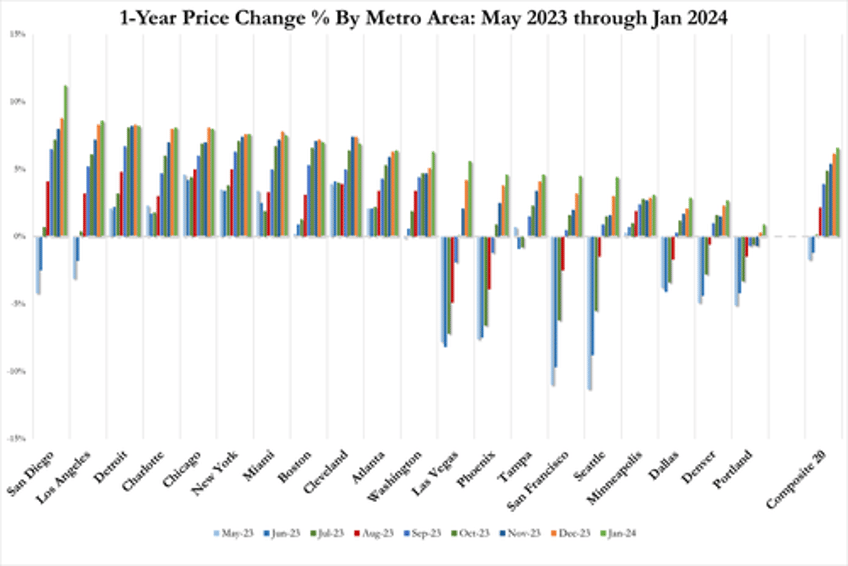

Home prices in America's 20 largest cities rose for the 12th straight month in January (the latest data released by S&P Global Case-Shiller today), up 0.14% MoM (less than the 0.2% exp)

Source: Bloomberg

That pushed the YoY price up to +6.59% (in line with the +6.60% exp).

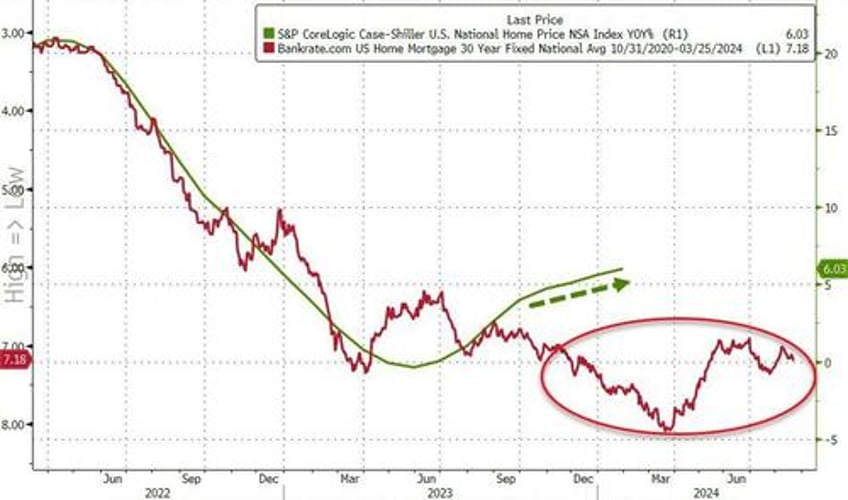

"Our National Composite rose by 6% in January, the fastest annual rate since 2022." According to Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices.

"For the second consecutive month, all cities reported increases in annual prices, with San Diego surging 11.2%"

Given the smoothing and heavy lag in the Case-Shiller data, it's hard to find a causal relationship between prices and mortgage rates, but with rates remaining above 7%, it seems hard to believe prices can continue their advance...

Source: Bloomberg

...and we just saw median new home prices tumble (though median existing home prices did increase).

How is Powell going to cut rates when home prices are rising at over 6% per year?