Alaska and Nevada are among 9 states that levy no individual income tax

Market analyst says US debt situation 'bad news' for taxpayers left to foot the bill

CPA and market analyst Dan Gertrude explains why the IRS's new tax brackets could put more money in Americans' pockets and startling numbers showing that America comprises approximately one-third of the global debt.

- Over the past three years, almost every U.S. state, except Alaska and Nevada, has cut at least one broad-based tax.

- Some states made permanent tax reductions, while others implemented one-time rebates, resulting in a nationwide trend of tax cuts.

- The pandemic-era revenue surge is now declining, leading to a potential slowdown in tax cuts as 2024 legislative sessions begin.

Income, sales, property and gas taxes: Almost every U.S. state cut at least one such broad-based tax as budget surpluses soared over the past three years.

Some states made permanent tax reductions. Others passed one-time rebates or temporary suspensions. One way or another, whether red or blue, all states save Alaska and Nevada joined in.

Though even more tax cuts are likely, the trend may be slowing as 2024 legislative sessions begin. That's because the pandemic-era revenue surge fueled by federal spending and inflation now is receding and, in some states, even reversing into negative numbers.

"Next year will likely be a return to normal for state budgets," said Brian Sigritz, director of state fiscal studies for the National Association of State Budget Officers. "Funds will be more limited. States will have to make decisions on what areas they prioritize."

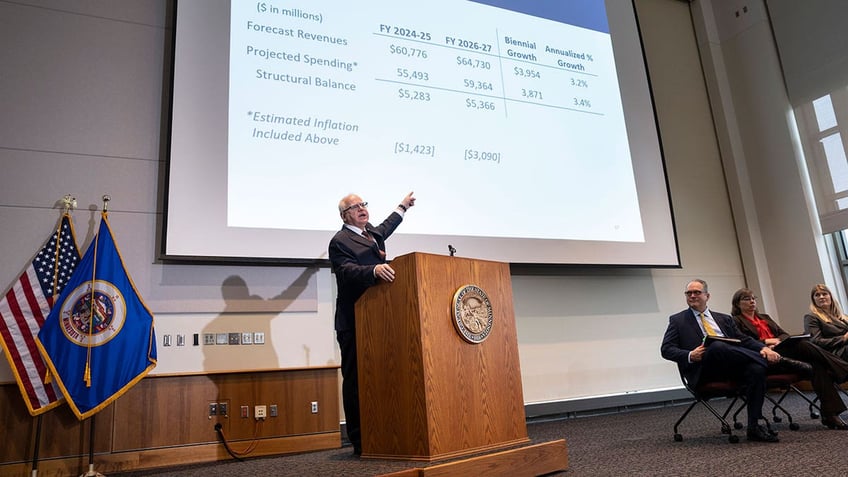

Minnesota Gov. Tim Walz speaks at a news conference on the Minnesota economic and budget forecast in St. Paul, Minn. on Feb. 27, 2023. Almost every U.S. state has cut taxes in some way in the past three years, but that trend may be slowing as many states head into their 2024 legislative sessions with lagging tax revenues. (Renée Jones Schneider/Star Tribune via AP, FILE)

California, where financial swings are felt more sharply than most states, has a projected budget deficit of a record $68 billion, an amount exceeding its hefty reserves. Just years after enjoying a record $100 billion surplus, Democratic Gov. Gavin Newsom is now facing a challenging task as he prepares to present the state budget in January.

Though not in the same hole as California, other states also have seen tax revenues decline and spending exceed forecasts. Arizona could face a $400 million shortfall in its 2024 fiscal year. Maryland’s legislative staff recently projected a $761 million budget deficit in 2025, growing to nearly $2.7 billion by 2029 without significant revenue increases or spending reductions.

And Minnesota’s budget office says a projected $2.4 billion surplus for the current two-year budget cycle could flip upside down in the next period, resulting in a $2.3 billion shortfall by the 2026-27 fiscal years.

