In a fascinating geopolitical shift, Bloomberg reports that, according to people familiar with the matter, that Saudi Arabia privately hinted earlier this year it might sell some European debt holdings if the G-7 decided to seize almost $300 billion of Russia's frozen assets.

As a reminder, we noted in May the European Union approved a US-backed plan to use seized Russian assets to generate profits which will in turn help arm Ukraine.

Associated Press reports that "The 27-nation EU is holding around 210 billion euros ($225 billion) in Russian central bank assets, most of it frozen in Belgium, in retaliation for Moscow’s war against Ukraine. It estimates that the interest on that money could provide around 3 billion euros ($3.3 billion) each year." A first tranche of funds could be available as early as July.

Starting in February, US Treasury Secretary Janet Yellen began getting more vocal on the "moral case" for using Russian assets to aid Ukraine, telling allies they must find a way to "unlock the value" of the hundreds of billions in immobilized Russian assets, also with an eye towards Ukraine's post-war reconstruction.

Previously some Ukrainian officials floated the idea of "reparation bonds" backed by future claims for war damages against Moscow, and utilizing frozen Russian assets. These initiatives have gained steam under US leadership.

Most of the $300 billion in frozen Russian assets are held in Europe - particularly France, Germany, and Belgium.

Which makes today's report from Bloomberg even more interesting from a geopolitical fissures perspective.

The Kingdom’s finance ministry told some G-7 counterparts of its opposition to the idea, which was meant to support Ukraine, with one person describing it as a veiled threat.

The Saudis specifically mentioned debt issued by the French treasury, two of the people said.

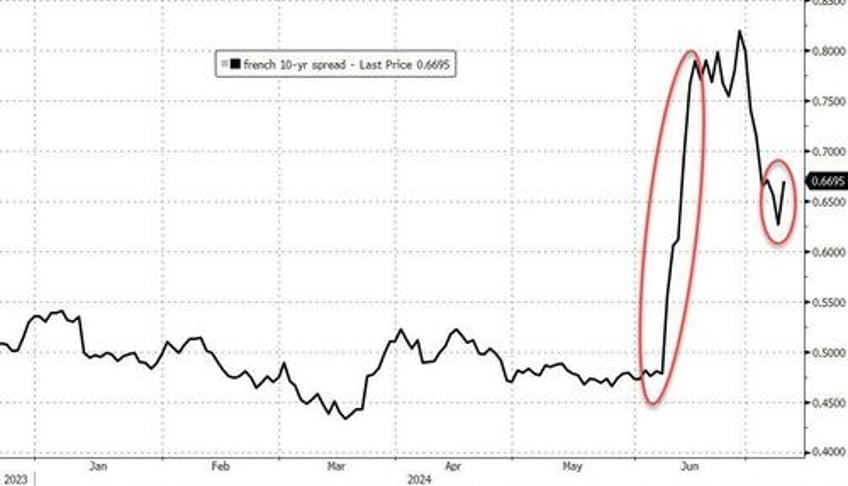

Now, notably, Macron called an election and that election swung wildly to the far-left in the interim, but since these 'talks' happened with the Saudis, French bond yield spreads to Germany have exploded wider...

Just a coincidence, we are sure.

We also note that the G-7 eventually agreed to tap the profits generated and leave the assets themselves alone despite a US and UK push for allies to consider bolder options, including a direct seizure.

Some euro-member nations were against that idea, concerned it could undermine the currency.

Sure enough, the Saudi position changed after G-7 nations went with a proposal that didn’t expropriate the assets, one of the people Bloomberg spoke to said.

We wonder if the Saudi threats influenced this decision and the reluctance of those countries?

Is that what helped relieve the pressure on French spreads?

While Saudi Arabia has maintained strong relations with Moscow, it has also built ties with Ukraine.

Bloomberg concludes by noting that whatever its motive, Saudi Arabia’s move underscores its growing clout on the world stage and the G-7’s difficulty in garnering support from so-called Global South nations for Ukraine in the face of Russia’s aggression.

Finally, we note that this is not the first time that The Kingdom has pre-emptively threatened retaliation for West's actions - they previously hinted at Treasury purchase pullbacks if US authorities allowed citizens to sue the Saudis over 9/11.