What Elon Musk Gets Wrong About The UK Protests

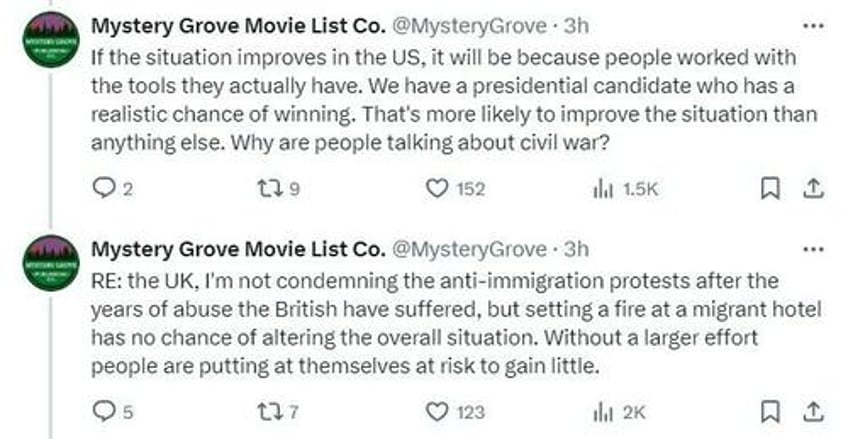

This ZeroHedge post ("Anti-Immigration Protests In UK Spread As Elon Musk Warns 'Civil War Is Inevitable'") offers a good explanation of what motivated the anti-immigration protests in the UK, but contra Elon Musk, civil war there actually isn't inevitable. My friend Mystery Grove, who is a student of civil conflict, offered an important corrective on X. I've posted screen caps of his posts below (since he warned me he'd be deleting them at the end of the day).

Following that, we'll wrap up with a brief market note about preparing for this week.

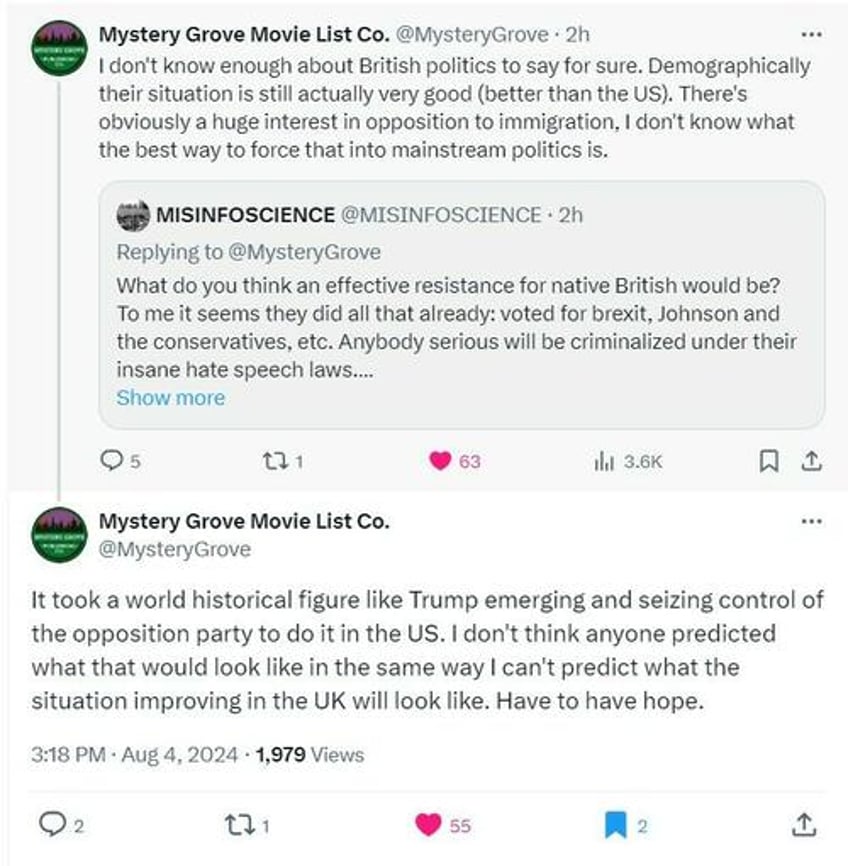

In response to questions about what the "something that works" would be in the UK, Mystery Grove offered this:

How Civil Wars Actually Start

For a look at how civil wars actually start, consider reading Mystery Grove's Introduction To The Russian Revolution.

The UK Protests And The Market Week Ahead

What impact to the UK protests end up having on the market remains to be seen, but we have no shortage of headwinds as it is, from the unwinding of the yen carry trade in Japan, to Kamala climbing in the polls.

In my last post, on the potential impact of a Kamala Presidency, I shared the game plan I've been following with my subscribers:

If you’re concerned about downside risk for positions you already own, consider hedging. As a reminder, you can download our iPhone hedging app here, or by aiming your iPhone camera at the QR code below.

We’ll use up days to add short positions, and down days to add long positions, when we surface compelling ideas.

Here, let me offer a brief elaboration on point #2. This week is stacked with earnings announcements.

Here's what I'll be looking for when it comes to potential buying opportunities. A stock that:

- Beats on top and bottom lines.

- Offers mostly positive guidance (some concerns expressed about the current economic uncertainty, etc. are understandable).

- Has an attractive valuation

- Is flat or even down post-earnings.

If I see situations that meet all of those criteria, I'll probably place an options trade betting on the stock to be higher after its next quarter. If you'd like a heads up when I do, feel free to subscribe to my trading Substack/occasional email list below.

If you'd like to stay in touch

You can follow Mystery Grove on X here (though he might be going dark for a while), and check out his Substack here.

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).