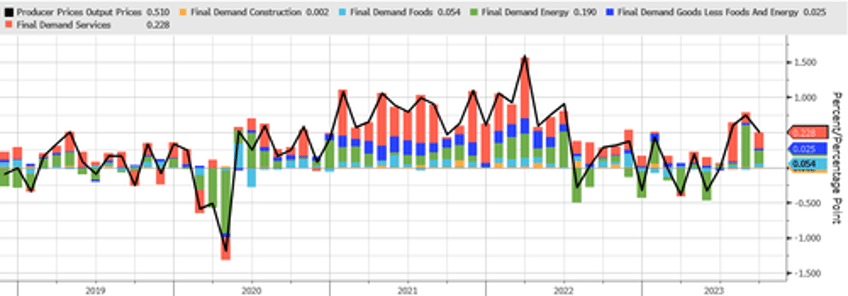

In an unusual event, we get a look at PPI this week before CPI and expectations are for another MoM gain in September - albeit smaller than the big jump in August. However, US Producer Prices jumped 0.5% MoM (+0.3% exp), lifting the headline Final Demand print up 2.2% YoY...

Source: Bloomberg

That is the biggest YoY jump since April 2023 and is up 3 straight months.

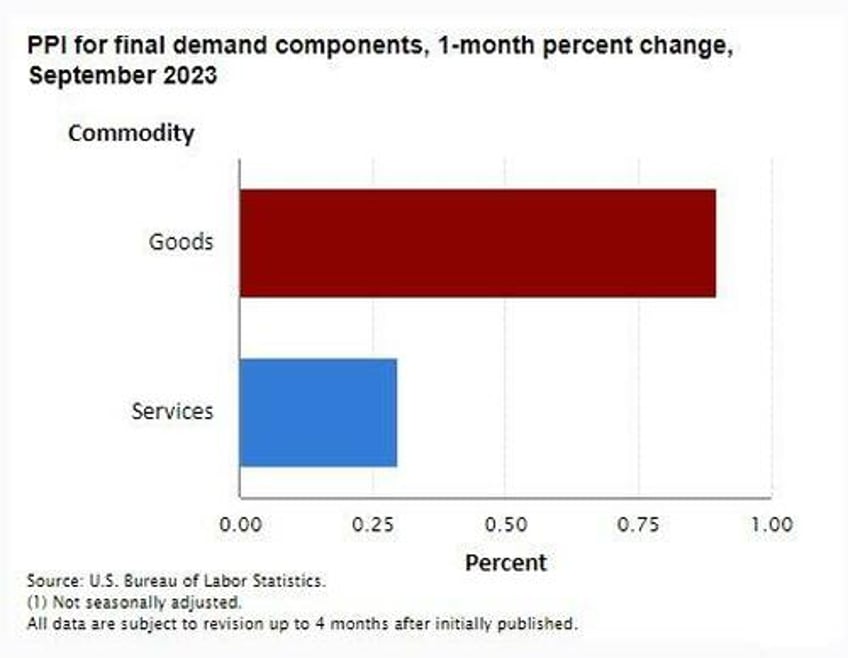

Goods prices dominated the jump in PPI (+0.9% MoM) but Services costs also rose MoM...

Final demand goods: The index for final demand goods moved up 0.9 percent in September, the third consecutive increase. Nearly three-quarters of the broad-based September advance is attributable to a 3.3-percent rise in prices for final demand energy. The indexes for final demand foods and for final demand goods less foods and energy moved up 0.9 percent and 0.1 percent, respectively.

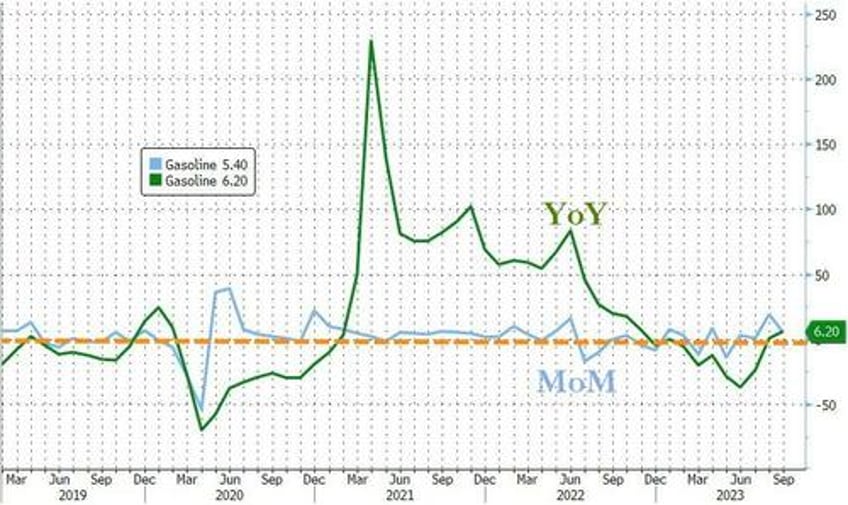

Product detail: Over 40 percent of the September increase in prices for final demand goods can be traced to a 5.4-percent rise in the index for gasoline. Prices for jet fuel, processed young chickens, ts, electric power, and diesel fuel also advanced. In contrast, the index for fresh and dry vegetables declined 13.9 percent. Prices for wood pulp and for utility natural gas also fell.

Food prices rose most since Nov 2022...

Final demand services: The index for final demand services advanced 0.3 percent in September following a 0.2-percent rise in August. Over 60 percent of the September increase is attributable to prices for final demand services less trade, transportation, and warehousing, which climbed 0.3 percent. The index for final demand trade services moved up 0.5 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.) Conversely, prices for final demand transportation and warehousing services declined 0.4 percent.

Product detail: A 13.9-percent jump in the index for deposit services (partial) was a major factor in the September rise in prices for final demand services. The indexes for machinery, equipment, parts, supplies wholesaling; health, beauty, and optical goods retailing; traveler accommodation services; outpatient care (partial); and application software publishing also moved higher. In contrast, prices for airline passenger services fell 2.1 percent. The indexes for automobile retailing (partial) and for bundled wired telecommunications access services also decreased.

Goods is once again higher YoY...

The much-watched portfolio-management segment saw deflation last month (as stock market prices declined) BUT deposit services exploded higher (flight to safety?)...

Put another way...

The biggest driver of today's PPI beat: a near record surge in PPI Deposit Services. In other words high rates (and inflation) lead to higher rates (and inflation) pic.twitter.com/9pZpxooBfv

— zerohedge (@zerohedge) October 11, 2023

This is not what The Fed wanted to see.