We (Still) Need a Vol Moment, Zoltan

Contents: (418 words)

- Intro

- We Still Need a Vol Moment

- GOLD during this cut cycle

- BONDS during this cut cycle

- USD during this cut cycle

- What happens to USD/Gold next?

Intro

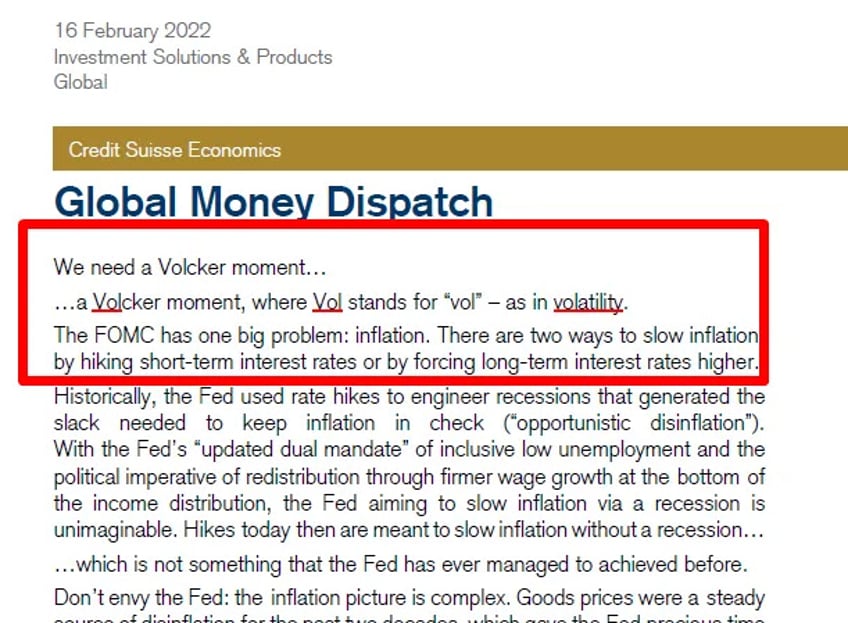

Remember when Pozsar said markets need a "Vol moment"?

"We need a Volcker moment…

…a Volcker moment, where Vol stands for “vol” – as in volatility."

We do.

He was right. But here we are two and a half years later and Bonds still offer no term-premia with a cutting cycle apparently (written at 10:53 on Fed day) starting. Meanwhile, stocks continue to take an escalator higher. Is today the Vol moment or is Powell that powerless in the face of Janet Yellen’s fiscal charms ? We wonder.

How can Powell refuse...

We Still Need a Vol Moment

He was referring to a time when Volcker used to keep them guessing.. Admittedly Volcker did that too much and it conveyed a lack of confidence on his part and resulted in too much volatility into markets back then.

Photos: Reuters. Illustration: The Wire

But we have come so far from that with the Fed’s kinder more transparent Bernanke Fed schtick; that a little uncertainty is what *is* prescribed now.

And despite Powell being a sphinx-like damp sponge this past year on market expectations with one notable exception in December... The market continues to expect more from him than he gives. They have not gotten the message yet.

So: Powell should let a little chaos in.. and let the froth ring itself out like Volcker did.

GOLD during this cut cycle

Gold is actually a predictive market now..... hasn't been one since 1980s. Translation? Other markets are beginning to take cues from Gold. Other markets are correlating to Gold again. As it did between 1971 and 1993. Gold matters again.

BONDS during this cut cycle

With no term Premia in bonds. as Zoltan also noted in May this year, how can the bond curve ever normalize except with FF at 0.00% again...

What happens when AI hits harder... Permanent yield curve inversion to balance out Fiscal UBI? Banks will get killed. hmmmm

USD during this cut cycle

Will probably not weaken as much as many think.. Why? The Fed’s no dummy and will find other ways to vacuum up orphaned dollars as rates drop like raising reserve requirements for US banks to slow money velocity down while amount of money increases…Sterilized QE and RRP were prime examples of them steering money towards assets they want money to flow into.

What happens to USD/Gold next?

Down the road the Fed will vacuum up too many USD (their bias always dictates this approach) and in doing so will ding the Eurodollar market and make the BRICS suffer more.(ht Concordia) Do not be surprised if Gold rallies despite a relatively strong USD during the cut cycle...

More here

Free Posts To Your Mailbox