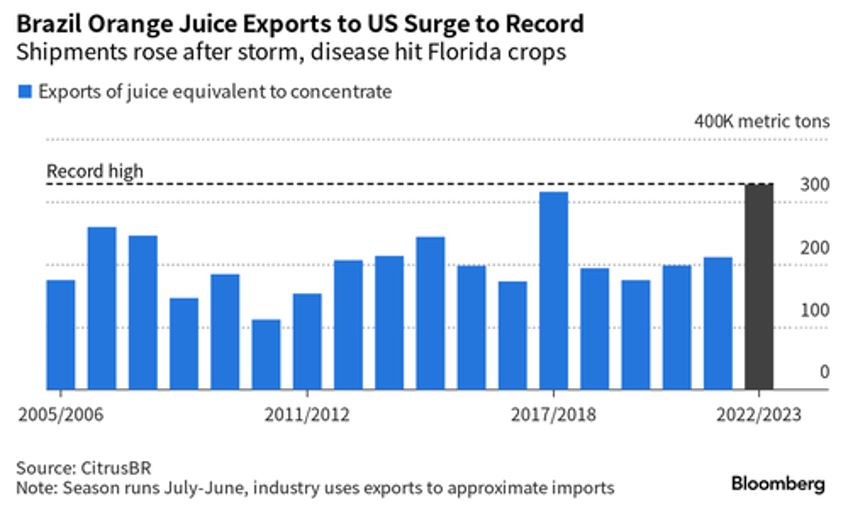

Orange juice futures have surged to record highs as stockpiles in the US tumble to a half-century low due to Florida citrus groves battered by years of disease and hurricanes. It's a perfect storm hitting the OJ market, as supermarket prices have risen this year. Fortunately, suppliers have ramped up imports from Brazil to mitigate sliding US inventories.

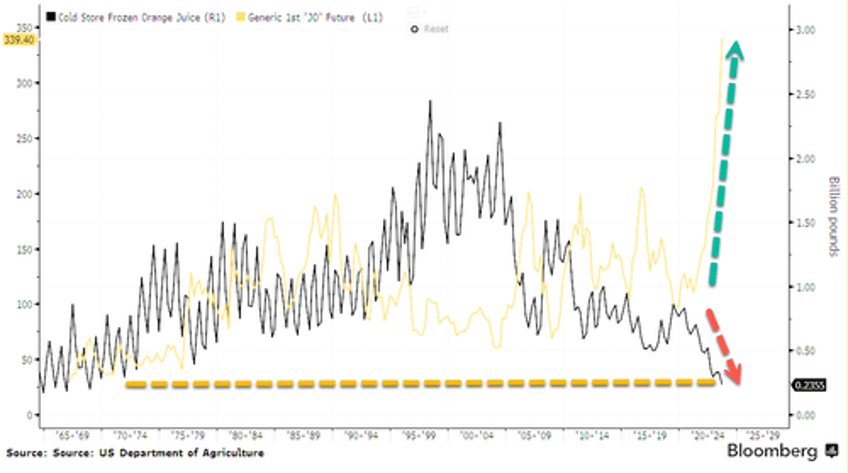

Bloomberg cites new data from the US Department of Agriculture that shows frozen orange juice concentrate fell to 235.5 million pounds by the end of August. This marks the lowest level since December 1968 and comes as Florida's 2022-23 season is the weakest since the 1936-37 harvest. As a result, OJ futures have tripled in the last several years, nearing $3 per pound.

"Low stocks and a dim outlook for future output from Florida and Brazil have also driven up futures prices to record highs in September," Bloomberg said.

In July, industry group CitrusBR said exports of orange juice from Brazil to the US jumped 55% for the 12 months ended in June. This means more Americans than ever are drinking OJ from Florida Brazil.

"Even if the next Florida crop shows some slight recovery, production levels are already set to be very low," said Ibiapaba Netto, executive director at CitrusBR.

Breakfast lovers can't catch a break after two years of food inflation.