The push towards a more sustainable future requires various key minerals to build the infrastructure of the green economy. However, the U.S. is heavily reliant on nonfuel mineral imports causing potential vulnerabilities in the nation’s supply chains.

Specifically, the U.S. is 100% reliant on imports for at least 12 key minerals deemed critical by the government, with China being the primary import source for many of these along with many other critical minerals.

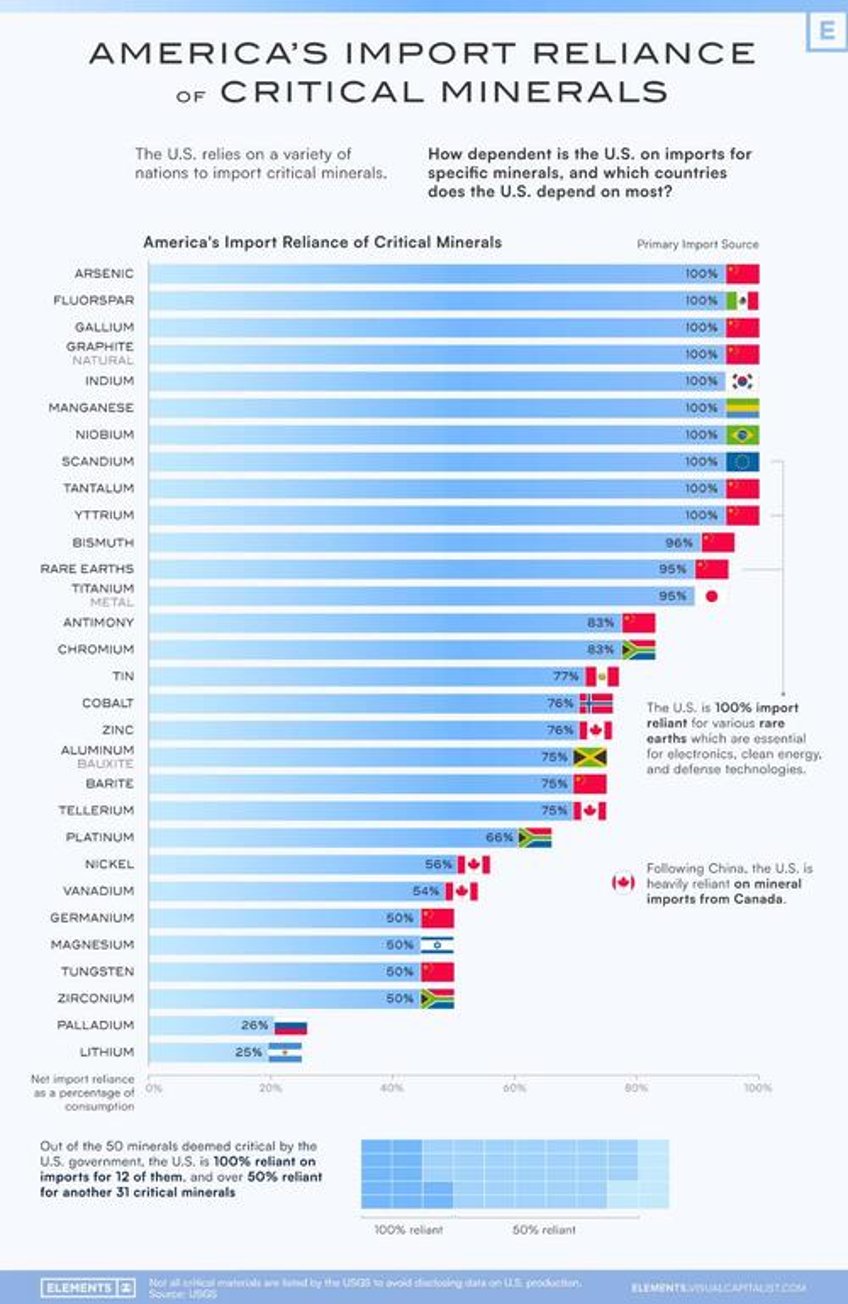

In the following infographic, Visual Capitalist's Niccolo Conte and Pernia Jamshed use data from the U.S. Geological Survey (USGS) to visualize America’s import dependence for 30 different key nonfuel minerals along with the nation that the U.S. primarily imports each mineral from.

