striking. On a year-over-year basis, the Revenge of the Rust Belt continues..." Craig Lazzara, managing director at S&P Dow Jones Indices, said in a statement Tuesday.

The three best-performing metropolitan areas in July were Chicago (+4.4%), Cleveland (+4.0%), and New York (+3.8%), repeating the ranking we saw in May and June. The bottom of the leader board reshuffled somewhat, with Las Vegas (-7.2%) and Phoenix (-6.6%) this month’s worst performers.

All of the cities at all-time highs are in the Eastern or Central time zones, and with two exceptions (Dallas and Tampa), all of the cities not at all-time highs are in the Pacific or Mountain time zones. The Midwest (+3.2%) continues as the nation’s strongest region, followed by the Northeast (+2.3%). The West (-3.8%) and Southwest (-3.6%) remain the weakest regions.

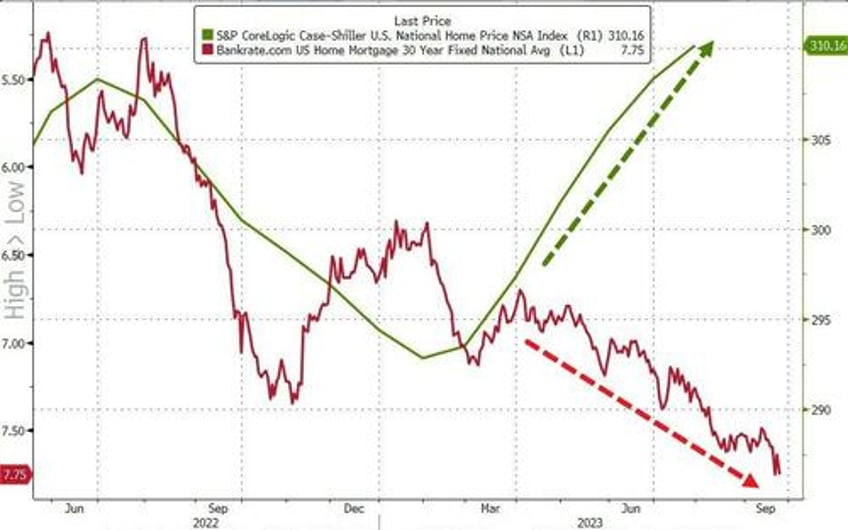

“On a year-to-date basis, the National Composite has risen 5.3%, which is well above the median full calendar year increase in more than 35 years of data. Although the market’s gains could be truncated by increases in mortgage rates or by general economic weakness, the breadth and strength of this month’s report are consistent with an optimistic view of future results," Lazarra said.

And judging by the continued surge in mortgage rates since the Case-Shiller data (July), rational actors might expect prices to resume their decline...

Source: Bloomberg

But, when selling volumes and inventory are so low, anything can happen. Certainly not the tamping-down of home unaffordability that The Fed would have been hoping for.