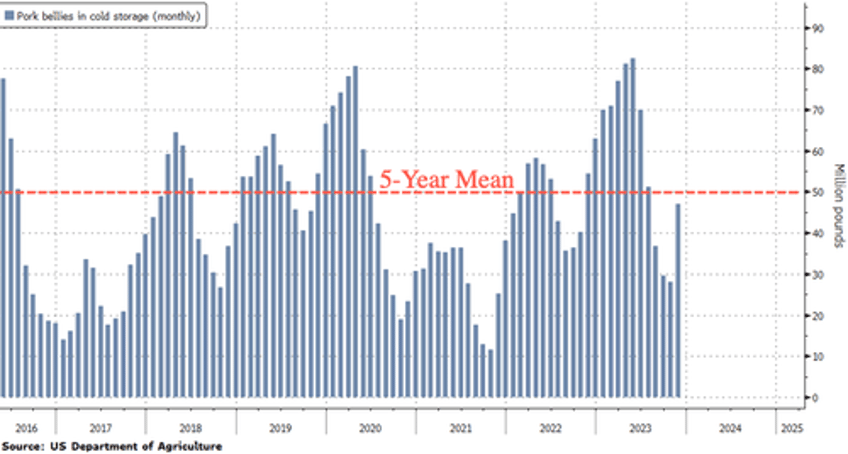

Chilled US stockpiles of pork bellies, the cut of meat from the underside of a pig that makes delicious bacon, have trended below a 5-year average since the back half of 2023. This occurred alongside a decline in overall pork production, which has ignited a rally in wholesale spot prices.

Since August, the number of pork bellies in US cold storage has been under a 5-year average, or 50 million pounds.

Since mid-December, wholesale spot prices for boxed pork belly 200 pounds jumped from $80 to more than $133, or about a 66% increase on tightening supplies.

The environment for pork producers was challenging in 2023, with many losing, on average, $32 per head. This trend is expected to continue this year.

Last month, Smithfield Foods, the world's pork processor, revealed it would shutter 26 of its contracted hog operations across Utah.

"Our industry and company are experiencing historically challenging hog production market conditions," Shane Smith, president and CEO of Smithfield, wrote in a statement in early December.

Smithfield has also shuttered pork plants in Charlotte, North Carolina, and closed 35 hog farms in Missouri last year.

"Profitability as we look at 2023 and 2024 is going to be potentially the worst two-year stretch ever for pork producers," said Lee Schulz, an economist and professor at Iowa State University, who recently spoke with QZ.

Traders will be focused on the USDA's World Agricultural Supply and Demand Estimates report on Feb. 8 for the latest status on the pork market.