U.S. Import Reliance, by Mineral

While the U.S. mines and processes a significant amount of minerals domestically, in 2022 imports still accounted for more than half of the country’s consumption of 51 nonfuel minerals. The USGS calculates a net import reliance as a percentage of apparent consumption, showing how much of U.S. demand for each mineral is met through imports.

Of the most important minerals deemed by the USGS, the U.S. was 95% or more reliant on imports for 13 different minerals, with China being the primary import source for more than half of these.

| Mineral | Net Import Reliance as Percentage of Consumption | Primary Import Source (2018-2021) |

|---|---|---|

| Arsenic | 100% | 🇨🇳 China |

| Fluorspar | 100% | 🇲🇽 Mexico |

| Gallium | 100% | 🇨🇳 China |

| Graphite (natural) | 100% | 🇨🇳 China |

| Indium | 100% | 🇰🇷 Republic of Korea |

| Manganese | 100% | 🇬🇦 Gabon |

| Niobium | 100% | 🇧🇷 Brazil |

| Scandium | 100% | 🇪🇺 Europe |

| Tantalum | 100% | 🇨🇳 China |

| Yttrium | 100% | 🇨🇳 China |

| Bismuth | 96% | 🇨🇳 China |

| Rare Earths (compounds and metals) | 95% | 🇨🇳 China |

| Titanium (metal) | 95% | 🇯🇵 Japan |

| Antimony | 83% | 🇨🇳 China |

| Chromium | 83% | 🇿🇦 South Africa |

| Tin | 77% | 🇵🇪 Peru |

| Cobalt | 76% | 🇳🇴 Norway |

| Zinc | 76% | 🇨🇦 Canada |

| Aluminum (bauxite) | 75% | 🇯🇲 Jamaica |

| Barite | 75% | 🇨🇳 China |

| Tellerium | 75% | 🇨🇦 Canada |

| Platinum | 66% | 🇿🇦 South Africa |

| Nickel | 56% | 🇨🇦 Canada |

| Vanadium | 54% | 🇨🇦 Canada |

| Germanium | 50% | 🇨🇳 China |

| Magnesium | 50% | 🇮🇱 Israel |

| Tungsten | 50% | 🇨🇳 China |

| Zirconium | 50% | 🇿🇦 South Africa |

| Palladium | 26% | 🇷🇺 Russia |

| Lithium | 25% | 🇦🇷 Argentina |

These include rare earths (a group of 17 nearly indistinguishable heavy metals with similar properties) which are essential in technology, high-powered magnets, electronics, and industry, along with natural graphite which is found in lithium-ion batteries.

These are all on the U.S. government’s critical mineral list which has a total of 50 minerals, and the U.S. is 50% or more import reliant for 43 of these minerals.

Some other minerals on the official list which the U.S. is 100% reliant on imports for are arsenic, fluorspar, indium, manganese, niobium, and tantalum, which are used in a variety of applications like the production of alloys and semiconductors along with the manufacturing of electronic components like LCD screens and capacitors.

China’s Gallium and Germanium Restrictions

America’s dependence on imports for various minerals has resulted in a new challenge resulting from China’s announced export restrictions on gallium and germanium that took effect August 1st, 2023. The U.S. is 100% import dependent for gallium and 50% import dependent for germanium.

These restrictions are seen as a retaliation against U.S. and EU sanctions on China which have restricted the export of chips and chipmaking equipment.

Both gallium and germanium are used in the production of transistors and semiconductors along with solar panels and cells, and these export restrictions present an additional hurdle for critical U.S. supply chains of various technologies that include LED lights and fiber-optic systems used for high-speed data transmission.

The restrictions also affect the European Union, which imports 71% of its gallium and 45% of its germanium from China. It’s another stark reminder to the world of China’s dominance in the production and processing of many key minerals.

The announcement of these restrictions has only highlighted the importance for the U.S. and other nations to reduce import dependence and diversify supply chains of key minerals and technologies.