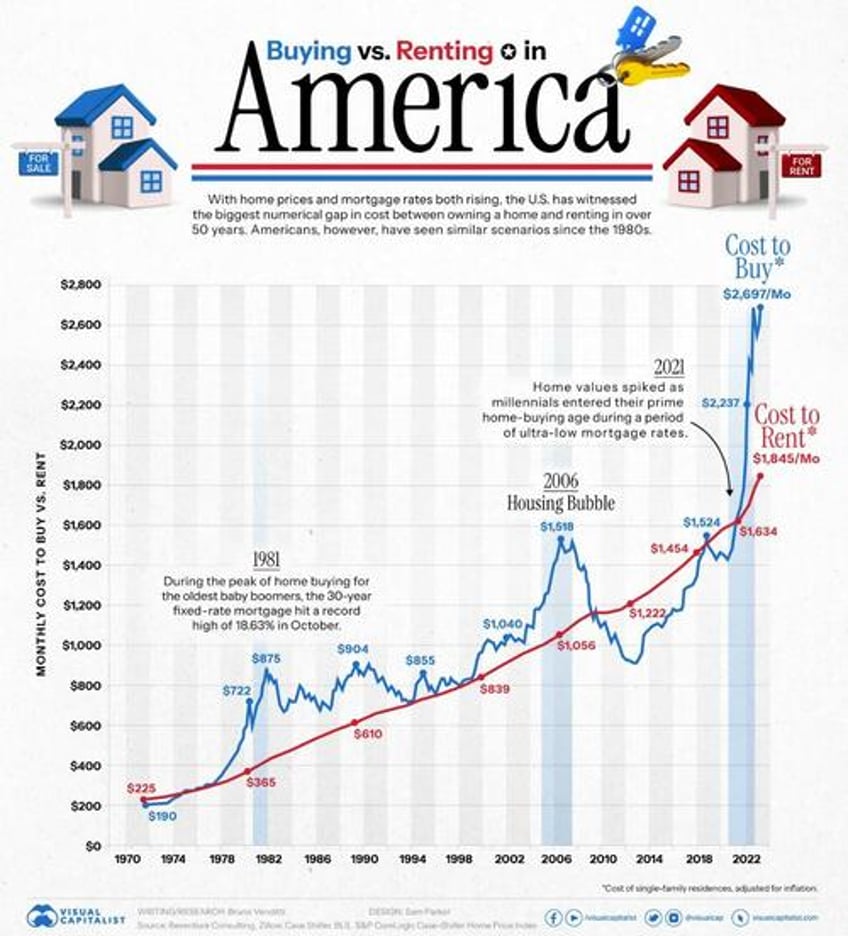

With home prices and mortgage rates both rising, the U.S. is now witnessing the biggest numerical gap in the monthly cost between owning a home and renting in over 50 years.

Americans, however, have seen similar scenarios occur since the early 1980s.

Visual Capitalist's Bruno Venditti and Sam Parker created the following chart, using data from Reventure Consulting, to highlight the cost of buying vs. renting a single-family residence in the U.S. since 1970, adjusted for inflation.

Mortgage Rates Jump to New High

In August 2023, mortgage rates rose to the highest level in 23 years, with the national average 30-year fixed mortgage hitting 7.48%.

As a result, the median rent in America is approximately $1,850 per month, about 30% cheaper than the median cost to buy, standing at $2,700 per month. This gap represents the largest difference between renting and buying in U.S. history.

While the difference was less than $200 in 2022, in 2023 the gap surpassed $800.

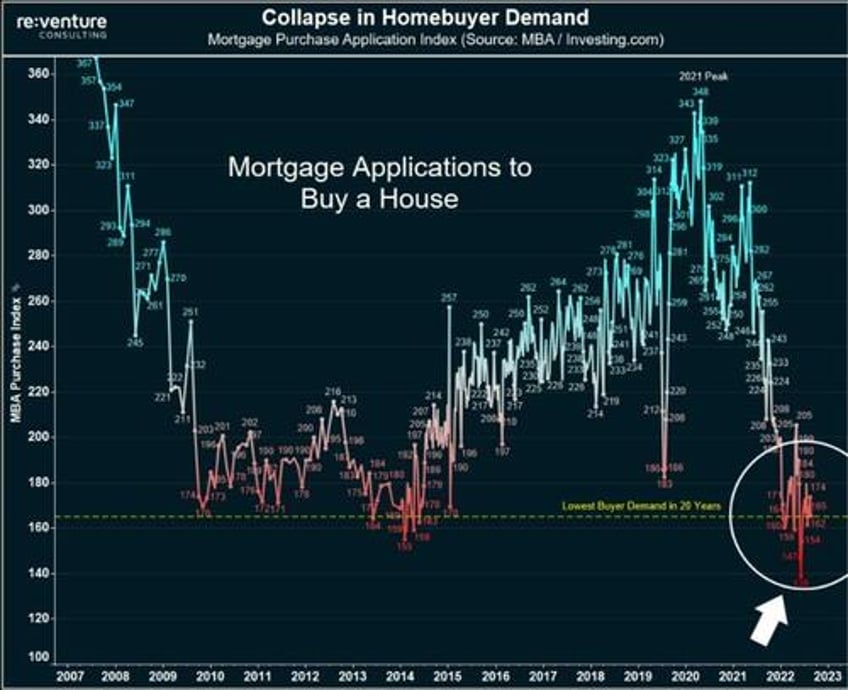

Many buyers, particularly those seeking their initial home purchase, have now been priced out of the market with concerns that they cannot afford home ownership. As a result, mortgage applications for home purchases have hit their lowest point in 20 years:

Rent costs have also seen an uptick, but not at the same pace, as the market adjusted following a steep rent spike witnessed during the pandemic.

Will Mortgage Rates Drop in 2023?

Increases in interest rates affect long-term home loans, such as 30-year fixed-rate mortgages. And starting in 2022, the Federal Reserve began to hike rates from their near-zero level to the current range of 5.25-5.5%.

Recently, the Federal Reserve unveiled new projections, indicating that the interest rate could potentially reach 5.6% by the end of 2023, implying at least one more rate hike in 2023.

As a result, numerous experts are anticipating that mortgage rates will likely remain above 6% for the rest of this year.