In the first quarter of 2024, the nationwide aggregate credit card utilization rate in the U.S. was about 23%, similar to previous quarters, according to the Federal Reserve Bank of New York.

However, as Visual Capitalist's Kayla Zhu details below, utilization rates vary widely between individuals. About 52% of credit card users were using less than 20% of their available credit in the beginning of 2024, while 18% were using at least 90% of their available credit, which the Federal Reserve sees as being “maxed-out.”

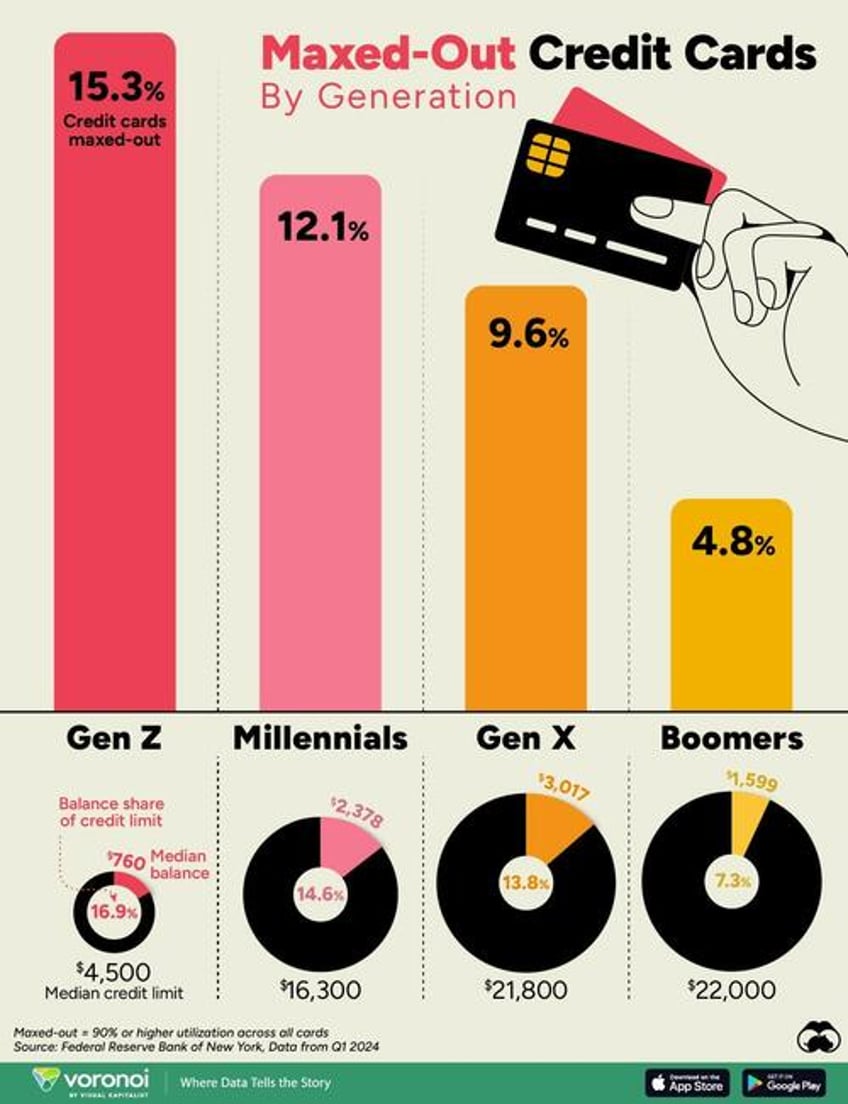

This chart uses data from the Federal Reserve Bank of New York to show the share of U.S. adults in each generation (Gen Z, Millennials, Gen X, and Baby Boomers) that have maxed-out credit cards as of Q1 2024, along with each generation’s median credit limit and median balance as of Q1 2024.

Methodology: Credit Card Utilization and Generations Defined

Credit card utilization is defined by the Federal Reserve as the share of the borrower’s aggregate credit limit being used. When borrowers are using 90% or more of their credit limit, the Federal Reserve considers them “maxed-out borrowers”.

Generations are defined by the Federal Reserve as having been born in the following years:

Baby Boomers: 1946 to 1964

Gen X: 1965 to 1979

Millennials: 1980 to 1994

Gen Z: 1995 to 2011

Which Generation Maxes Out Their Credit Card The Most?

Below, we show the percentage of U.S. adults in each generation that have maxed-out credit cards, as well as the median balance and credit limit of each generation.

Younger credit card users typically have higher utilization rates, with this trend decreasing among older generations. Over 1 in 7 Gen Z credit card users were maxed-out borrowers in the first quarter of 2024.

On the other end, fewer than 5% of Baby Boomers have maxed out their credit cards.

However, it’s important to note that Gen Z borrowers have lower median credit limits, averaging $4,500, compared to $16,300 for Millennials and $22,000 for Baby Boomers. Borrowers with lower limits generally have higher utilization rates.

This disparity is largely due to Gen Z’s shorter credit histories and generally lower income, which result in lower credit scores.

While Gen Z has the highest share of credit card delinquency (when payments are at least 30 days late) at 3.1%, Millennials aren’t far behind at 2.9% and as of Q3 2023 were the only generation exceeding their pre-pandemic delinquency levels.

To learn more about the state of debt in the United States, check out this graphic that shows the household debt of OECD countries.