SUPREME COURT APPEARS WARY OF MASSIVE TAX CODE OVERHAUL

It's hard to say how much, if any, of the projected shortfalls are attributable to tax rebates or reductions passed in each particular state. But in general, as tax collections slow, "we’re seeing the impacts of widespread tax cuts being implemented across states," said Justin Theal, a state fiscal policy officer for the nonprofit Pew Charitable Trusts.

As a whole, state-level tax reductions are projected to result in $13.3 billion less in general revenue this year compared to what states otherwise would have collected, according to a recent report by the National Association of State Budget Officers. That follows a $15.5 billion net tax reduction from the 2023 fiscal year.

About four-fifths of the states passed some sort of income tax break since 2021, according to a tally by The Associated Press. Those include cash-back plans, such as Delaware's $300 rebate and California's rebate of between $200 and $1,050 for individuals earning up to $250,000 and households up to $500,000.

The tally also includes targeted tax breaks such as expanded deductions or credits for families with children and seniors on retirement incomes. And it includes permanent individual income tax rate reductions enacted primarily by Republican-led states such as Missouri and Mississippi, which is now feuding internally over new revenue projections.

The past few years marked the largest wave of individual income tax rate reductions since states began enacting such taxes over a century ago, said Jared Walczk, vice president of state projects at the nonprofit Tax Foundation.

Alaska and Nevada are among nine states that levy no individual income tax. Alaska also has no statewide sales tax, instead relying heavily on oil revenue and earnings from investment funds.

The bulk of Nevada’s revenue comes from sales and gambling taxes, which fall heavily on out-of-state travelers spending money in places like the Las Vegas Strip. As a result, Nevada’s revenue plummeted when the COVID-19 pandemic kept tourists away, then rebounded to produce a historic $11.6 billion biennial budget as tourists returned and inflation took hold.

New Republican Gov. Joe Lombardo proposed last year to suspend the state's gasoline tax, which would have added Nevada to the national tax-cutting trend. But the plan went nowhere in the Democratic-led Legislature. Lombardo said in a statement to the AP that his plan "would have saved Nevada families and small businesses millions" of dollars,

But Democratic state Sen. Rochelle T. Nguyen, who sits on the Senate Finance Committee, said there was no way of ensuring Nevada residents would have been the main beneficiaries, or that oil companies wouldn't have hiked prices despite the suspension. Nevada’s two metro areas, Las Vegas and Reno, are a short trip from the California border, along with Nevada’s side of Lake Tahoe.

"Why would we spend $250 million in Nevada taxpayer money cutting gas taxes for Californians?" Nguyen said.

Though fewer states may pursue income tax cuts this year, more may be looking to provide property tax relief, Walczak said.

"Lawmakers are hearing from their constituents about dramatically higher property tax bills and dramatically higher assessments, and they’re under pressure to do something," he said.

Colorado lawmakers meeting in a November special session approved legislation increasing residential deductions for property tax purposes and decreasing the property tax assessment rate.

Kansas lawmakers are expected to consider a range of proposals for reining in local property taxes during their 2024 session, including a state constitutional cap on how much home values can rise annually for tax purposes, a cut in taxes on homes, and aid to cities and counties to replace property tax revenues.

ALABAMA RESIDENTS TO RECEIVE TAX REFUND FROM SURPLUS IN EDUCATION TRUST FUND

Wyoming Gov. Mark Gordon is proposing a $20 million expansion of a property tax relief program as part of his 2025-26 budget. But he's also recommending the state stash more money in savings.

"A realistic and conservative approach means Wyoming must strive to prepare for a future that could well see declining revenues," Gordon said in a written budget message.

States ended their 2023 fiscal years with total savings and cash balances of a record $407 billion — up significantly from the $111 billion they had at the close of 2020, according to NASBO. Though those fund balances are projected to decline in the current year, they still should provide states a cushion against declining tax revenues.

"Overall states remain in a strong fiscal condition," Sigritz said.