By Graham Summers, MBA

Yesterday, I noted that inflation has very likely bottomed for 2023.

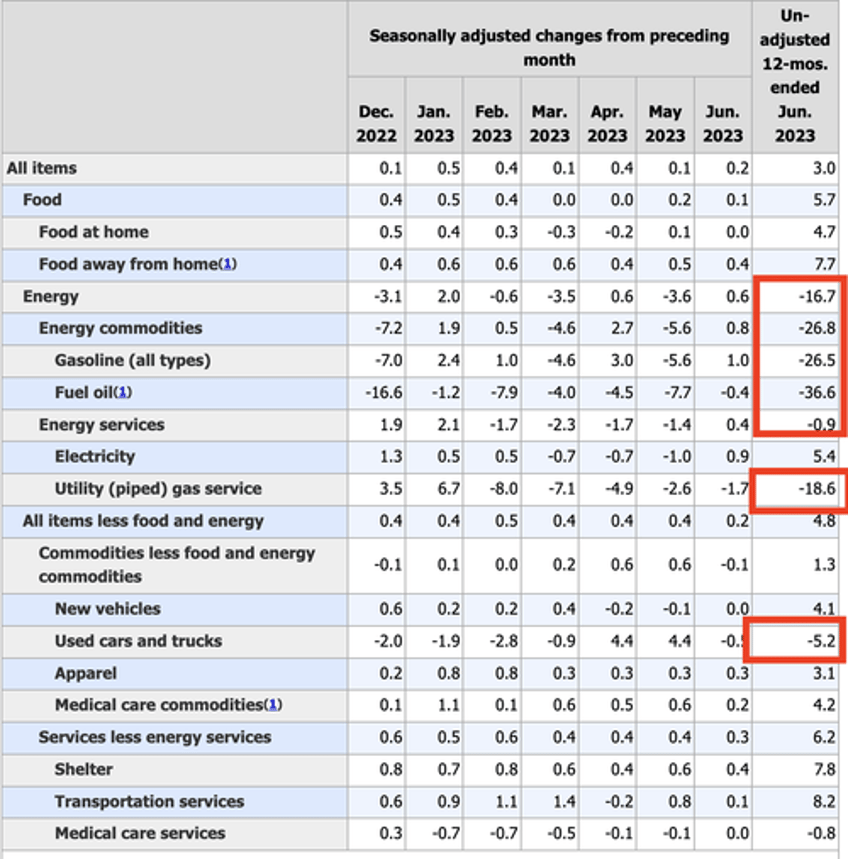

No one in the media is discussing this, but the only parts of the inflation data that is actually falling are energy prices.

See for yourself. Below is the chart I posted yesterday.

Everything else is still going UP in price, though the pace is slower (this doesn’t stop the media from claiming inflation is falling though).

However, by the look of things, energy prices are bottoming here, particularly in Year over Year comparables.

You see, the inflation data published in the U.S. is based on year over year comparisons. When the Consumer Price Index (CPI) comes out at 5%, what it’s really stating is that a basket of goods and services costs ~5% more currently than it did a year ago.

This is called the base effect: a comparison between two data points in which the current one is expressed as a ratio of the older one. And it can result in some pretty strange circumstances if you’re not careful.

Situations like the one we’re in today.

Let’s wind the clocks back to the first quarter of 2022. Oil prices were rising rapidly due to inflation as the Fed had yet to end its Quantitative Easing (QE) program, let alone raise interest rates. Then Russia invaded Ukraine, and oil spiked even higher to $130 a barrel as the financial world grew terrified of large-scale oil production disruptions.

I’ve illustrated this time period on the below chart of oil prices with a red rectangle.

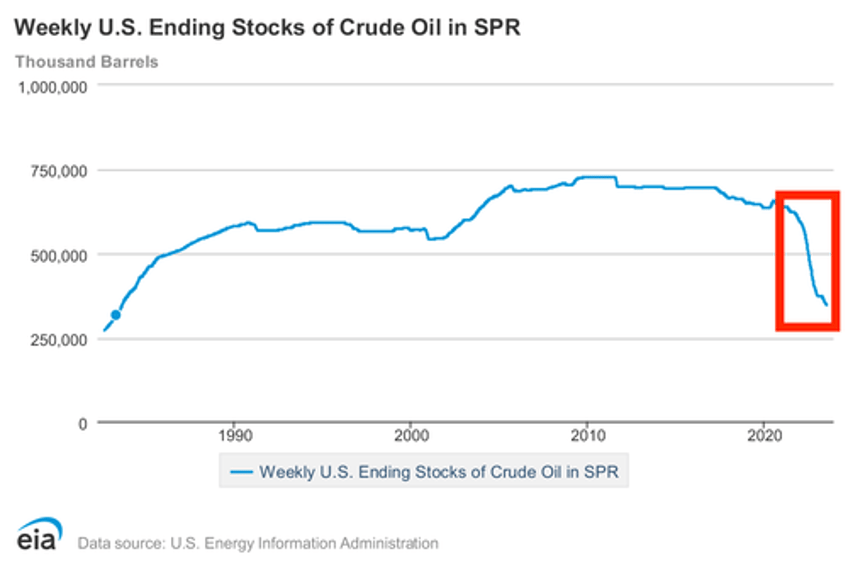

The rise in oil prices then halted as it became clear that Russia’s war with Ukraine wouldn’t disrupt global oil production by much if at all (Russia would continue selling oil via back-channels to India and other countries). Another factor that stopped oil prices from rising was the fact the Biden administration dumped 292 million barrels of oil on the market by draining the Strategic Petroleum Reserve (SPR).

I’ve been accused of playing politics with this data point, but the chart is clear. President Biden took office in January 2021. At that time the SPR had 638 million barrels of oil. What followed was the largest drop in the SPR’s history, with the SPR declining to 346 million barrels of oil where it sits today. That is a decline of 292 MILLION barrels of oil.

Add it all up, and the end result is that since June 2022, oil prices have declined from $130 a barrel down to the upper $60s/ lower $70s per barrel. The result of this, as far as the CPI is concerned, is that on a year over year basis, for the entirety of 1H23, we have been comparing oil prices in the blue rectangle to oil prices in the red rectangle. As a result of this, energy inflation is down sharply.

This trend is now ending as we work our way into the second half of 2023. Going forward, oil prices on a year over year basis will be compared to the prices in the red rectangle in the chart below.

Put simply, on a year over year basis, the massive drop in energy prices that has lowered overall CPI considerably will be ending. And since energy prices are the ONLY part of the CPI data that has been declining… it is highly likely that the inflation data is bottoming here… or at the very least, won’t be declining much more.

This opens the door to some VERY inflationary surprises in the near future. And those who are positioned to profit from this could see some absolutely stunning returns.

We recently outlined a unique “of the radar” investment that will could EXPLODE higher as inflation turns back up. We detail this investment in an investment report called Billionaire’s “Green Gold.”

It details the actions of a family of billionaires who literally made their fortunes investing in inflationary assets. And they just became involved in a mid-cap company that has the potential to TRIPLE in value in the coming months.

Normally this report would be sold for $249. But we are making it FREE to anyone who joins our Daily Market Commentary Gains Pains & Capital.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html