The frenzy around AI stocks has blindsided Wall Street forecasters, spurring a race among strategists to keep up with a stock market rally that has already blown past their expectations when 2024 began.

Most investment banks would have underestimated the rise in mega-cap tech stocks for 2024 even if the year were to end today!

There is a lot of talk of an ‘inflated market’, the ‘start of a bubble’, but who really knows and who can really predict what will happen next? Clearly not Wall Street.

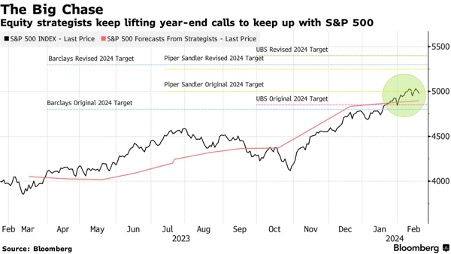

Five Wall Street firms have already lifted their forecasts for the S&P 500 Index, which is up a 7% to start the year after rising 24% in 2023. In the past week alone, Piper Sandler, UBS Group and Barclays boosted their targets. Two firms, Goldman Sachs and UBS, have done it twice since December.

“I’ve been doing the strategy job for about 20 years, and this is the first time I’ve ever done something like that,” said Jonathan Golub, UBS Investment Bank’s chief US equity strategist.

Savita Subramanian, the Bank of America strategist who was hailed for quickly adjusting her view as the 2023 rally got going, is sticking to her year-end call of 5,000, writing in a note on Wednesday that it was “hard to be bullish based on valuations.”

The S&P 500 is “egregiously expensive, with a price-to-trailing-earnings ratio in the 95th percentile in data going back to 1900,” she said, while also acknowledging the challenge of comparing current measures of value to those from prior eras.

At 5,117 the index is already beating the average year-end forecast of 4,899.40, a figure it eclipsed just 24 days into 2024. Even the loftiest calls of 5,400 are just another 4% away. Everyone has either called 2024 as badly as 2023, or the rest of the year is going to trade sideways – or even down.

Morgan Stanley’s MikeWilson won’t budge, arguing he sees no justification to upgrade his outlook given an absence of broad earnings growth.

The strategist stuck to his year-end S&P 500 Index forecast of 4,500 in an interview on Tuesday with Bloomberg Surveillance Radio.

Wilson’s call is roughly 12% below the S&P 500’s closing level Monday of around 5,118, and 8% short of the average year-end call of Wall Street strategists tracked by Bloomberg, of 4,915. Among the big banks, only JPMorgan Chase has a lower 2024 forecast than Wilson’s which they set at 4,200 in December.

“A lot of folks have raised their price targets because of higher multiples,” Wilson said. “We’re not willing to do that.”

His scepticism comes in the face of a sharp rally in US stocks since October. The S&P 500 gained in 16of the past 19 weeks amid enthusiasm around corporate earnings, artificial intelligence and economic strength.

The index resumed its climb this week in the face of hotter-than-forecast inflation reading, as well as a higher PPI number, that left intact expectations for at least three Federal Reserve interest-rate cuts by year-end.

This is beginning to make no sense at all, but if the YOLO crowd insist on buying Meta and Nvidia, then what can stop them? Valuations are not a consideration for many of these buyers.

Wilson’s more optimistic counterparts at rival banks have pointed to strength from US firms and the economy in the face of tighter monetary policy. But he said Tuesday that broader earnings growth is still missing.

Earnings for the S&P 500 grew 7.4% in the fourth quarter from the same time a year ago. Excluding the Magnificent Seven group of technology giants, profits in the index posted a 1.7% contraction, data compiled by Bloomberg Intelligence show. Wilson also added that “the risk of a hard landing has still not been exterminated.”

The strategist has been one of Wall Street’s most prominent bears in recent years. He kept his call for a market decline throughout 2023 as the S&P 500 soared 24%, after correctly predicting 2022’s rout. He’s since taken a more constructive view on US equities.

In Wilson’s view, speculative activity across the market has picked up in a “meaningful way.” He points to the rising popularity of zero-day options trading and the use of leverage, noting that exuberance is high.

“Now, it doesn’t have to end in tears,” he said. “Leverage isn’t always bad. We have a situation where people are reaching for risk because there is FOMO.” We saw it before in 2021, and then we saw a fall in the market of 20% in 2022. This may not happen, but where such a huge increase in valuations isn’t based on earnings, what is it based on?

Some investors believe the market's nearly uninterrupted ascent means a pullback is due. The last time the S&P 500 slid more than 5% was in October, though BofA data shows such sell-offs historically occur three times per year on average. The index is up 8.5% this year.

"A lot of good news is priced into the market," said Michael Arone, chief investment strategist at State Street Global Advisors. "From my perspective that just suggests that the risks are skewed to the downside."

It is not immediately clear what could cause a market sell-off. While stronger-than-expected inflation has dented expectations for how deeply the Fed will cut rates this year, many believe borrowing costs are still heading lower. Elevated consumer prices have also been seen as evidence of economic strength.

Nevertheless, some indicators are flashing a warning. The S&P 500's weekly relative strength. index (RSI) - which gauges whether stocks are overbought or oversold - has climbed to just over 76, a level it has rarely topped since 2000, Miller Tabak data showed.

Significant sell-offs followed the last two times the index exceeded those levels: a 10% drop in the S&P 500 in January 2018 and a 30% plunge as COVID-19 emerged after the index topped that level in January 2020.

"None of this means we're looking at a major long-term top," said Matt Maley, chief market strategist at Miller Tabak. "However, it does tell me that we're getting ripe for a material pullback."

As with all economic forecasting, there is no real way of knowing what will happen next. A pullback usually requires a catalyst. We may get one soon, we may not. Gold, which is generally considered a safe haven for capital when the markets are running scared, has also topped all-time highs. The asset classes are out of sync with each other, but which one is right? If only we knew.

For more insight visit www.tppglobal.io