S&P Global's US Manufacturing PMI surged to its highest in 22 months (52.5 vs 51.8 exp) while Services PMI disappointed, sliding for the second month in a row to 51.7 (vs 52.0 exp)...

Source: Bloomberg

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“Further expansions of both manufacturing and service sector output in March helped close off the US economy’s strongest quarter since the second quarter of last year. The survey data point to another quarter of robust GDP growth accompanied by sustained hiring as companies continue to report new order growth.

“The brightest news came from the manufacturing sector, where production is now growing at the fastest rate since May 2022. Production gains are linked to improving demand for goods both at home and abroad, driving a further upturn in business confidence in the outlook.

“Service providers meanwhile reported a slower pace of expansion than factories, with the rate of increase also moderating slightly compared to February, linked in part to ongoing cost of living pressures. However, service providers have also become increasingly optimistic about the outlook, with confidence striking a 22-month high in March to suggest the broad-based economic expansion seen in March will persist into the summer. "

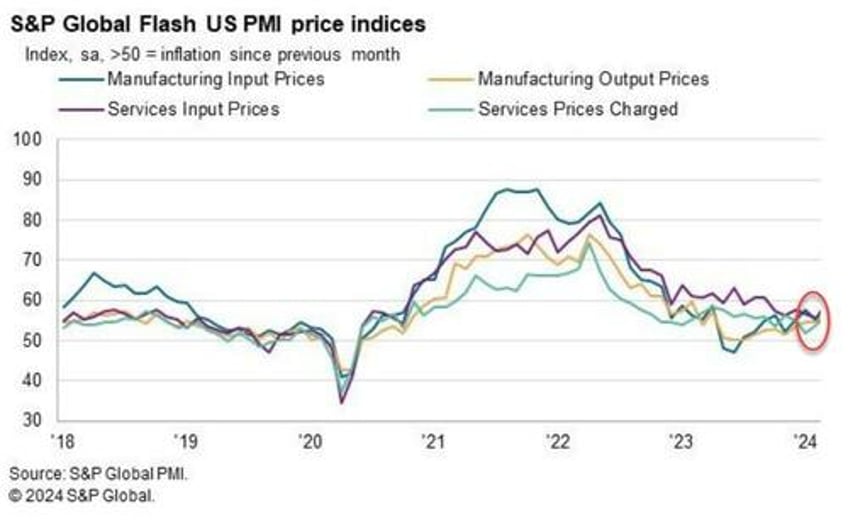

However, it was not all rainbows and unicorns as inflation is starting to show up again:

“A steepening rise in costs, combined with strengthened pricing power amid the recent upturn in demand, meant inflationary pressures gathered pace again in March. Costs have increased on the back of further wage growth and rising fuel prices, pushing overall selling price inflation for goods and services up to its highest for nearly a year.

The steep jump in prices from the recent low seen in January hints at unwelcome upward pressure on consumer prices in the coming months.”

Not what Powell and his dovish pals wanted to see.