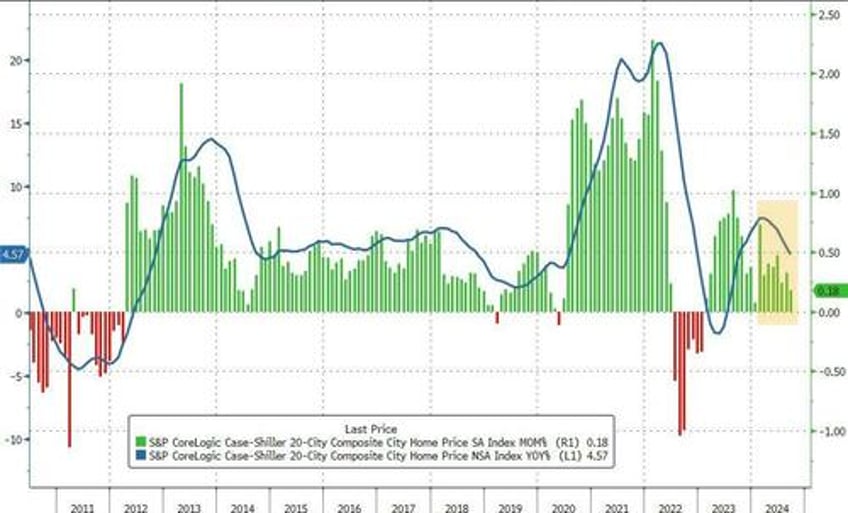

Home prices in America's 20 largest cities rose (again) in September (the latest data from S&P CoreLogic's Case Shiller index) but at a slower pace than expected (+0.18% MoM vs +0.3% exp vs +0.33% prior)...

Source: Bloomberg

That left home prices up 4.57% YoY (below the 4.7% expected and the slowest annual pace since Sept 2023.

“Home price growth stalled in the third quarter, after a steady start to 2024,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets.

“The slight downtick could be attributed to technical factors as the seasonally adjusted figures boasted a 16th consecutive all-time high.”

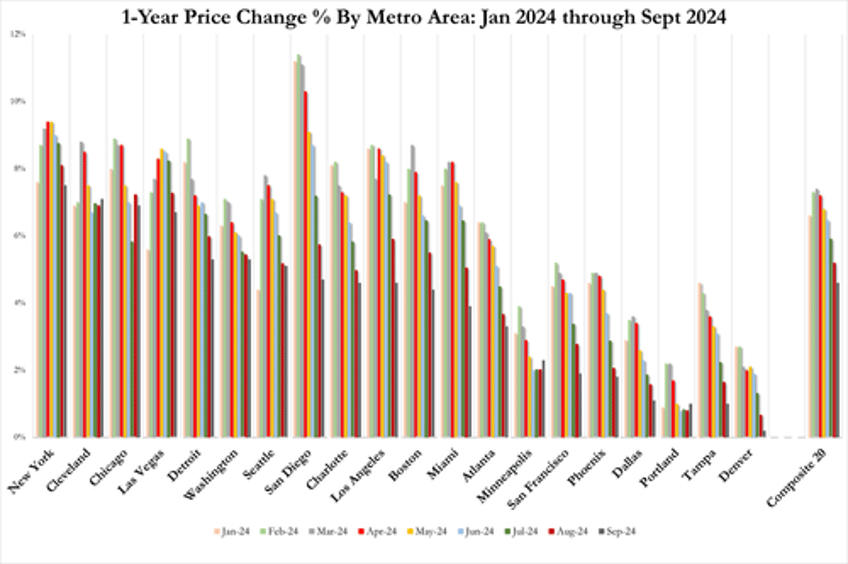

West Coast cities are seeing home price growth slowing fast with Seattle, San Diego, LA, San Francisco, and Portland all seeing home price declines on a MoM basis...

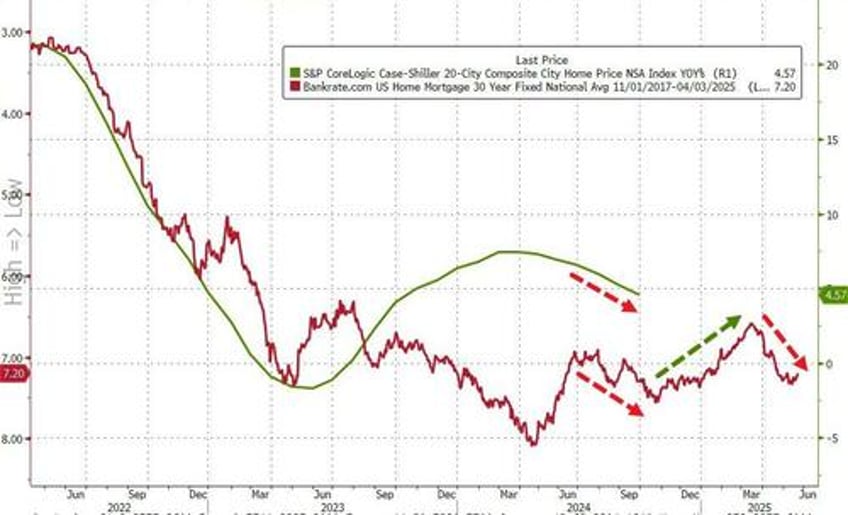

Arguably, (lagged) mortgage rates increased during that period, and dipped since (positive short-term for the highly smoothed and lagged Case Shiller series), but as is clear, things do not end well...

Source: Bloomberg

However, home price appreciation does seem to track very closely with bank reserves at The Fed (6mo lag)...

Source: Bloomberg

Which suggests the pace of home price appreciation is set to slow further from here...